Crypto investment products experienced a sharp turnaround last week, with inflows reaching $436 million to partly reverse weeks of previous outflows totaling $1.2 billion, according to CoinShares‘ latest weekly report,

Despite the influx, ETF trading volumes remained flat at $8 billion, significantly lower than the yearly average of $14.2 billion.

What triggered the inflows?

James Butterfill, CoinShares’ head of research, attributed the shift to changing market expectations for a potential 50 basis point interest rate cut on Sept. 18.

This came after remarks by William Dudley, former president of the Federal Reserve Bank of New York, at the Bretton Woods Committee’s annual Future of Finance Forum in Singapore.

Dudley argued that a 50 basis point cut was warranted, citing a weakening US labor market. He highlighted that job risks outweighed inflationary concerns to back his call for a reduction.

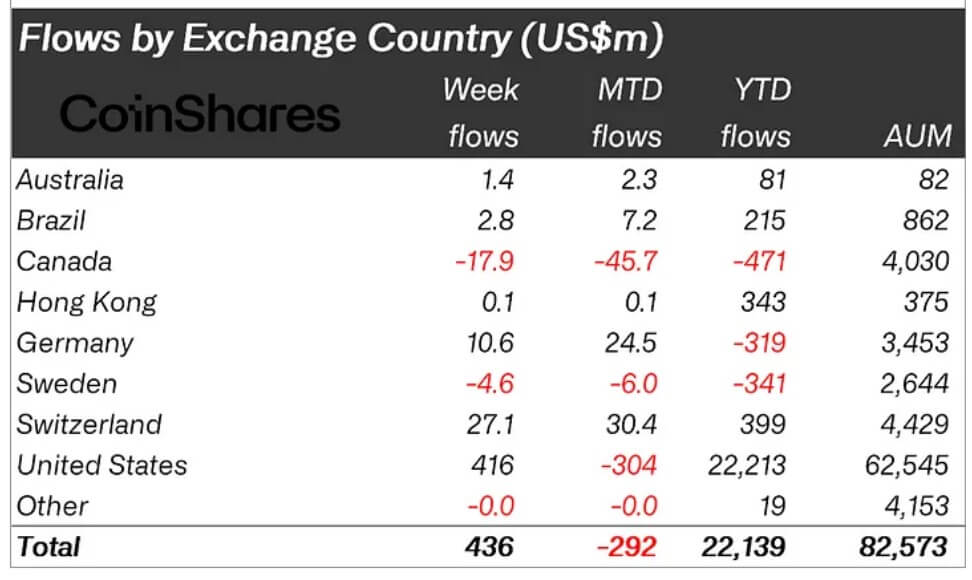

Due to these changing sentiments, the US saw inflows totaling $416 million, with Switzerland and Germany also seeing inflows of $27 million and $10.6 million, respectively.

On the other hand, Canada saw outflows totaling $18 million during the period.

Bitcoin surges while Ethereum struggles

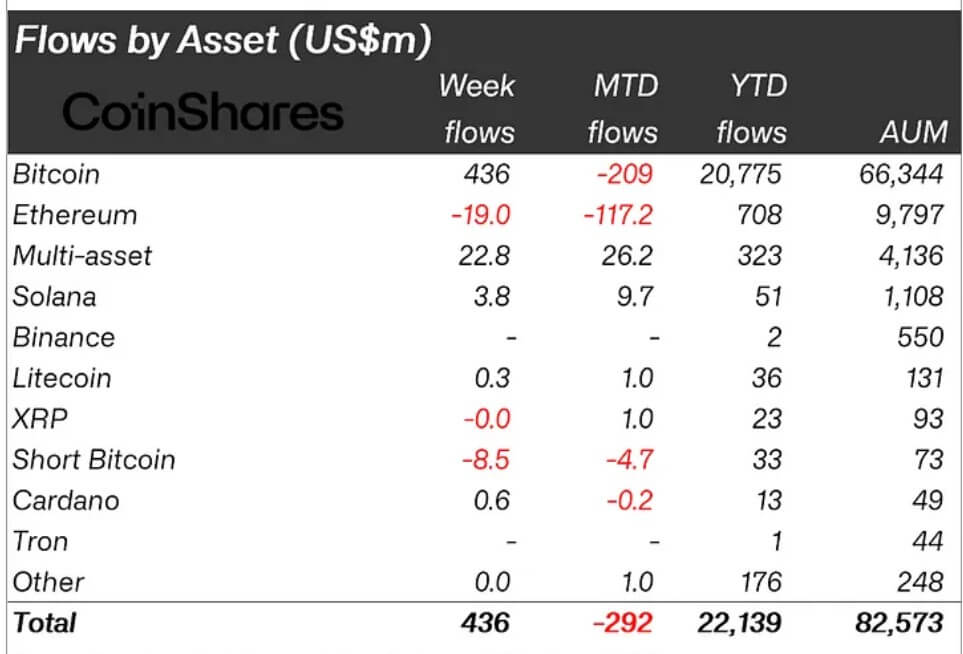

Bitcoin saw the largest inflows, with $436 million, marking a reversal afterten0 days of outflows totaling $1.18 billion. Conversely, short-Bitcoin products saw outflows of $8.5 million after three consecutive weeks of inflows.

Ethereum faced $19 million in outflows. This downturn stems from concerns about Layer-1’s profitability following the March Dencun upgrade. Market observers have noted a 99% decline in Ethereum’s mainnet revenue since March 2024.

The rise of Layer-2 (L2) networks, boosted by the Dencun upgrade’s lower fees, has made L2 solutions more appealing. Analysts warn that if this trend continues, L2 networks could dominate and possibly shift away from Ethereum’s mainnet, especially for consumer applications.

Meanwhile, Solana marked its fourth consecutive week of inflows, totaling $3.8 million. Litecoin and Cardano also saw inflows, with a combined total of about $900,000.

In addition, blockchain equities saw inflows of $105 million following the launch of several new ETFs in the US.