61% Ethereum holders still in profit: What does this mean for ETH?

09/17/2024 21:00

Amid Ethereum ongoing price decline, holders have shown resilience with roughly 61% of them still in profit.

- 61% of Ethereum holders remained in profit despite recent price declines, showing market resilience.

- Rising leverage and declining new addresses suggested potential market volatility ahead.

Ethereum [ETH] has been experiencing a downward trend in recent weeks, dropping below several key price levels.

This decline has culminated in a more than 10% decrease in its value over the past month, with the cryptocurrency now trading at around $2,298, down 2% in the last week alone.

Despite this bearish movement, market analytics firm IntoTheBlock has provided some key insights into Ethereum and the state of its holders that may offer a more nuanced view of the asset’s current situation.

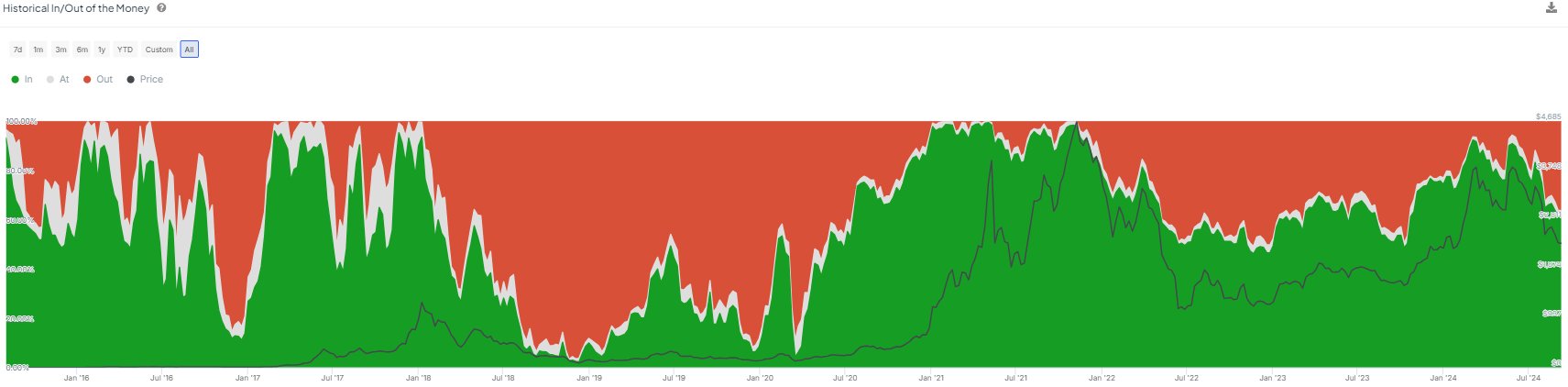

According to a recent analysis by IntoTheBlock, 61% of Ethereum holders remained in profit despite the ongoing market slump.

IntoTheBlock revealed that this figure reflected a degree of resilience among Ethereum holders, compared to previous market cycles.

The analytics firm drew parallel to the previous year, noting that during the recent bear market, the percentage of profitable holders dropped to a low of 46%.

After the 2017 market cycle, the percentage of addresses in profit fell to a mere 3%.

This indicated that the current cycle demonstrates a stronger belief in Ethereum’s long-term value.

IntoTheBlock notes that this resilience reflects increased confidence among holders, which may suggest a more robust foundation for Ethereum even during market downturns.

According to IntoTheBlock, in comparison to the 2019-2020 period, when profit-making addresses fell below 10%, the present situation suggests that any potential downturn may be less severe.

On-chain data

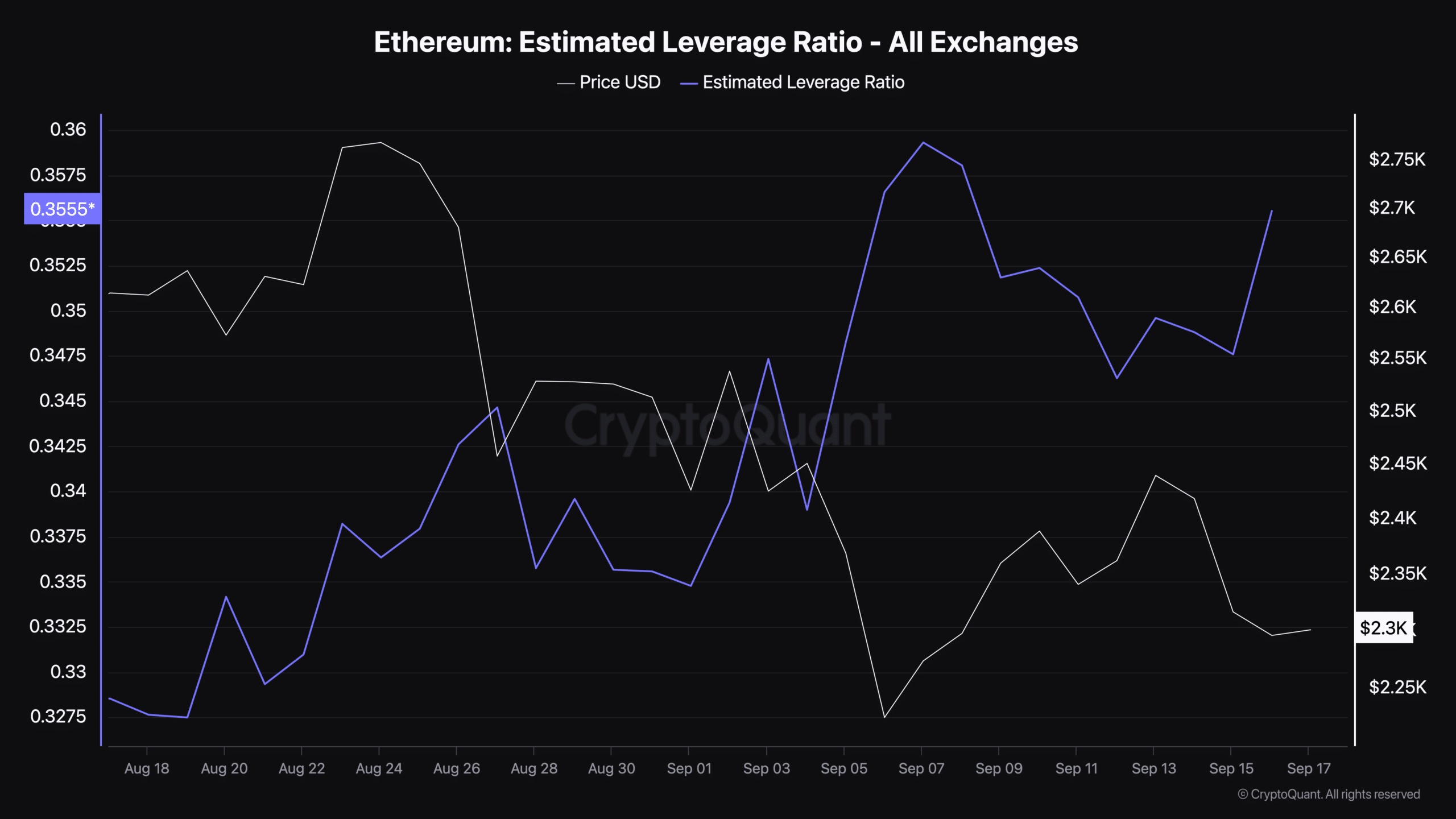

To further understand Ethereum’s current market position, it is crucial to examine some of its key on-chain datasets. One such data is the estimated leverage ratio.

According to CryptoQuant, Ethereum’s estimated leverage ratio has seen a noticeable increase in recent months, sitting at 0.355 at press time.

The estimated leverage ratio measures the degree of leverage used in the derivatives market, comparing the amount of Open Interest to the total amount of coins held on exchanges.

An increasing leverage ratio can indicate heightened speculative activity, suggesting that traders may be taking on more risk.

This trend can lead to higher price volatility in either direction, as more leveraged positions increase the likelihood of liquidations, which can exacerbate price movements.

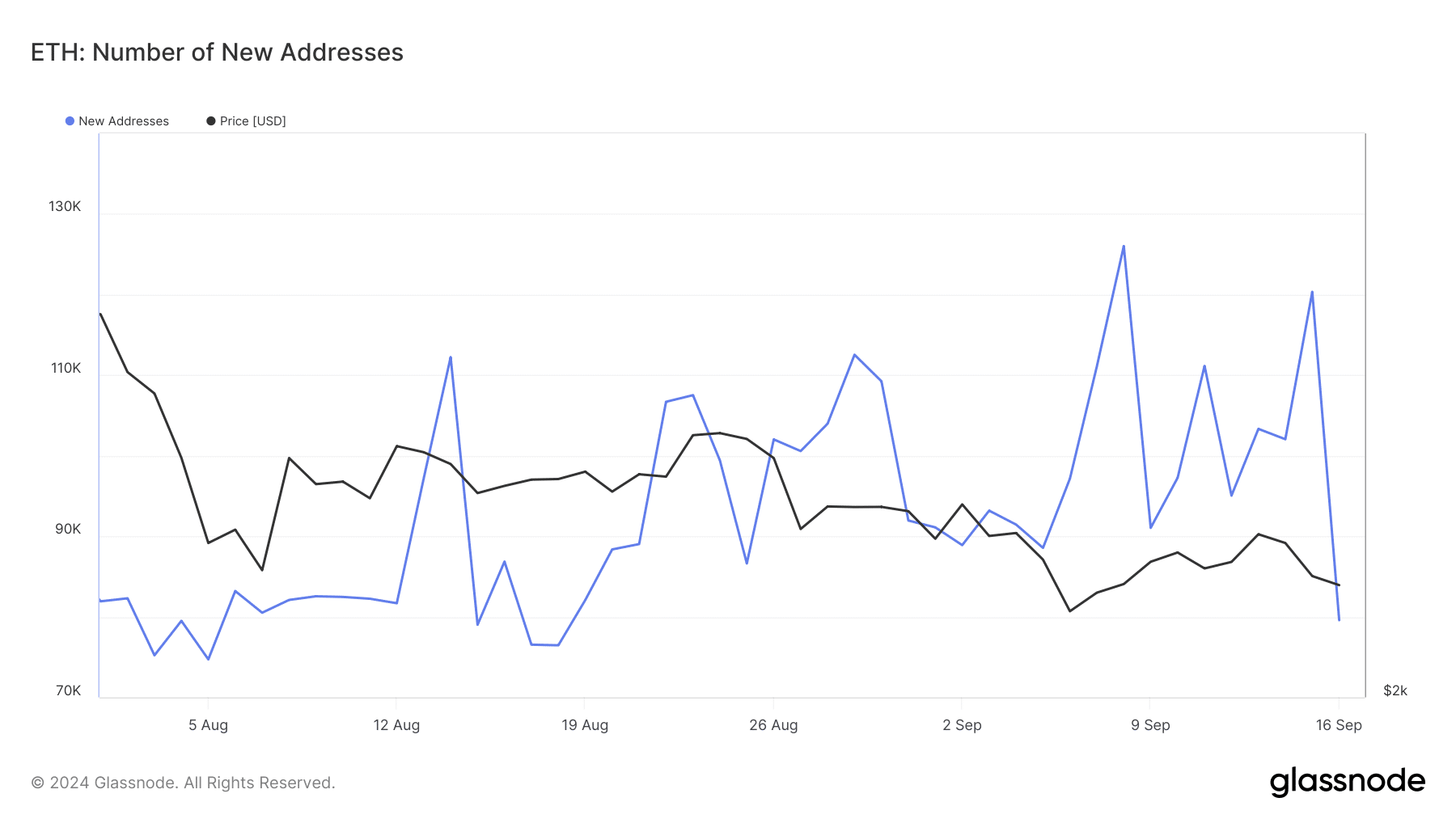

In addition to the leverage ratio, the number of new Ethereum addresses provides insight into network activity and potential market sentiment.

Data from Glassnode revealed a decline in the number of new addresses. After peaking above 126,000 on the 6th of September, the figure has since dropped sharply to around 79,000 new addresses.

A decreasing number of new addresses typically signals reduced participation or interest in the network, which can be a bearish indicator.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Lower growth in new addresses may imply that fewer new investors are entering the market, potentially leading to a decrease in buying pressure.

This decline in network activity can contribute to the ongoing downward pressure on Ethereum’s price, especially when coupled with the rising leverage ratio.