NewsBriefs - Arbitrum co-founder defends layer 2 networks amid Ethereum's underperformance

09/17/2024 22:20

Arbitrum CEO Steven Goldfeder refutes claims that layer 2 networks are parasitic to Ethereum. Despite generating $32 million since 2021, Gol...

Editor-curated news, summarized by AI

Arbitrum co-founder defends layer 2 networks amid Ethereum's underperformance

Arbitrum CEO Steven Goldfeder refutes claims that layer 2 networks are parasitic to Ethereum. Despite generating $32 million since 2021, Goldfeder argues layer 2s aim to grow Ethereum's ecosystem. Critics point to Ethereum's 3% growth compared to Bitcoin's 42% and Solana's 31% in 2023. With 78 Ethereum layer 2s now active, Goldfeder remains optimistic about future growth, emphasizing security and decentralization over immediate expansion. The $12 billion layer 2 market continues to evolve amid debates over its impact on Ethereum's performance.

Latest

-

Arbitrum co-founder defends layer 2 networks amid Ethereum's underperformance

Arbitrum CEO Steven Goldfeder refutes claims that layer 2 networks are parasitic to Ethereum. Despite generating $32 million since 2021, Goldfeder argues layer 2s aim to grow Ethereum's ecosystem. Critics point to Ethereum's 3% growth compared to Bitcoin's 42% and Solana's 31% in 2023. With 78 Ethereum layer 2s now active, Goldfeder remains optimistic about future growth, emphasizing security and decentralization over immediate expansion. The $12 billion layer 2 market continues to evolve amid debates over its impact on Ethereum's performance.

Expand

-

Fed's first rate cut signals potential gains for stocks and crypto

Data shows stocks tend to rise after the Fed begins cutting interest rates, contrary to bearish predictions. The S&P 500 averages 9.5% annual returns long-term. After rate cuts begin, markets typically gain 6.8% in 12 months and 26.5% in 24 months. This trend suggests potential upside for both stocks and crypto assets, which often move similarly as risk assets. Investors should consider this historical pattern when evaluating market prospects following expected Fed rate cuts.

Expand

-

TON Foundation partners with Curve Finance for stablecoin swap project

TON Foundation and Curve Finance are collaborating on a TON-based stable swap project using Curve's CFMM tech. This partnership aims to enhance stablecoin trading on TON, improving user experience and accessibility. An independent team will be selected to develop the project, with Curve's founder Michael Egorov advising. The initiative includes token airdrops for qualified users and aligns with Curve's recent shift towards its native stablecoin, crvUSD.

Expand

-

Flyfish Club settles with SEC for $750K over NFT membership sales

Flyfish Club, set to open in Manhattan, settled with the SEC for $750K over alleged violations related to NFT membership sales. The company must destroy all Flyfish NFTs, stop accepting royalties, and pay the penalty by September 26. The SEC claims Flyfish led investors to expect profits from the club's management and potential NFT resale. SEC Commissioners Peirce and Uyeda dissented, arguing the NFTs were utility tokens, not securities. The club is still scheduled to open on September 20, with standard memberships now available.

Expand

-

Polymarket amasses nearly $1 billion in bets on 2024 US election outcome

Polymarket has garnered close to $1 billion in bets on the 2024 US presidential election. Kamala Harris leads with a 50% chance, backed by $135 million in wagers, while Donald Trump follows at 49% with $150 million in bets. The platform faces challenges post-election, including competition from Solana-based BET and potential regulatory hurdles. Crypto.com highlights liquidity concerns for Polymarket as the prediction market sector matures, emphasizing the need for growth in sports and major crypto events to maintain its edge.

Expand

-

Bitcoin stagnates as gold hits record high amid market caution

Bitfinex analysts note Bitcoin's decoupling from gold, which reached an all-time high, signaling investor caution amid recession fears. Bitcoin dropped 3% to $58,700, struggling to maintain $60,000, while gold hit $2,589. The trend of favoring traditional safe-havens over crypto may intensify after an expected Fed rate cut. Analysts anticipate increased local volatility and potentially rapid price movements in the crypto market. Gold's surge is attributed to a weakening dollar and expectations of significant Fed rate cuts, bolstered by slowing job growth indicators.

Expand

-

SEC increases scrutiny on Binance's token listing process in amended complaint

The SEC filed a proposed amended complaint against Binance, focusing on the exchange's token listing process. The filing addresses previously dismissed charges and strengthens allegations about 10 digital assets. The SEC emphasizes Binance's role in promoting listed tokens and alleges BNB was offered as an investment. The complaint also details Binance's Simple Earn product and token economics. The SEC clarified its stance on "crypto asset securities" to avoid confusion.

Expand

-

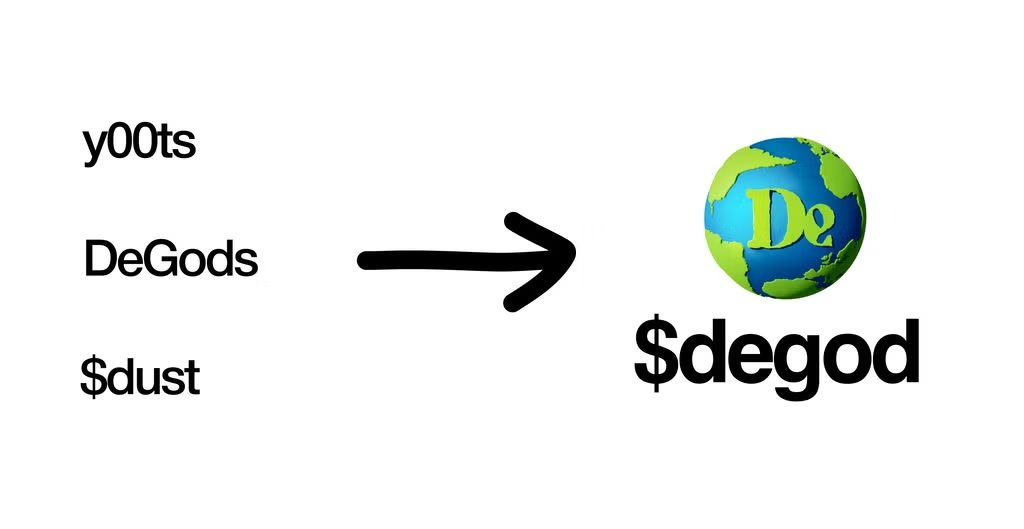

DeGods unites y00ts, DeGods, $dust under new DEGOD token

DeGods, a popular Solana NFT project, has launched DEGOD token, consolidating its entire NFT ecosystem. This move aims to boost liquidity and community cohesion but has sparked mixed reactions. The project allocates 85% of the token supply to the community, yet concerns arise over NFT rarity disregard and price volatility. DeGods' transition to the memecoin market is seen as a significant gamble, with success dependent on community management, product development, and market conditions. The prices of DeGods and y00ts NFT collections have surged in the past 24 hours as investors rush to acquire NFTs in exchange for DEGOD tokens.

Expand

-

Hacker drains $6M from DeltaPrime on Arbitrum

Crypto broker DeltaPrime experienced a $6M token drain on its Arbitrum version due to a private key leak. A hacker gained control of the admin proxy, redirecting it to a malicious contract. The exploit affected DPUSDC, DPARB, and DPBTCb pools. Users couldn't withdraw funds on Arbitrum due to the platform's borrowing and lending structure. PRIME tokens dropped 6.5% amid the incident. The DeltaPrime team is investigating the issue at the time of reporting.

Expand

-

CFTC warns of election gambling 'explosion' harming public interest

The CFTC claims prediction markets are vulnerable to manipulation, citing recent incidents on Polymarket and PredictIt. A legal battle with Kalshi over election betting continues, with the CFTC filing an appeal after a judge ruled they exceeded authority. The regulator argues allowing more election bets could cause significant harm, dismissing Kalshi's concerns about financial losses. This case is seen as significant for the crypto industry, with debates over whether prediction platforms constitute gaming under US law.

Expand

-

Binance warns of global clipper malware attacks on crypto transactions

Binance alerts users to a surge in clipper malware attacks globally, targeting crypto transactions by altering withdrawal addresses. The malware, distributed via unofficial apps and plugins, has caused significant financial losses. Binance's security team is blacklisting suspicious addresses, notifying affected users, and monitoring threats. Users are advised to verify app authenticity, double-check withdrawal addresses, and stay informed about security risks. The malware primarily affects Android and web apps, but iOS users should also remain cautious.

Expand

-

Wormhole brings World ID to Solana enabling human-focused applications

Wormhole has integrated World ID with Solana, allowing developers to build apps prioritizing real humans. This move expands World ID beyond Ethereum, enabling Solana-based protocols to authenticate users' World IDs. Worldcoin, co-founded by OpenAI CEO Sam Altman, aims to assign digital IDs to humans via eyeball scans, distinguishing between people and AI bots. The project has garnered 6.6 million signups, promoting increased trust online.

Expand

-

SEC expands lawsuit against Binance to include more tokens as securities

The SEC has broadened its lawsuit against Binance, now classifying AXS, FIL, ATOM, SAND, and MANA as securities. The regulator accuses Binance and BAM Trading of facilitating unregistered security token trades and promoting them as investments. The SEC reiterates claims of Binance operating illegally as an unregistered exchange, broker-dealer, and clearing agency. This move aligns with the SEC's ongoing efforts to regulate the crypto industry, though the agency faces scrutiny for apparent contradictions in its approach to crypto asset classification.

Expand

-

Kraken demands jury trial in SEC lawsuit, presents defense arguments

Crypto exchange Kraken has requested a jury trial in its legal battle against the US SEC. The firm denies engaging in illegal conduct and argues it never registered with the SEC as it wasn't required to. Kraken claims digital assets aren't investment contracts subject to SEC regulation. The exchange faces allegations of violating federal securities laws, similar to cases against Binance and Coinbase. Kraken accuses the SEC of acting without due process and fair notice, suggesting action was taken for exercising its first amendment rights.

Expand

-

Taiko prepares to upgrade rollup protocol and launch Ontake fork

Taiko is upgrading its rollup protocol to version 1.9.0 and preparing for Ontake, the first Taiko BCR protocol fork. Key improvements include enhanced L2 EIP-1559, transaction re-confirmation support, batch processing, and Calldata for contract proposers. These upgrades aim to boost efficiency, reduce Gas costs, and improve data handling flexibility on the Taiko L2 network.

Expand