DeFi revival ahead amid potential rate cuts: Bernstein report

09/18/2024 00:00

DeFi is set to capture more attention from traders in the coming weeks as the potential for U.S. Federal Reserve rate cuts looms.

- The DeFi market capitalization was $67 billion at press time.

- With the Bernstein prediction, the market cap could increase, getting close to its previous high.

According to a recent report by Bernstein, Decentralized Finance (DeFi) is poised to capture greater attention from traders in the coming weeks.

While the sector is still recovering from its 2022 lows, recent data shows promising growth in Total Value Locked (TVL).

Also, as traders prepare for a shift in market dynamics, key assets like Chainlink [LINK] and Lido Staked Ether continue to lead the market.

DeFi set to attract more traders

A recent report from Bernstein suggests that Decentralized Finance (DeFi) could see increased interest from traders in the coming weeks.

According to analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, the potential for U.S. Federal Reserve rate cuts—ranging from 25 to 50 basis points on Wednesday—could make DeFi yields more attractive.

While the total value locked (TVL) in DeFi is still only half of its 2021 peak, it has doubled from its 2022 low, reaching $77 billion. Additionally, monthly users have surged three to four times since the market’s bottom.

Stablecoins have also regained momentum, with values around $178 billion, and monthly active wallets remain steady at approximately 30 million.

DeFi market cap sees decline, but…

According to data from CoinGecko, the current market capitalization of the DeFi sector is approximately $68 billion.

A closer analysis revealed that the market had experienced a significant decline since April, when its market cap stood at around $116 billion. Since then, substantial losses have occurred.

However, based on the recent predictions from Bernstein, a rebound in DeFi market capitalization could be imminent.

As interest in DeFi grows and favorable conditions arise, such as potential U.S. Federal Reserve rate cuts, the market may recover in the coming months.

Chainlink leads asset market

According to data from CoinGecko, LINK held the second-largest market capitalization among DeFi assets, following Lido Staked Ether.

Lido Staked Ether leads with a market cap exceeding $22 billion, while LINK has a market capitalization of over $6.4 billion. As of this writing, LINK was trading at approximately $10.60, reflecting a 0.8% increase.

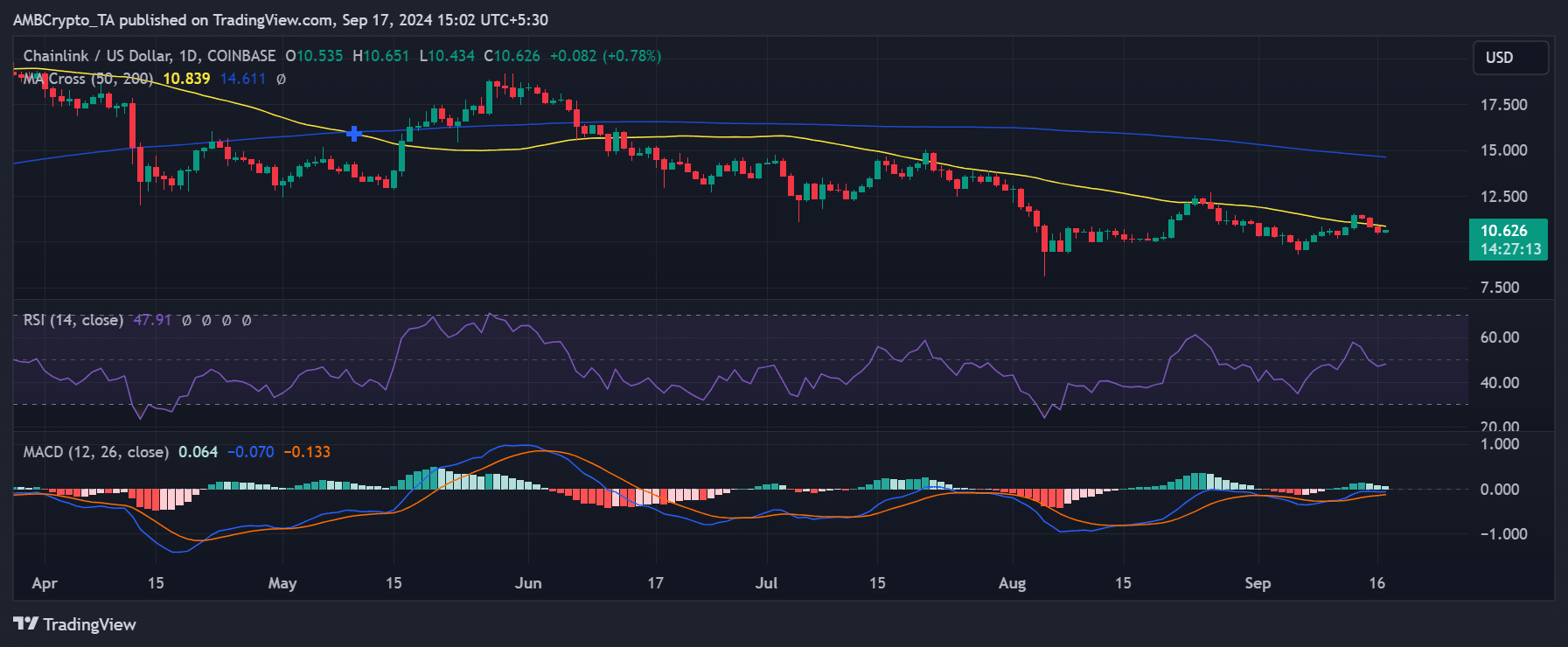

Despite recent gains, LINK previously experienced consecutive declines that pushed it below its short-term moving average (represented by the yellow line).

While it briefly broke above this resistance level on the 13th of September, it was unable to sustain the upward trend, falling back below the moving average.

As DeFi prepares for renewed interest from traders, fueled by potential rate cuts and attractive yields, the sector appears primed for a rebound.

Though the market capitalization has seen significant declines since April, positive trends such as the doubling of TVL and stable user activity point to a potential recovery.