Bitcoin Surges as Fed Goes for Massive Rate Cut

09/19/2024 00:43

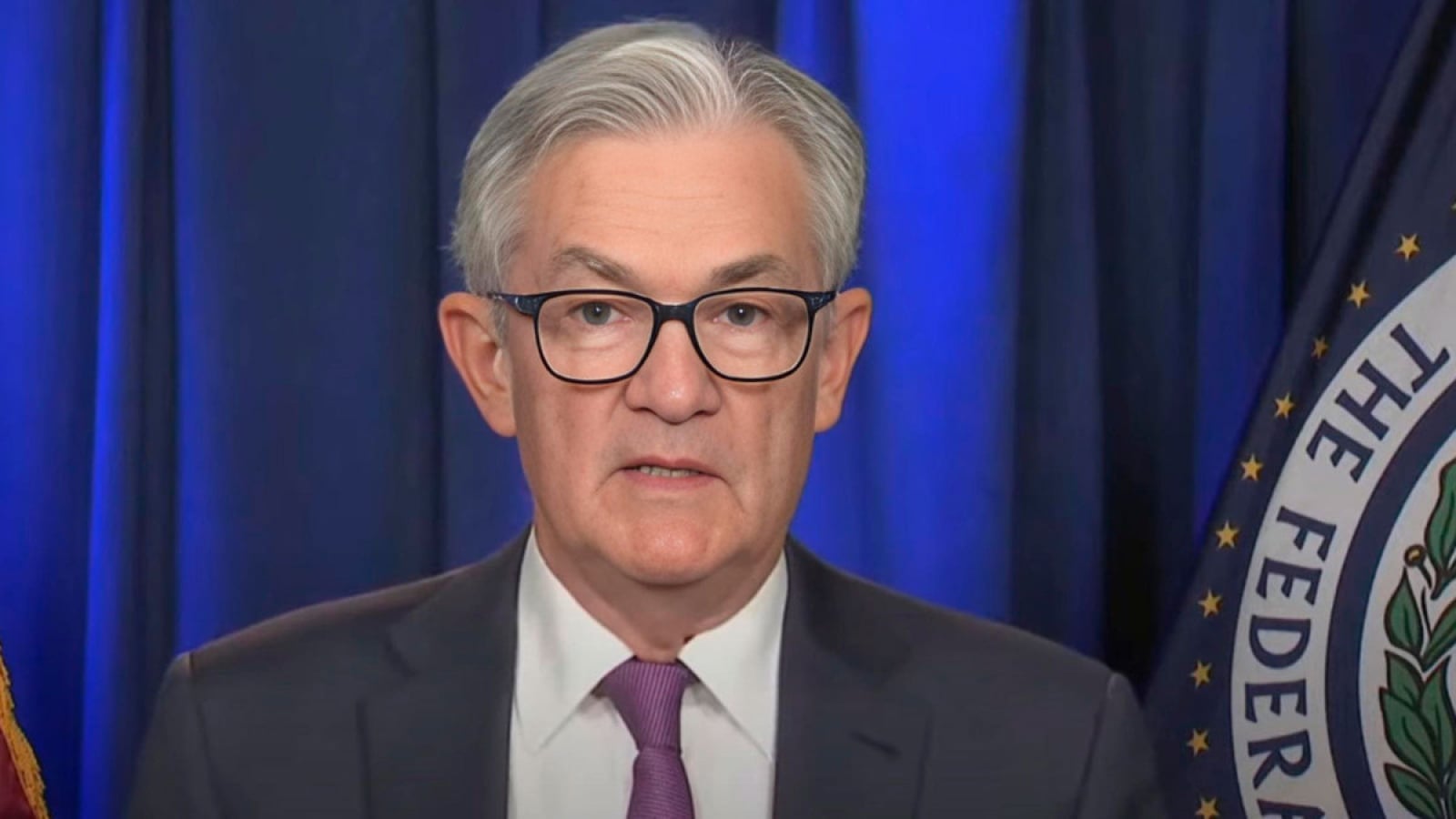

The Fed has implemented the first rate in four years

The U.S. Federal Reserve has decided to cut rates by 50 basis points.

This is the first rate cut initiated by the world's most important central bank in four years.

The price of Bitcoin, the leading cryptocurrency, is currently sitting at $60,900 on the Bitstamp exchange.

The Fed kept market observers guessing about the size of its much-awaited rate cut until the very last moment.

While the Fed's moves tend to be more or less predictable, there was a lot of uncertainty surrounding its most recent decision.

More than $55 million had been staked on the Fed rate cut on the popular crypto-based prediction market PolyMarket.

As reported by U.Today, the odds of a 50-basis point rate cut surged sharply higher on PolyMarket earlier this week, surpassing 50%. However, on Wednesday, the odds of a super-sized move declined substantially.

The Fed went on a prolonged rate hike cycle back in 2022 in order to tame out-of-control inflation. This hawkish cycle lasted until July 2023.

It is worth noting that the European Central Bank (ECB) has already cut rates multiple times this year due to declining eurozone inflation. Some economists claim that the Fed was actually too slow to start cutting rates.

While speculation about the Fed's rate cut has dominated headlines over the past few weeks, JPMorgan CEO Jamie Dimon recently downplayed the significance of the Fed's move. He claimed that the central bank's decision would not matter much, urging investors to pay attention to "a real economy."

About the author

Alex Dovbnya

Alex Dovbnya (aka AlexMorris) is a cryptocurrency expert, trader and journalist with extensive experience of covering everything related to the burgeoning industry — from price analysis to Blockchain disruption. Alex authored more than 1,000 stories for U.Today, CryptoComes and other fintech media outlets. He’s particularly interested in regulatory trends around the globe that are shaping the future of digital assets, can be contacted at [email protected].

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox