Bittensor’s open interest nears ATH — Is a TAO bullish rally ahead?

09/19/2024 11:00

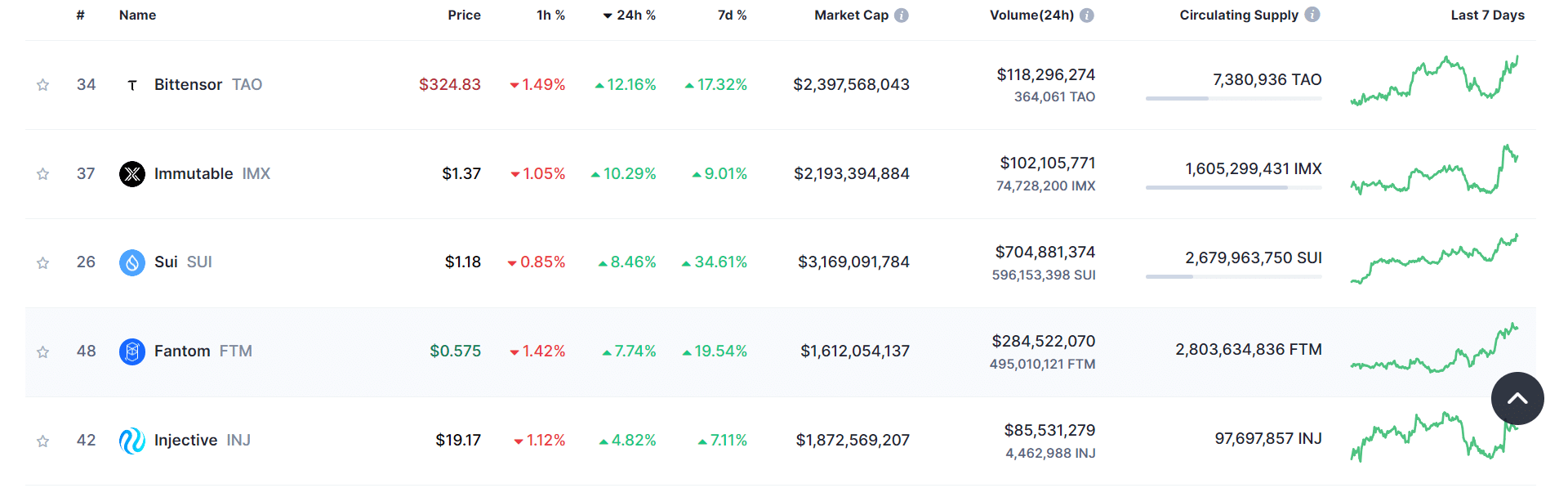

TAO recorded over 12% gains past 24 hours, making it the top-performing coin among the top 50 by market cap but can the trend continue?

- BitTensor leading by gains for top 50 coins by market cap.

- Open interests approaching the all-time high.

BitTensor [TAO], a leading AI coin, is gaining significant traction in the cryptocurrency market as web3 continues to evolve on blockchain technology.

In the last 24 hours, TAO has recorded over 12% gains, making it the top-performing coin among the top 50 by market cap at press time, according to CoinMarketCap.

TAO is well-positioned to surpass Fetch.AI (FET) as the top AI coin, depending on broader market conditions.

Major companies like Nvidia (NVDA) recently posted better-than-expected earnings, influencing the market with their collective views.

This has sparked a bullish sentiment toward AI coins, as Nvidia plays a significant role in the AI industry.

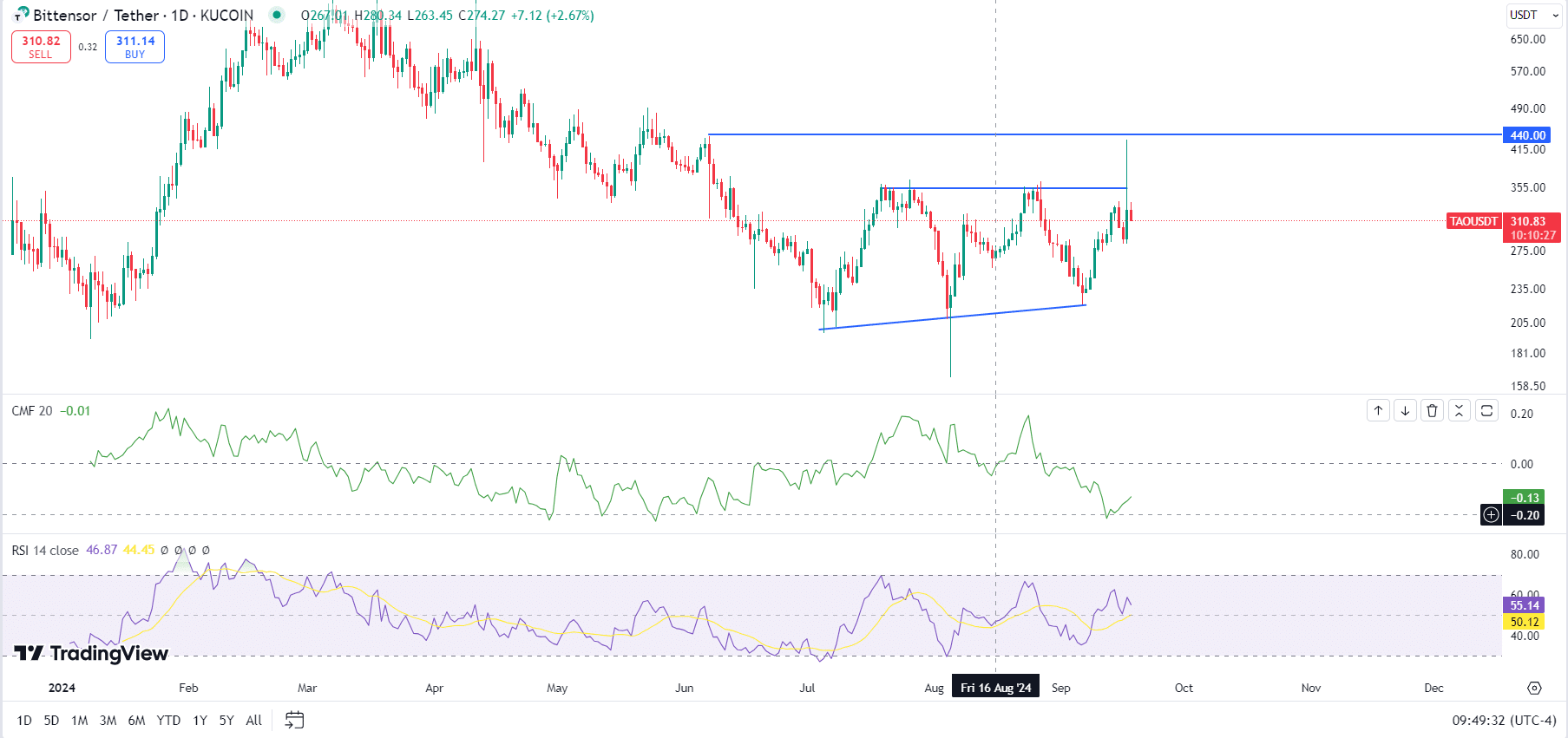

TAO price actions wicks to around $440

In the past 24 hours as at press time, TAO’s price spiked to $440 on Kucoin Exchange but faced immediate rejection, suggesting strong selling pressure at that level.

This creates a significant resistance zone moving forward. Typically, wicks are viewed as gaps that markets tend to fill, meaning BitTensor needs to climb higher to fill this gap.

Whether TAO/USDT will rally to fill this gap remains uncertain, as the price rejection could indicate that sellers still hold control. However, TAO briefly wicked above $356, where there’s liquidity due to equal highs at this level.

Additionally, the bullish close of the August 5th candle, a hammer with a long tail, suggests increasing buying pressure.

TAO/USDT’s consolidation, while in a range, is marked by higher lows, which is typically a bullish signal. The Chaikin Money Flow, currently negative, hints at a possible reversal that could drive TAO’s price higher.

The Relative Strength Index (RSI) on the 14-day moving average has also flipped bullish, further supporting the case for potential gains in the near future.

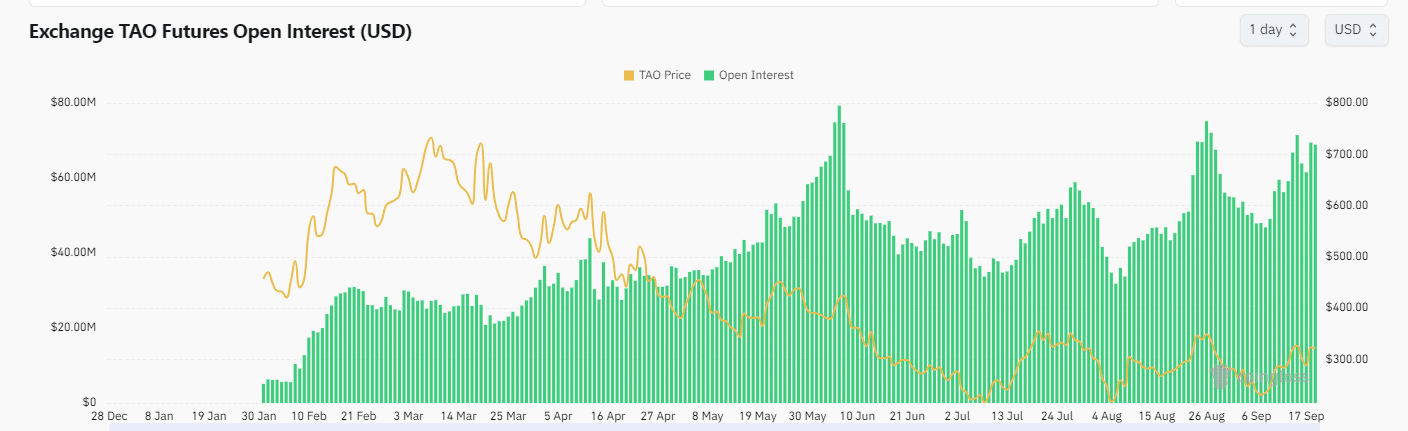

The open interest for BitTensor across popular exchanges is nearing its all-time high, with a current total of $68.88 million at a price of $322 as of press time.

Binance leads the pack with $29M in TAO open interest, followed by Bybit with $18.6M. Bitget and BingX follow with $13.19 million and $5.54 million, respectively.

Other exchanges like Coinbase, Kraken, HTX, and CoinEx show notable, but lower, open interest.

Source: Coinglass

This strong open interest is a bullish sign for TAO. Now could be a good time to accumulate TAO tokens.

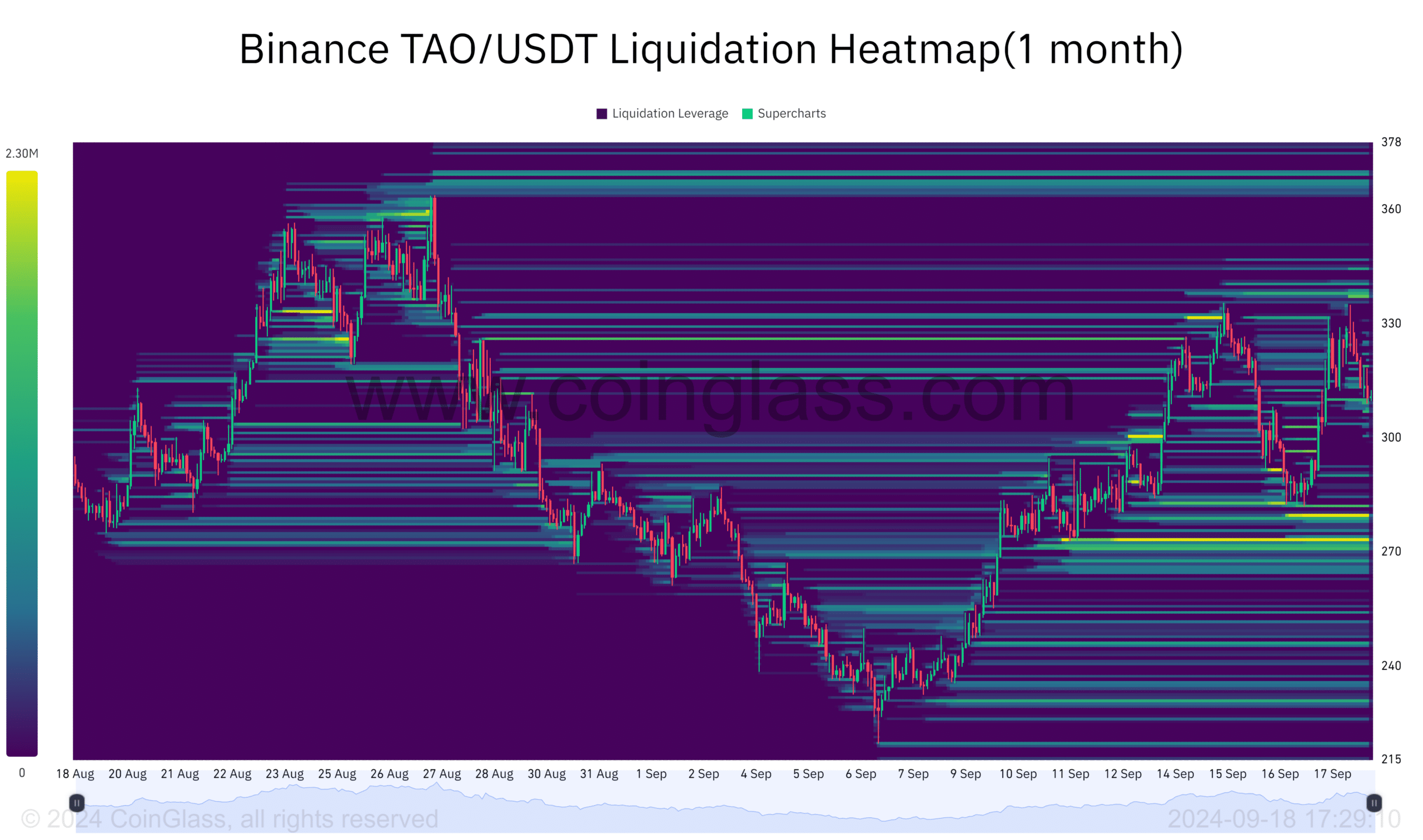

Liquidation heatmap

Lastly, examining the liquidation heatmap, several liquidation levels suggest potential price movements.

There’s a significant cluster of $482.17K in liquidation leverage above the $366 price level, likely held by traders who are bearish on BitTensor following its rejection.

Is your portfolio green? Check the TAO Profit Calculator

Below $280, there’s $1.11 million in liquidation leverage, and another $1.92M is resting below $275.

Source: Coinglass

If TAO’s price captures liquidity above its current level, it could boost bullish activity and push TAO/USDT higher.