BlackRock’s Bitcoin whitepaper explains – BTC is not a…

09/19/2024 22:00

BlackRock’s whitepaper highlights Bitcoin’s unique investment characteristics, noting its high risk and complex behavior.

- BlackRock’s Bitcoin ETF (IBIT) faced fluctuating inflows; Ethereum ETF (ETHA) performed better.

- BlackRock’s whitepaper highlighted Bitcoin’s exceptional performance over the past decade but acknowledged its high risks.

BlackRock’s Bitcoin [BTC] ETF (IBIT) faced fluctuating inflows over recent days, with the most recent update on the 18th of September, revealing zero new inflows.

In contrast, BlackRock’s Ethereum [ETH] ETF (ETHA) recorded a healthy inflow of $4.9 million during the same period as per Farside Investors.

Blackrock’s ETF performance analyzed

Despite these short-term variations, the IBIT ETF has accumulated total inflows of $20.92 billion since its inception, surpassing the cumulative inflows of $17.45 billion for all BTC ETFs combined.

Similarly, ETHA has seen total inflows of $1.03 billion since its launch, whereas the cumulative Ethereum ETF sector has experienced a negative net outflow of $9.8 million.

These figures suggest that the lack of inflows for IBIT may be a temporary fluctuation, with potential for improvement soon.

Blackrock on Bitcoin’s role

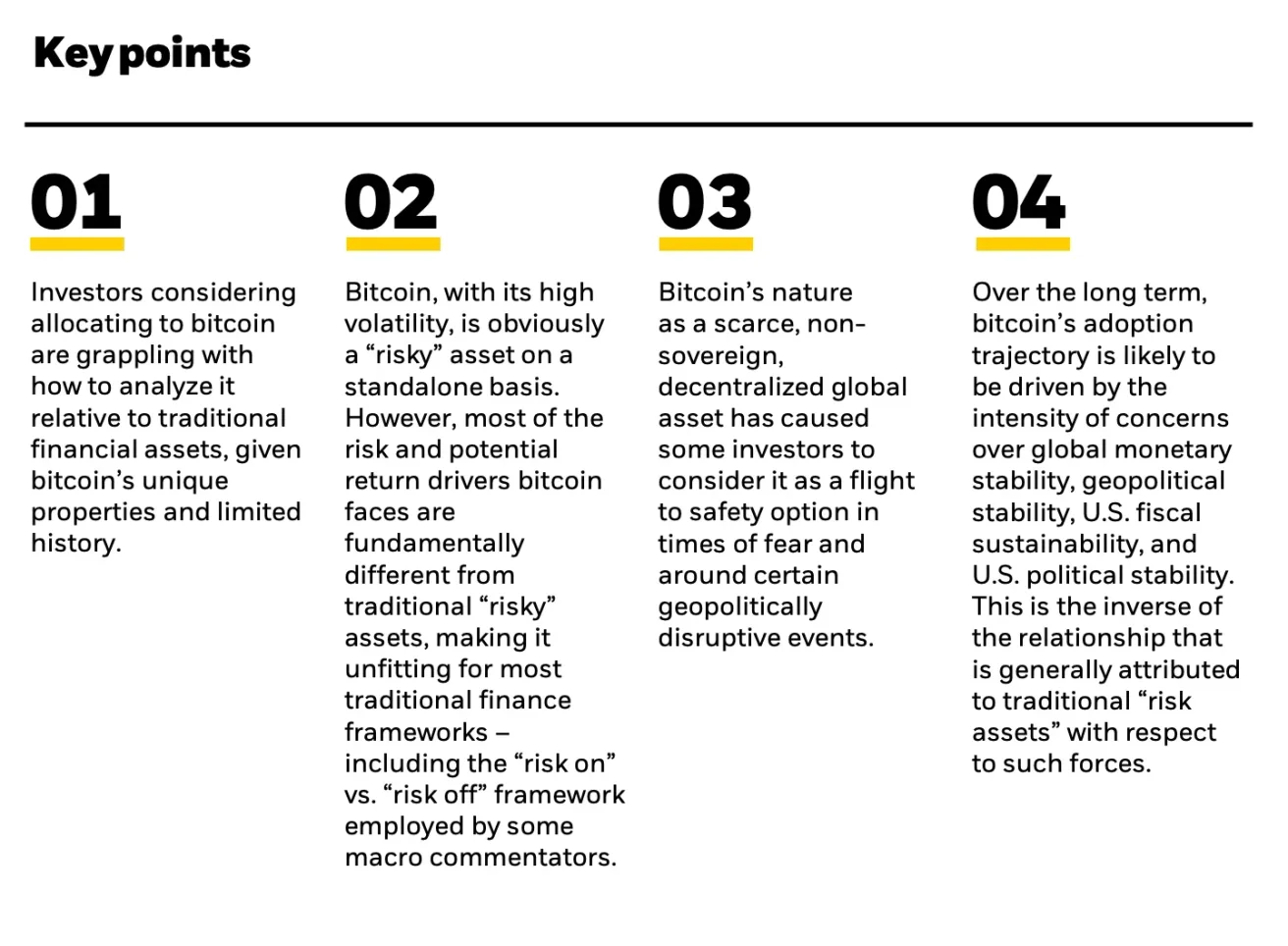

Following its history of successful launches, BlackRock has unveiled a comprehensive nine-page whitepaper that delves into Bitcoin’s distinctive role among major asset classes.

The paper emphasizes BTC’s unique position as a “diversifier,” contrasting it with traditional assets by highlighting its fleeting correlations with U.S. equities and USD interest rates.

According to BlackRock, Bitcoin’s unconventional characteristics present both opportunities and challenges for investors accustomed to analyzing traditional asset classes.

Bitcoin’s journey so far

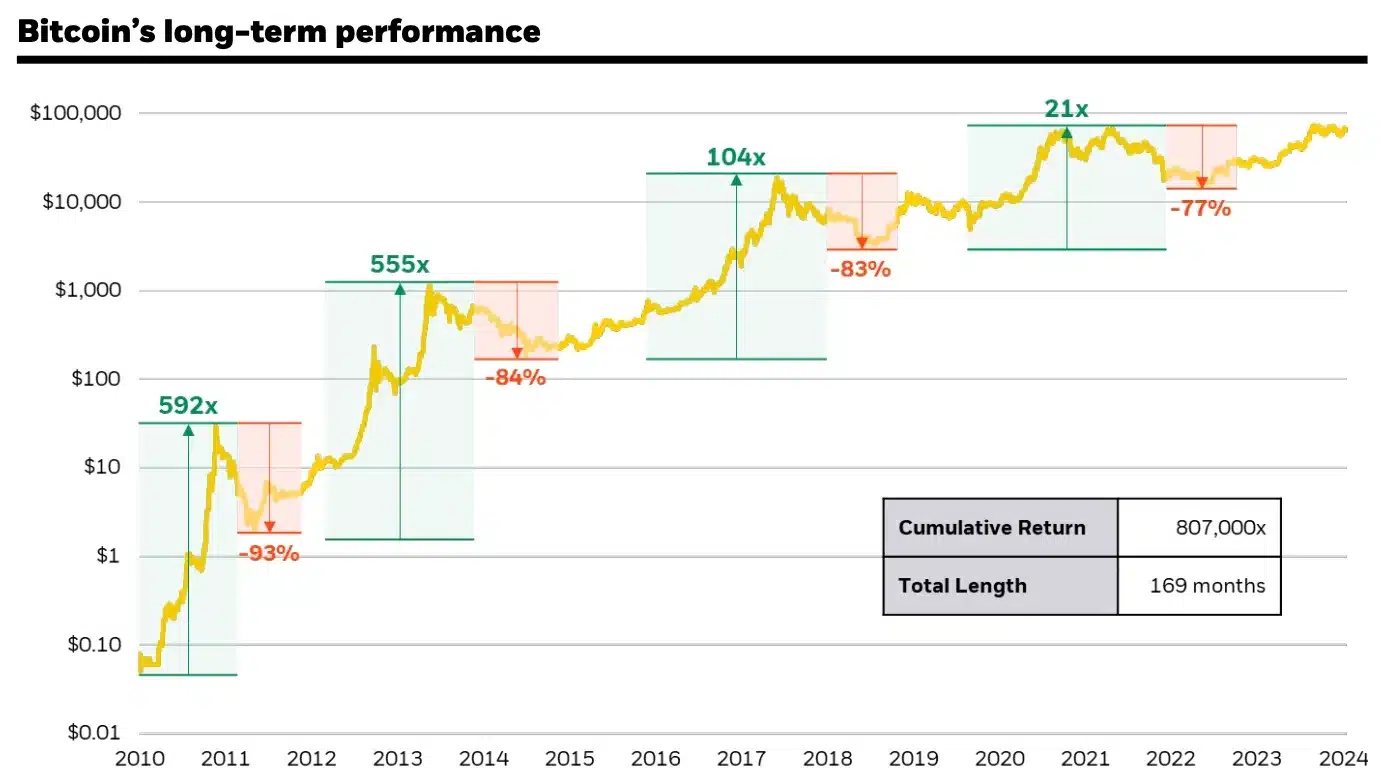

The whitepaper provides an in-depth analysis of Bitcoin’s journey to a $1 trillion market capitalization, showcasing its exceptional performance over the past decade.

It reveals that BTC outpaced all major asset classes in seven of the last ten years, delivering an impressive annualized return of over 100%.

This remarkable growth occurred despite Bitcoin being the poorest performer in three of those years, marked by four significant drawdowns exceeding 50%.

“These movements in bitcoin’s price continue to reflect, in part, its evolving prospects through time of becoming adopted on a widespread basis as a global monetary alternative.”

A hedge against U.S. dollar weakness

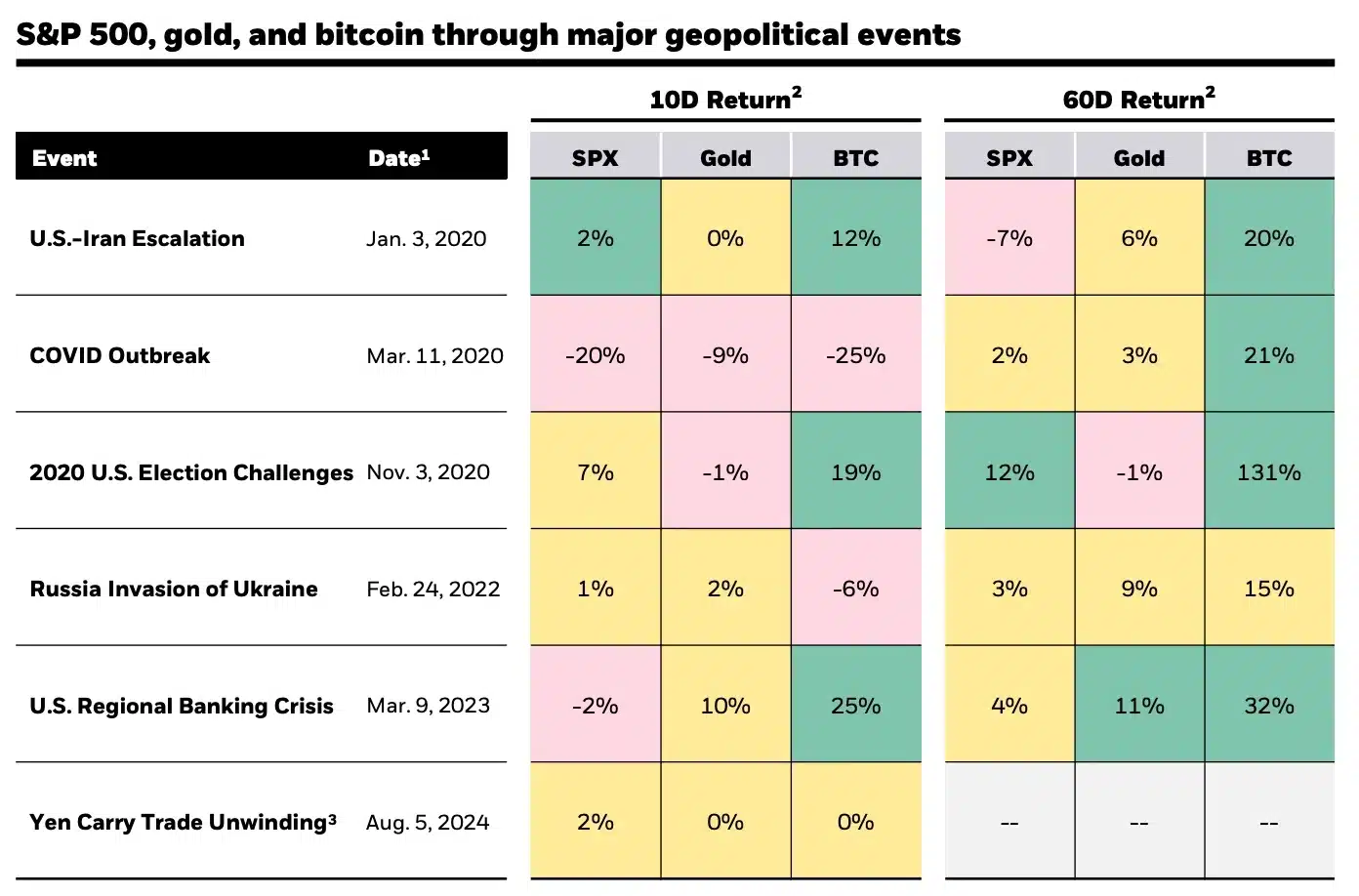

The paper also emphasizes BTC’s perceived insulation from global macroeconomic factors, suggesting that, for some investors, it has emerged as a “flight to safety” during times of geopolitical uncertainty.

Additionally, BlackRock argued that Bitcoin offers a hedge against potential U.S. dollar weakness, which could arise from the growing federal deficit.

The whitepaper further contrasts Bitcoin with U.S. equities by emphasizing Bitcoin’s continuous trading and near-instantaneous cash settlement, which enhances its liquidity during market stress.

Unlike traditional equities that are confined to standard trading hours, Bitcoin operates 24/7, making it particularly valuable during periods of liquidity strain, such as over weekends when traditional markets are closed.

This unique characteristic positions Bitcoin as a highly saleable asset in times of financial uncertainty, offering an advantage over traditional assets that are less accessible during such periods.

Bitcoin, a risk-on asset — Why?

That being said, the whitepaper concluded that Bitcoin remains a high-risk asset, and noted:

“None of the prior analysis negates the fact that bitcoin, on a standalone basis, is still very much a risky asset. Bitcoin has also been volatile and subject to myriad risks that include regulatory challenges, uncertainty over the path of adoption, and a still- immature ecosystem.”

This means that BTC’s risks are distinct from those of traditional investment assets.

Unlike other assets, Bitcoin’s behavior and risk factors cannot be easily categorized within simple “risk on” (investing in assets perceived as higher risk for higher returns) versus “risk off” (avoiding riskier assets in favor of safer ones) frameworks.

All in all, BTC’s unique characteristics make it a special case, showing that these traditional risk assessment models may not fully capture its complexities.