Is Ethereum on the road to $2810? What market sentiment says

09/20/2024 22:00

ETH has surged by 9.03% over the last 7 days. TD Sequential indicates a buy on Ethereum's Weekly charts positioning ETH for further gains

- ETH has surged by 9.03% over the last seven days.

- An analyst eyes further gains if $2200 support level holds.

Ethereum [ETH] has recently experienced a strong recovery in its price, trading at $2553 at press time.

This marked a 5.25% increase over the past 24 hours, thus completing a week-long upsurge. As such, on weekly charts, the altcoin has surged by 9.03%.

Prior to these gains, Ethereum had been on a downtrend, reaching a low of $2251 last week.

Despite the recent surge, Ethereum’s price has remained considerably below its March high of $4070. Equally, it still remains down by 47.9% from its all-time high of $4878.

Therefore, the current market conditions raise questions about the sustainability of the recovery. Inasmuch, popular crypto analyst Ali Martinez suggested a potential rebound if the $2200 support level holds

According to Martinez, the TD Sequential was flashing “buy” on Ethereum’s weekly charts at press time.

This suggested that markets have a strong potential for a strong rebound if ETH’s prices hold above the $2200 support level.

In context, TD Sequential helps to identify trend exhaustion and Potential reversal points. Thus, a buy signal on the TD Sequential suggests that the downtrend is losing strength, indicating a potential reversal to the upside.

Therefore, based on weekly charts, ETH may see a sustained rally rather than a short-term bounce.

ETH looks favorable

According to AMBCrypto’s analysis, ETH was experiencing a strong upward momentum on weekly charts. This was a result of favorable market conditions that positioned the altcoin for further gains.

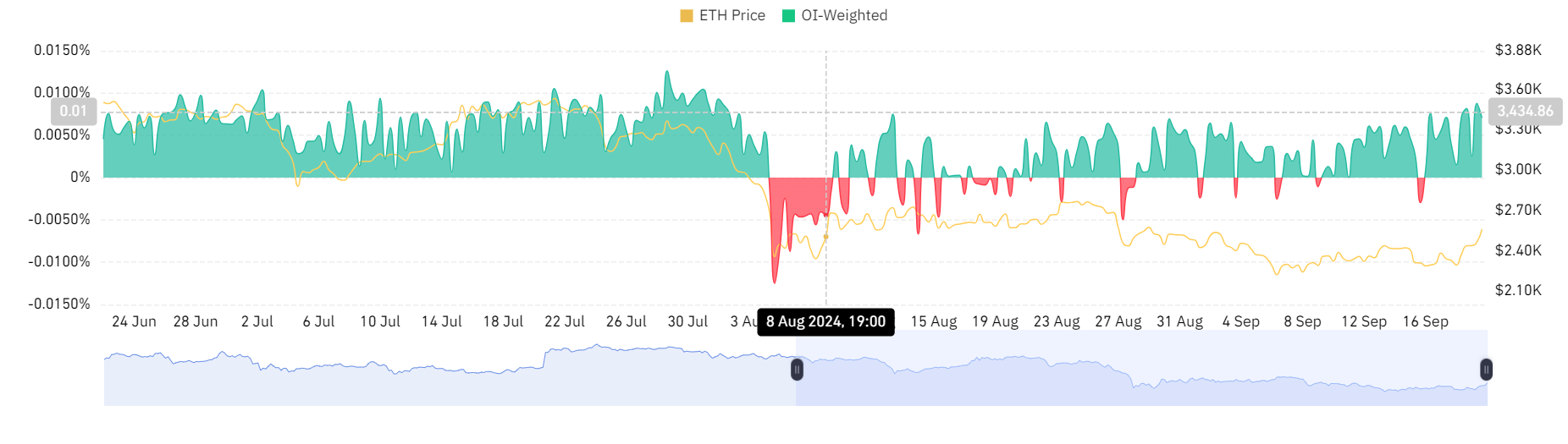

For starters, Ethereum’s OI-Weighted Funding Rate has remained for the past 4 days.

Usually, a positive OI-Weighted Funding Rate indicates a significant volume of open interest is associated with investors taking long positions.

A high Open Interest combined with a positive Funding Rate suggests that investors are using leverage to bet on price increases, thus indicating confidence in upward movement.

This is a bullish sentiment, with long position holders paying short position holders.

Additionally, Ethereum’s Funding Rate Aggregated by Exchange has been positive for the last three days. This further supported AMBCrypto’s previous observation regarding a higher demand for long positions than short.

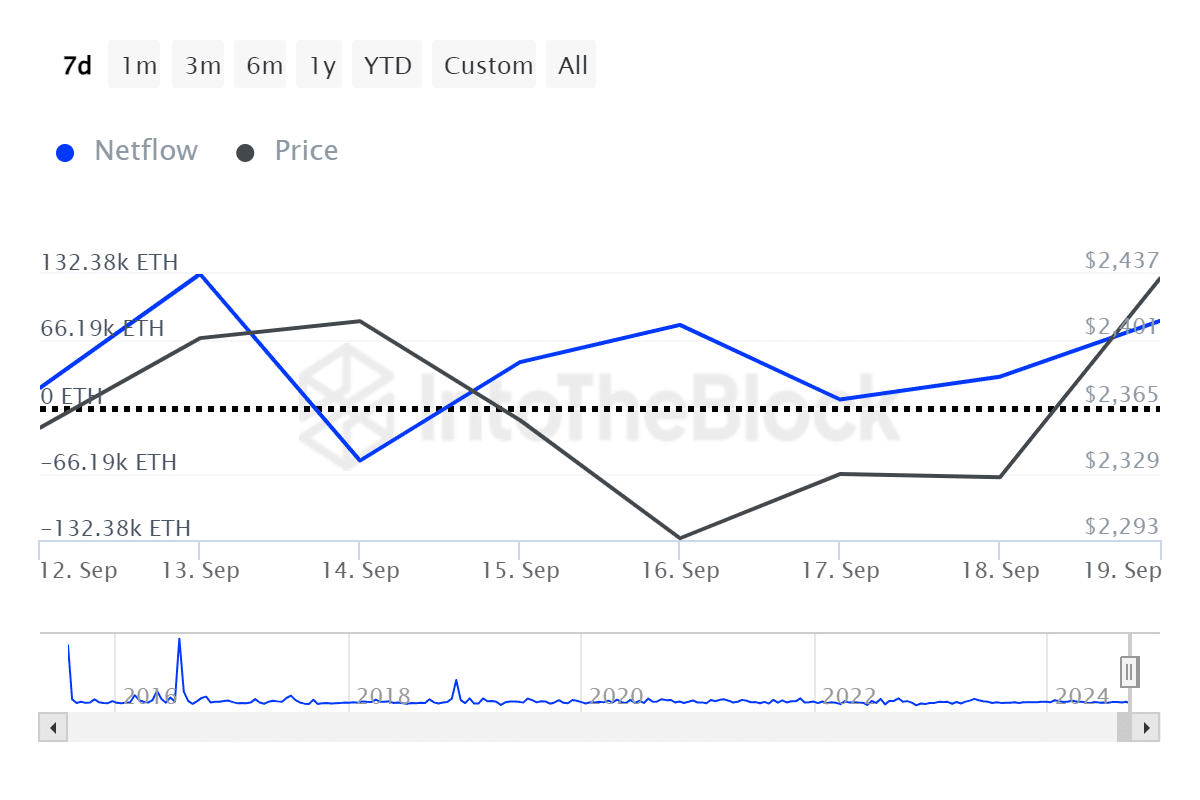

Finally, Ethereum’s large holder netflow has remained positive most of the week, only turning negative once on the 14th of September.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Thus, for the last six days, ETH has enjoyed more inflow from large holders than outflow. This indicated that large holders were accumulating, signaling confidence in the asset’s future value.

To sum up, Ethereum is enjoying positive market sentiment. If these conditions are maintained, ETH will challenge the next resistance level around $2810 that has proven stubborn in the past.