Celestia crypto gains 31.5% in 2 days, but are bears ready to pounce?

09/21/2024 14:00

Celestia crypto has a strong bullish outlook after its performance this week, but a minor dip could occur over the weekend.

- TIA has a short-term bullish outlook but could see a minor retracement.

- A revisit to the $5.6 and $5.8 support levels would offer a buying opportunity.

Celestia [TIA] was on a good bullish run over the past week and traders expect that this trend will continue next week. AMBCrypto’s analysis of the liquidation charts showed that a minor price dip was possible over the weekend.

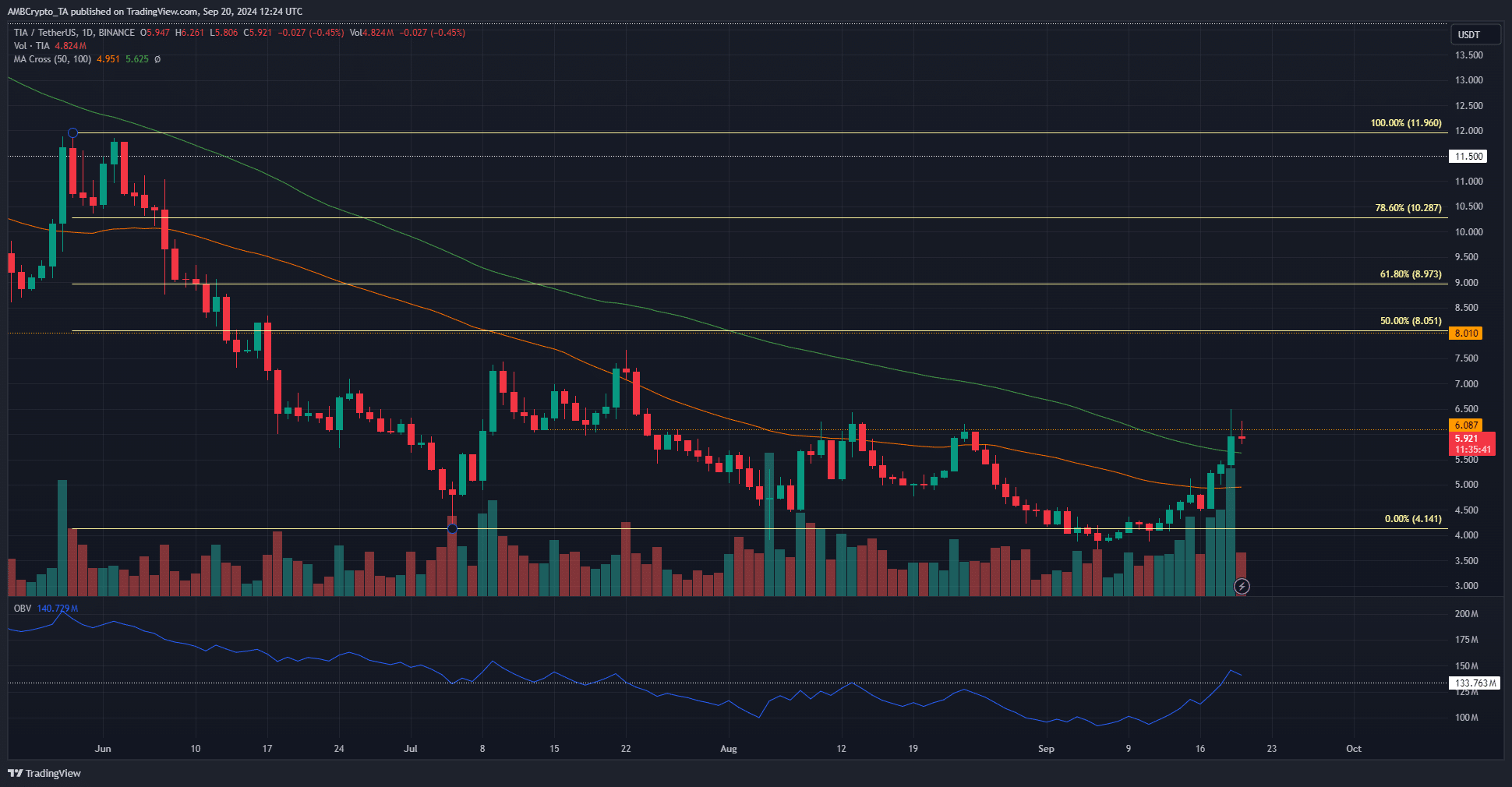

The higher timeframe charts showed that momentum was bearish, but the heightened trading volume pointed toward increased bullish conviction. A move to $8 is likely based on the evidence at hand.

The 100% Fibonacci retracement level defense prompts a large rally

The most recent lower high was at $6.194. On the 19th of September, TIA reached $6.498 but was unable to close a daily trading session above $6.194. This meant that the market structure was not flipped bullishly.

It appeared to be a matter of time, based on the increasing trading volume of the past few days. Correspondingly, the OBV also rose above the local highs in August. This suggested that the price would soon follow and break the $6.2 resistance zone.

The 20 and 50-period simple moving averages showed that the long-term momentum was bearish since they have not crossed over yet. The price of Celestia crypto has breached both the moving averages, showing that short-term momentum was bullish.

Targets for the current impulse rally

The quick Celestia crypto surge of the past has been building up for ten days and noted most of its gains within three days. The liquidation heatmap showed that $7 and $8 were the next magnetic zones.

Prices are attracted to these liquidity pockets and could see a bearish reversal from them. It appeared likely that TIA would proceed higher toward the $8 mark instead of facing rejection at $7 due to the trading volume of the past few days.

AMBCrypto analyzed the liquidation levels chart to see if traders should expect short-term price volatility. It appeared that they should be wary of a price dip, as the cumulative liq levels delta was positive.

Read Celestia’s [TIA] Price Prediction 2024-25

Long positions were disproportionately high, which could drag prices downward to liquidate the late bulls. The liq levels chart showed that $5.8 and $5.6 are short-term support levels where the dip could end and Celestia crypto continues its upward move.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion