FlokiFi Locker hits $165.6M TVL: Is FLOKI set for a breakout?

09/23/2024 16:00

FlokiFi Locker has soared to a record-breaking TVL of $165.6 million, outpacing popular memecoins like Dogecoin and Shiba Inu.

- FlokiFi Locker’s $165.6 million TVL, neutral RSI, and growing holder base suggest potential bullish momentum.

- Mixed on-chain signals and stable liquidation data indicate caution, but bulls may still prevail.

FlokiFi Locker has soared to a record-breaking TVL of $165.6 million, outpacing popular memecoins like Dogecoin and Shiba Inu. Every lock on the ETH and BSC chains triggers a deflationary burn, contributing to Floki’s [FLOKI] reduced supply.

With this milestone, FLOKI is poised to leverage its momentum for a potential price breakout.

Are technical indicators pointing to a bullish surge?

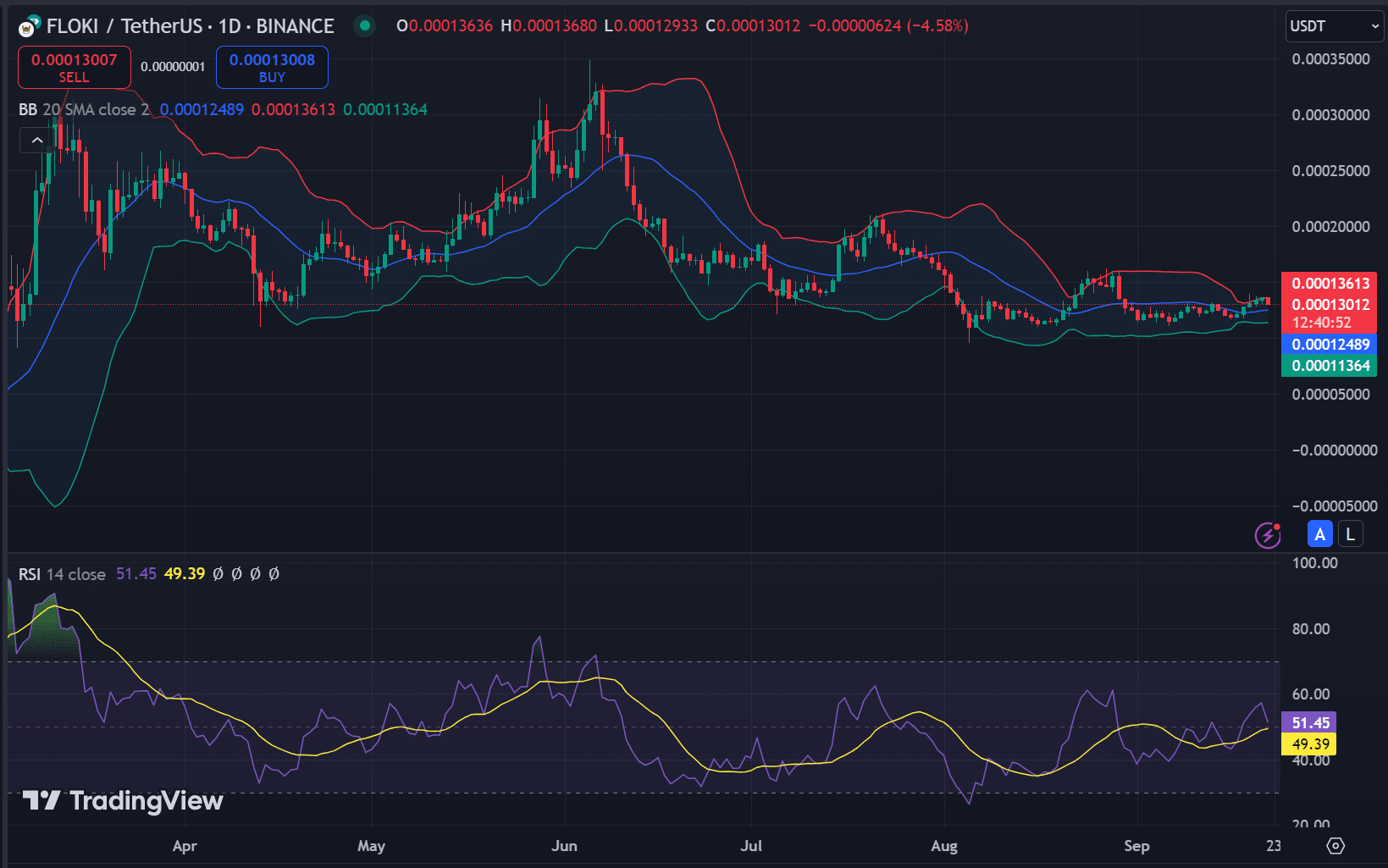

FLOKI’s price is currently consolidating, trading within a narrow range at $0.000136. Bollinger Bands suggest low volatility, which typically signals a breakout is near.

The key question remains: which direction will it take? The RSI sits at 51.45, neither in the overbought nor oversold zone.

Therefore, with neutral momentum, traders should closely monitor the price action for potential upward or downward movement. A breakout above the Bollinger Band’s upper range could signal a bullish surge, but caution is advised.

Growing holder base: A bullish signal?

By mid-September, the total number of FLOKI holders had reached 595, signaling growing investor confidence and suggesting increasing demand for the token.

Moreover, higher demand, combined with reduced supply from deflationary burns, could push the price higher in the coming weeks. The growing holder base is a key bullish indicator that investors should monitor.

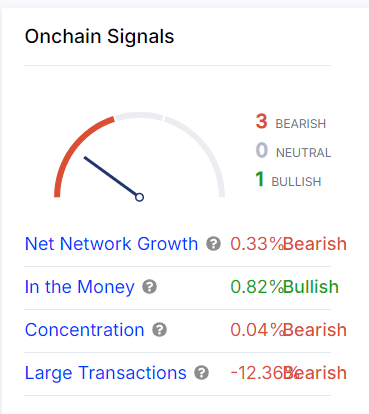

On-chain data: What are the signals telling us?

The on-chain data provides a mixed picture. While the “In the Money” metric shows a bullish 0.82%, other metrics are less encouraging. Net network growth is down by 0.33%, and large transactions have declined by 12.36%, signaling bearish pressure.

Despite some positive signals, caution is warranted as these bearish factors could weigh on short-term price action.

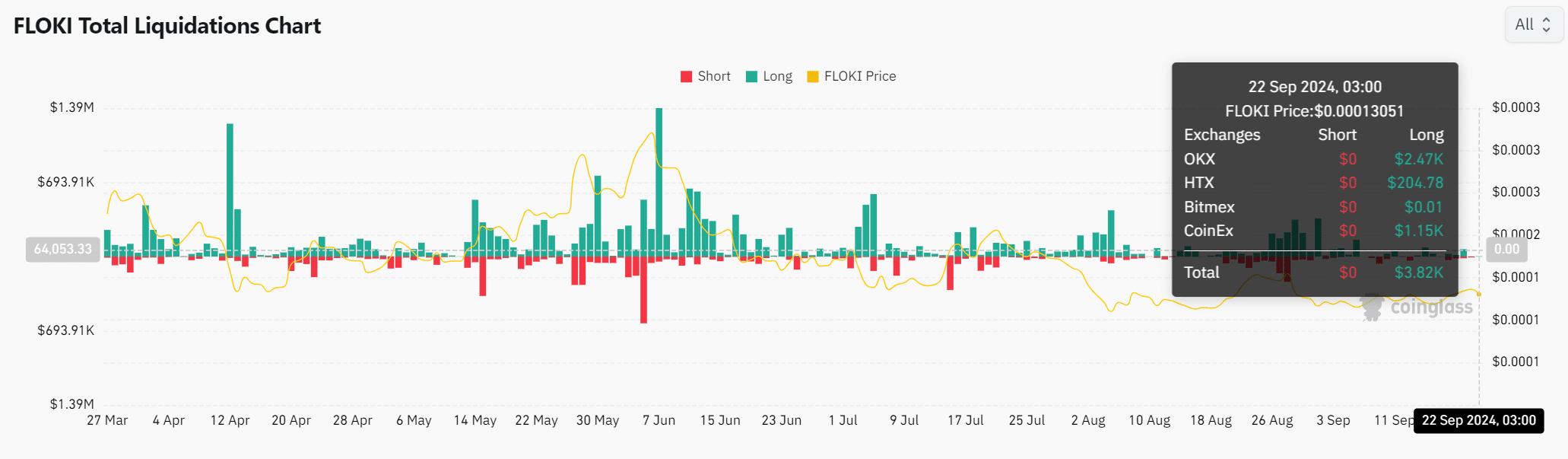

Liquidation data: Can bulls take control?

Recent liquidation data indicates that long positions outweigh shorts, with $3.82K in long liquidations recorded on September 22. This suggests that bullish traders still dominate the market.

The relatively low level of liquidations points to market stability, leaving room for a potential upward price movement.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

With a record TVL, a growing holder base, and bullish on-chain signals, FLOKI seems poised for a breakout.

However, mixed on-chain data and low volatility could lead to market hesitation. FLOKI has bullish potential, but traders should stay alert for confirmation signals before diving in.