Bitcoin sees spike in slippage – Will this trigger volatility and local reversals?

09/25/2024 02:00

The Bitcoin market volatility may increase due to recent spikes in slippage, which can lead to short-term reversals.

- Bitcoin see spikes in slippage as traders advised to take caution.

- Bitcoin concentrated liquidation levels are near $60K.

Bitcoin [BTC] continues to show strong momentum, with its price trading above $63k as of today. The current market data suggests that BTC has the potential to move even higher.

However, market volatility may increase due to recent spikes in slippage, which can lead to short-term reversals. A significant level to watch if Bitcoins stays above it is $62,500.

If BTC moves below this level, a cascade of liquidations could push prices lower. Despite these risks, Bitcoin’s overall upward trend remains intact, with potential support near the $60k price zone.

Bitcoin liquidation updates

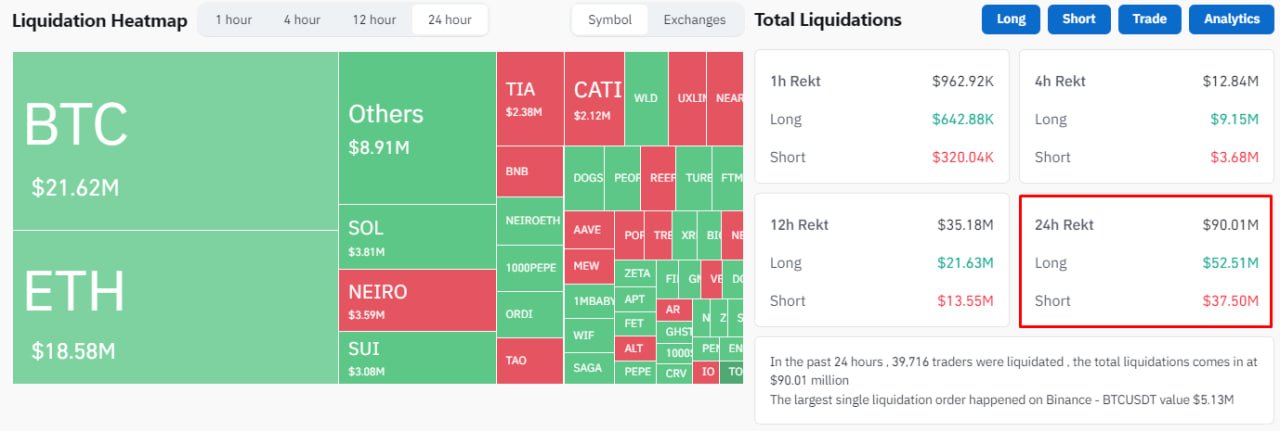

Liquidations continue to play a crucial role in BTC’s price movements. In the last 24 hours, Bitcoin experienced a total of $23.29 million in liquidations, with $16.42 million in longs and $6.87 million in shorts.

The broader crypto market saw 39,721 traders liquidated, with total liquidations reaching $90.03 million. The largest single liquidation order took place on the Binance exchange for the BTC/USDT pair, valued at $5.13 million.

These liquidations can often indicate potential reversal zones in the market, providing insights into where the price might head next.

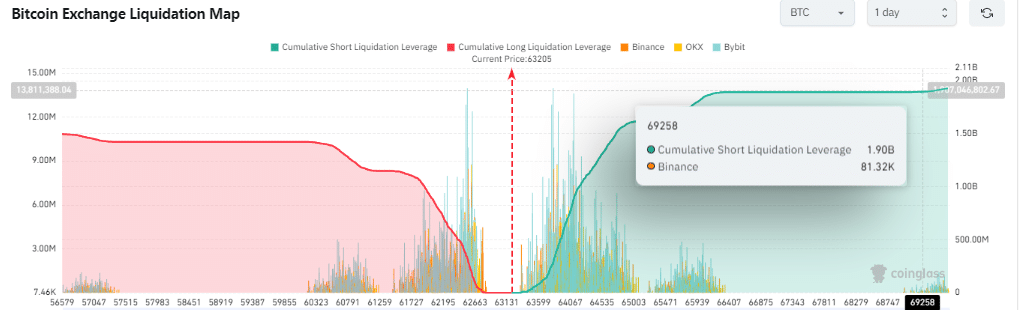

Looking forward, if Bitcoin rallies to $69k, an additional $1.9 billion is set to be liquidated, affecting 81,320 trades. The price is expected to reach for this liquidity level, though a short-term correction could occur before BTC climbs toward $69k.

Source: Coinglass

Traders on social platforms are also advised to take caution, suggesting risk management of short liquidations accordingly as the regains market volatility. DeFi Mann post on X, formerly Twitter, read:

If you have your short liquidation at 70k manage your risk Otherwise the market will manage it for you within the next 2 weeks

Liquidation levels concentration

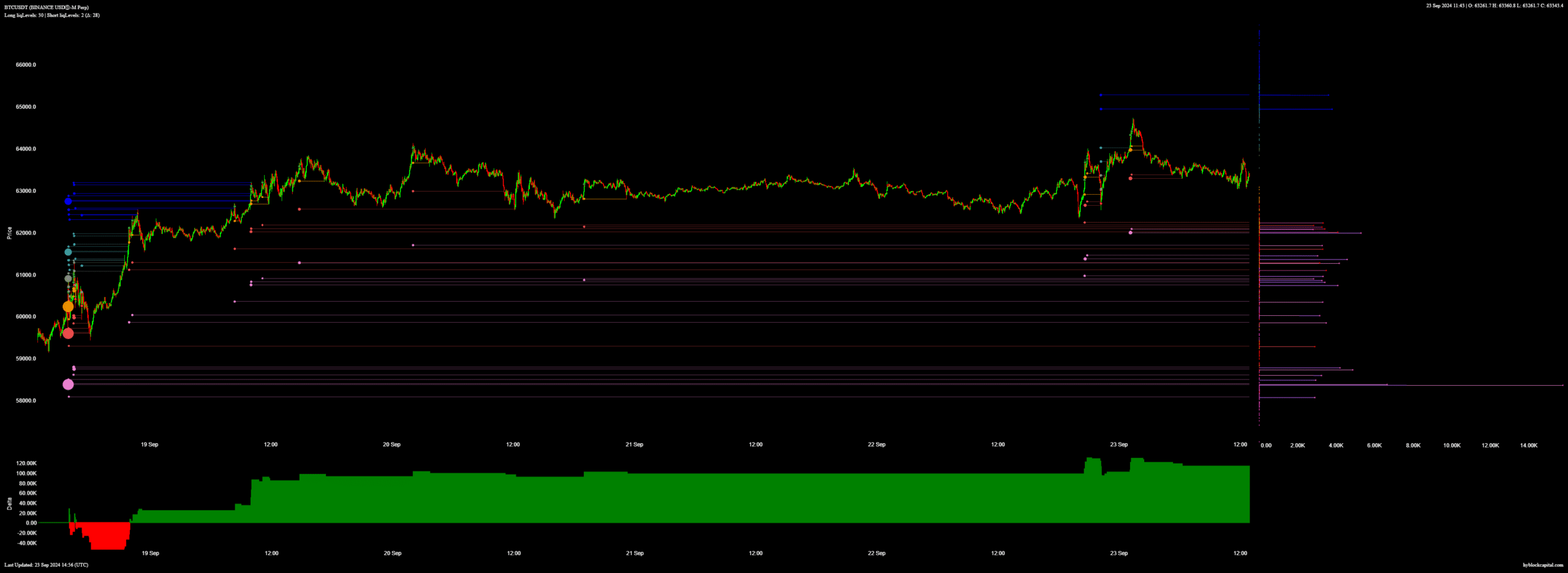

Lastly, for liquidation maps which show where large amounts of traders’ positions may be liquidated, have highlighted Bitcoin’s key areas of potential volatility.

The highest concentrations of liquidation levels for Bitcoin are near $62,500 and $60,000. If prices dip below these levels, it could trigger further liquidations, leading to increased volatility and downward pressure.

Read Bitcoin (BTC) Price Prediction 2024-25

Source: Hyblock Capital

Bitcoin remains in a strong position, with the potential to move higher. However, traders should be mindful of the potential for increased volatility and liquidations, particularly if BTC drops below critical levels like $62,500.

If market conditions remain favorable, BTC could continue its upward trend, targeting higher price levels in the near future.