SUI price surges as TVL hits $1.3 billion - CoinJournal

09/25/2024 02:58

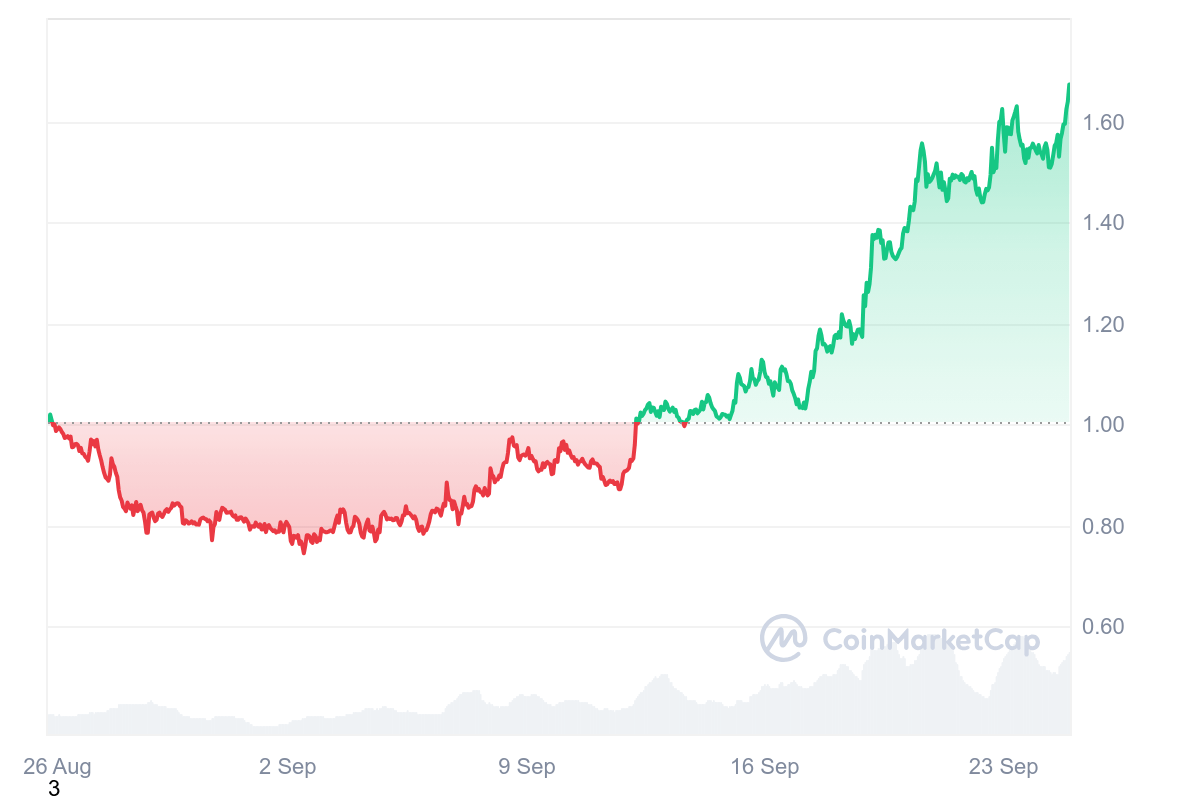

SUI price reached highs of $1.67, increasing 8% in 24 hours and over 44% in a week as TVL hit $1.34 billion

- Sui has seen a more than 44% spike in price in the past week and 65% in 30 days.

- Gains come after the Grayscale Sui Trust opened for accredited investors.

- The SUI network’s total value locked has surpassed $1.34 billion.

SUI price has surged by more than 44% in the past week to trade above $1.67. The gains include a more than 65% spike in the past 30 days. This sees the native token of the layer 1 blockchain platform reach highs last seen in early April.

What catalyzed SUI price surge?

Sui has experienced a notable surge in volume after Grayscale announced its Sui Trust was now open to accredited investors.

Daily volume for SUI skyrocketed after the news, and price followed, hitting levels above $1.

Sui’s price rally to above $1.67 has also coincided with a sharp increase in total value locked in various decentralized finance protocols in the Sui ecosystem. OKX Ventures pointed to the Grayscale Sui Trust’s boost to SUI market credibility as institutional interest emerged.

Sui TVL hits $1.3 billion

The bullish sentiment around this outlook is showing in the on-chain activity that has the TVL hitting $1.34 billion.

According to DeFiLlama, Sui’s TVL rose from about $250 million at the start of 2024 to cross $1 billion in May. However, it dropped to $462 million on Aug. 5 amid the cryptocurrency market crash that pushed Bitcoin price below $50k.

Notable though is the spike back to $1 billion and acceleration to $1.34 billion in less than a month. It means a more than 377% spike year-to-date and 47% month-to-date.

Sui’s growing DeFi ecosystem that’s behind this surge include increased adoption for protocols across lending, decentralized exchanges, real-world assets, derivatives and yield.

Navi Protocol has seen its TVL increase 34% month-to-date to over $449 million.

Lending protocols Scallop and Suilend have respective TVL readings of $246 million and $203 million. It represents a 34% and 100% MTD spike respectively.