Solana Could Reach 50% of Ethereum’s Market Cap, Says VanEck

09/26/2024 00:48

VanEck suggests Solana's technical strengths could help it capture 50% of Ethereum's market cap, despite Ethereum's first-mover edge.

A recent VanEck report suggests that Solana is undervalued for its technical achievements and could potentially reach 50% of Ethereum’s market cap.

To reach these projected gains, Solana will need to focus on its strengths, like fast transaction speeds and low fees, while addressing Ethereum’s “first-mover advantage”.

Solana’s Technical Achievements

A new report from MarketVector, a research arm of VanEck, presents a bullish outlook for Solana. The report compares Solana to Ethereum across various metrics, highlighting several key advantages that position Solana for notable growth.

It suggests that Solana has the potential to reach 50% of Ethereum’s market cap. However, for such a radical transformation to take place, Solana must play its cards well.

Solana’s recent rise has been remarkable, driven by major technological advancements. These developments, along with broader institutional interest, have boosted Solana’s visibility. VanEck backed this momentum with concrete user data to quantify the asset’s increasing prominence.

“When comparing Ethereum and Solana, the data is striking. Solana processes 3,000% more transactions than Ethereum, has 1,300% more daily active users, and its transaction fees are nearly 5 million percent cheaper. These are monumental differences that showcase Solana’s potential efficiency and scalability advantages,” the report claimed.

Read more: Solana vs. Ethereum: An Ultimate Comparison

Despite these technical superiorities, SOL’s market cap is currently only 22% of ETH’s. VanEck attributes much of this gap to Ethereum’s “first-mover advantage” and the institutional adoption it enjoys, most notably seen in the Ethereum ETF.

However, the report suggests that these advantages won’t ensure Ethereum’s dominance forever. To close the gap, Solana should focus on its competitive strengths.

The report highlights DeFi, stablecoins, and payments as key areas where Solana can challenge Ethereum. Solana’s ability to surpass Ethereum in speed and efficiency is crucial to gaining an edge in these massively-expanding markets.

“Another major use-case is lending and borrowing within the DeFi space, a sector expected to continue growing at a rapid pace. Payments and remittances also hold massive potential, especially with Solana’s lower fees and faster transaction times. If institutions and everyday users can save money through cheaper, faster transactions, Solana’s user base could grow even more rapidly”, VanEck stated.

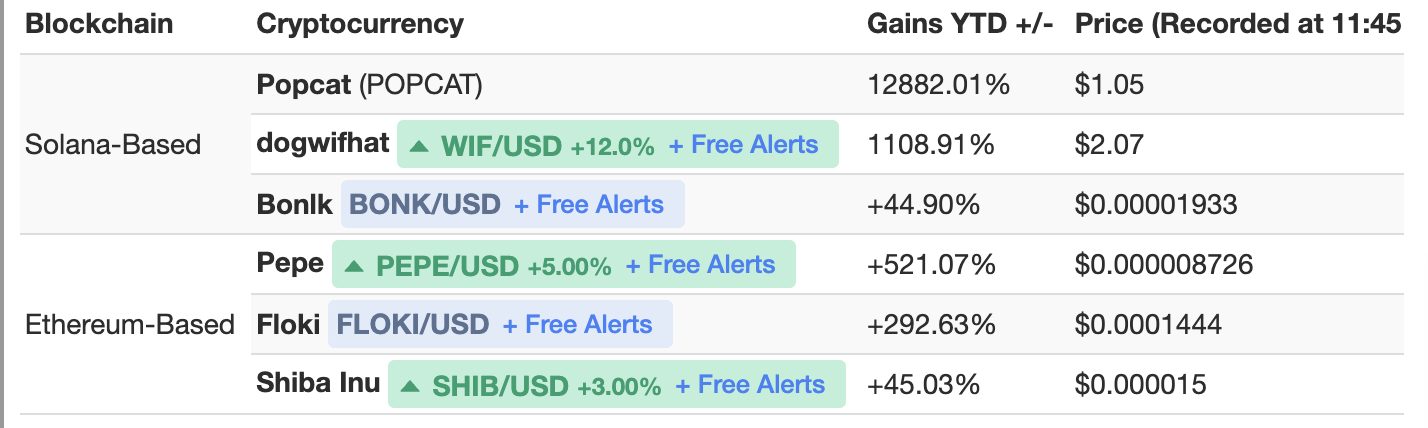

At the very least, Solana is already excelling in several areas. For instance, data from CoinGecko shows that a range of Solana-based meme coins are outperforming their Ethereum counterparts. While pet-themed cryptos have surged across the board in 2024, those on Solana are seeing significantly higher growth.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

However, Ethereum won’t give up its market share without a fight. As BeInCrypto reported, it outperformed Bitcoin in a late September rally, signaling potential for future gains. While Bitcoin’s ETFs may be doing better than Ethereum’s, ETH is still gaining momentum. Solana faces a challenging path to reach 50% of Ethereum’s market cap, but it’s an attainable target.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.