Why Wrapped Bitcoin on AAVE surged past $2B, explained

09/28/2024 10:00

Wrapped Bitcoin [WBTC] supply on AAVE has reached a record high, surpassing $2B. AMBCrypto explores the factor driving the surge.

- Wrapped Bitcoin dominates the DeFi ecosystem with a strong foothold.

- Per AMBCrypto, AAVE has strategically maximized its benefits from the rising WBTC exposure.

Wrapped Bitcoin [WBTC] remains the dominant Bitcoin derivative in DeFi, commanding over $9 billion in TVL. In fact, WBTC supplied on AAVE has reached a record high, surpassing $2B.

This surge reflects the broader trend in DeFi, where bullish Bitcoin sentiment fuels increased WBTC activity.

Benefits of Wrapped Bitcoin

Interestingly, developers created WBTC to bridge the gap between Bitcoin and Ethereum, allowing users to leverage the benefits of both networks.

However, AAVE, a Layer 2 DeFi platform on the Ethereum blockchain, has reaped the most benefits, holding 37,000 WBTC valued at over $2B.

In essence, Wrapped Bitcoin remains a favored choice among investors. Additionally, factors like increased liquidity and the desire for BTC exposure in DeFi might have contributed to this surge.

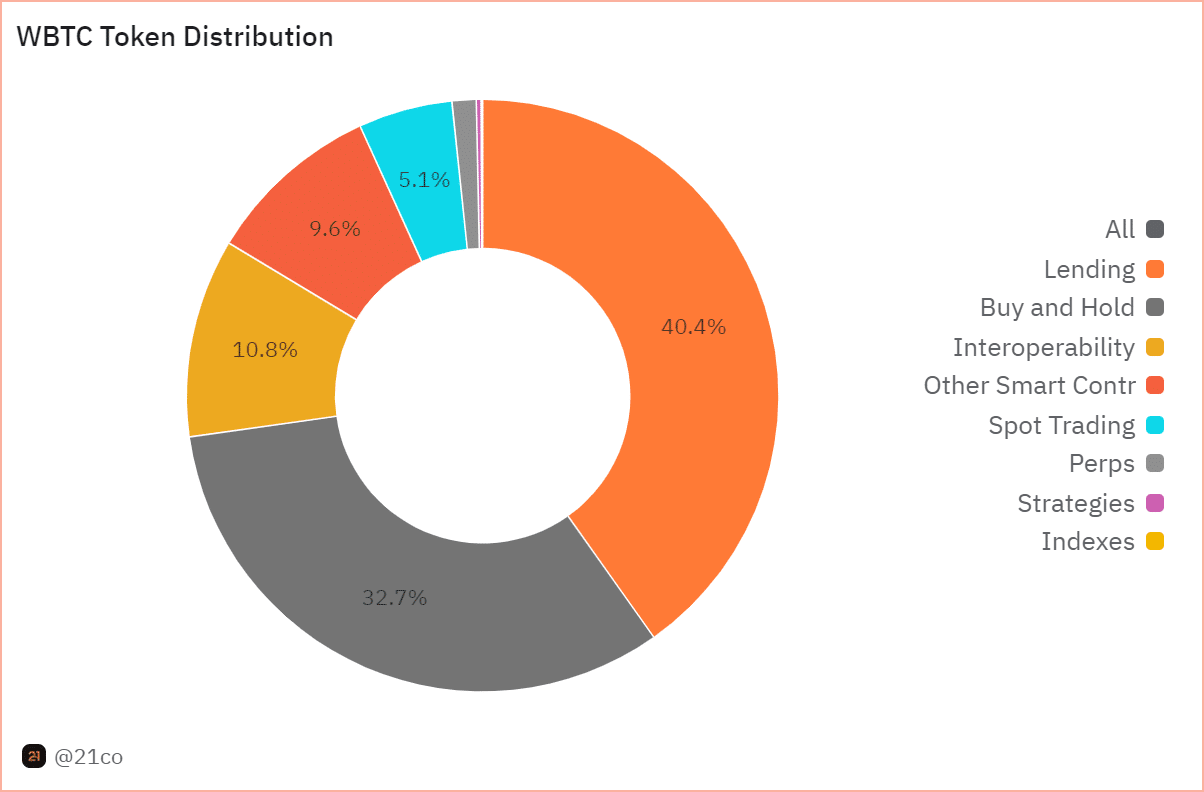

Given AAVE is a lending platform, the 40.4% dominance of WBTC in the lending sector justifies the record supply of Wrapped Bitcoin on the platform.

Here, investors can earn interest, enabling Bitcoin holders to maximize returns on their assets without selling their BTC, while also retaining direct exposure to Bitcoin when it tests key resistance levels.

Simply put, as Bitcoin’s value rises, the collateral amount in WBTC can also increase, further encouraging its use on platforms like AAVE. Additionally,

THIS is attracting WBTCs on AAVE

As mentioned earlier, WBTC can be used in yield farming, where users stake their assets in DeFi platforms to earn additional rewards. This incentivizes users to convert their Bitcoin into WBTC.

Per AMBCrypto, AAVE has strategically embraced factors that attract Wrapped Bitcoin holders to its platform.

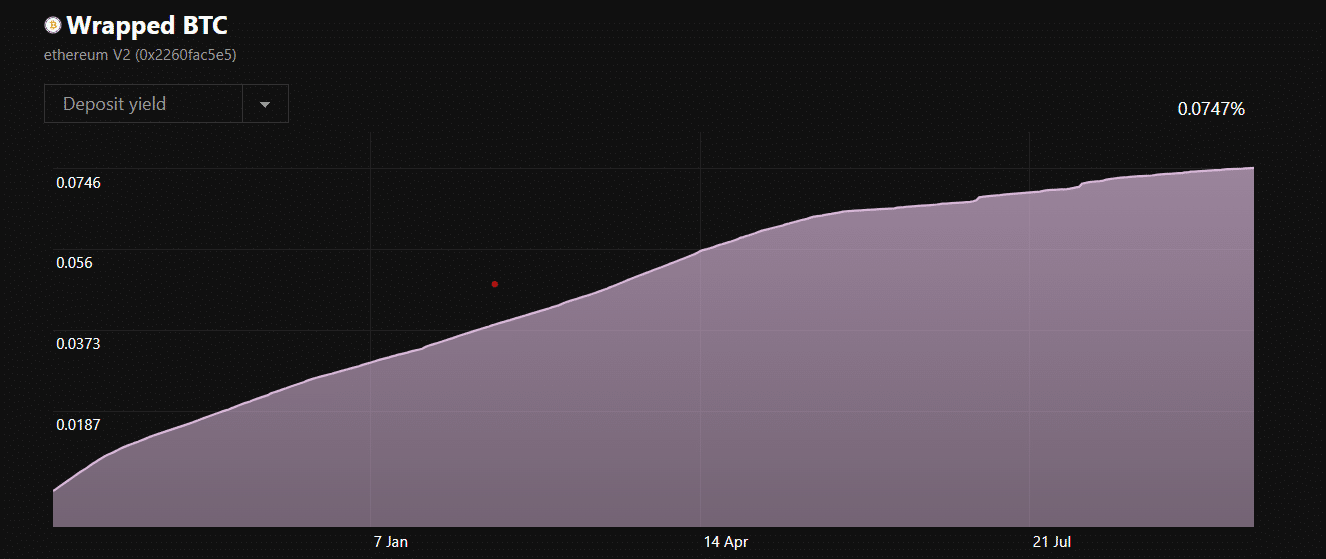

Interestingly, a year ago, the yield earned on WBTC deposits was 0.000489%, which has surged to 0.0747% a year later, marking a staggering 15,196% increase.

Most importantly, each WBTC token backs one Bitcoin, meaning users can always redeem it for the equivalent amount of Bitcoin.

Additionally, by using WBTC as collateral, users can borrow other cryptocurrencies or stablecoins, allowing them to leverage their Bitcoin holdings in various ways.

Read Wrapped Bitcoin’s [WBTC] Price Prediction 2024 – 2025

In summary, the uptick in WBTC supply on AAVE comes amid skepticism surrounding its custodial arrangements.

Despite these concerns, Wrapped Bitcoin remains a favored choice among investors, and AAVE has certainly reaped the most benefits.