Bitcoin – THIS key signal suggests BTC’s next ATH will be in November

09/29/2024 02:00

At press time, Bitcoin was trading at $66k, sparking excitement for potential new all-time highs (ATHs) in the final quarter of the year...

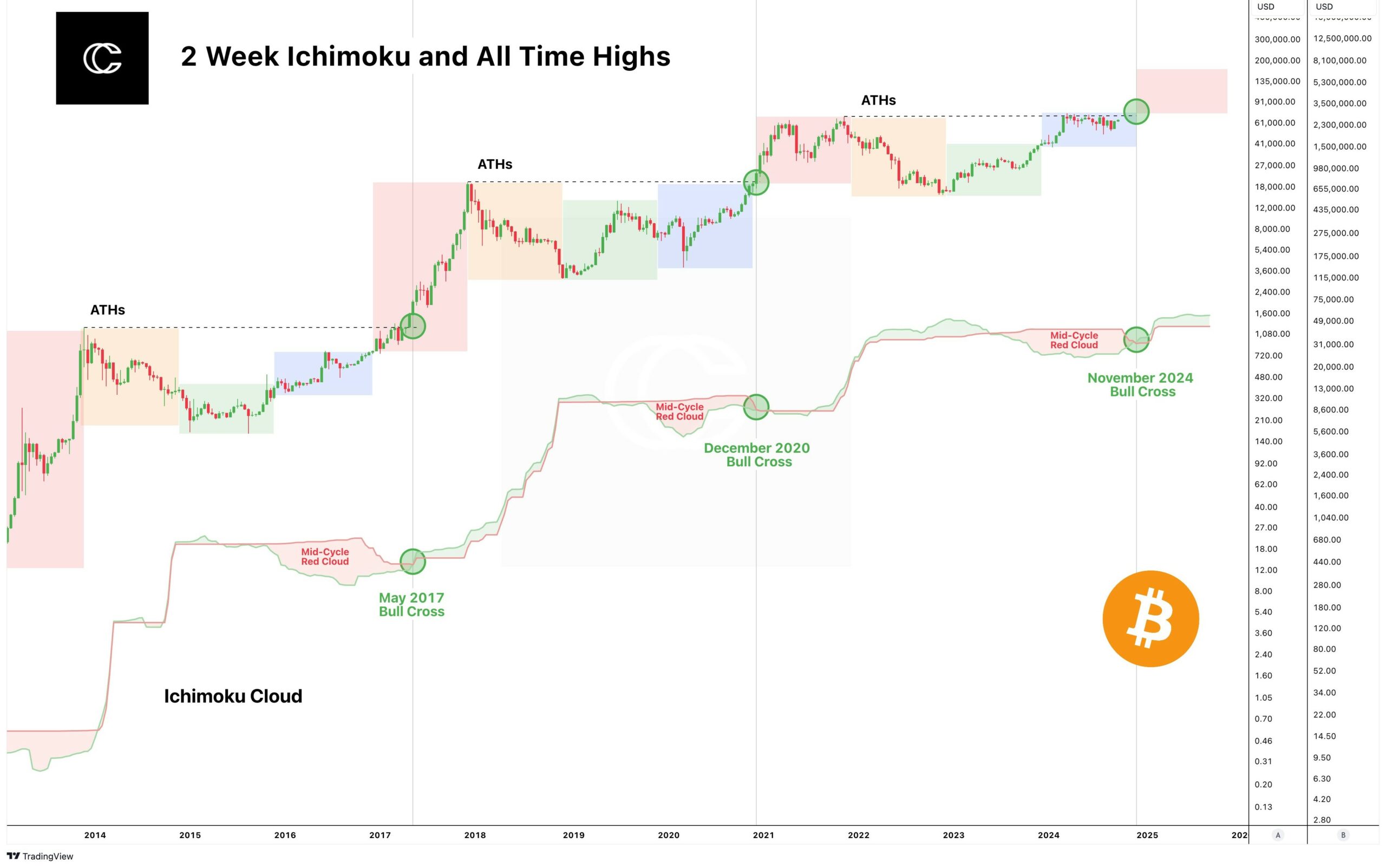

- The 2-week Ichimoku Cloud indicator has predicted potential Bitcoin highs in Q4

- Institutions and retail are getting heavily involved in Bitcoin

Bitcoin (BTC) is once again at the forefront of the crypto market, driving momentum towards a much-anticipated bull market.

At press time, Bitcoin was trading at $66k, sparking excitement for potential new all-time highs (ATHs) in the final quarter of the year. Here, it’s worth looking at historical data though. Particularly the 2-week Ichimoku Cloud indicator since it has accurately predicted Bitcoin’s ATHs in past cycles.

With the current cycle progressing ahead of schedule, there’s probably no need to wait for the moving averages to cross. The leading spans show us when it will happen, indicating that a new high may be formed in November.

Many are now wondering if November will be the month Bitcoin hits new heights. Especially with institutions and traders keeping a close eye on this timeline.

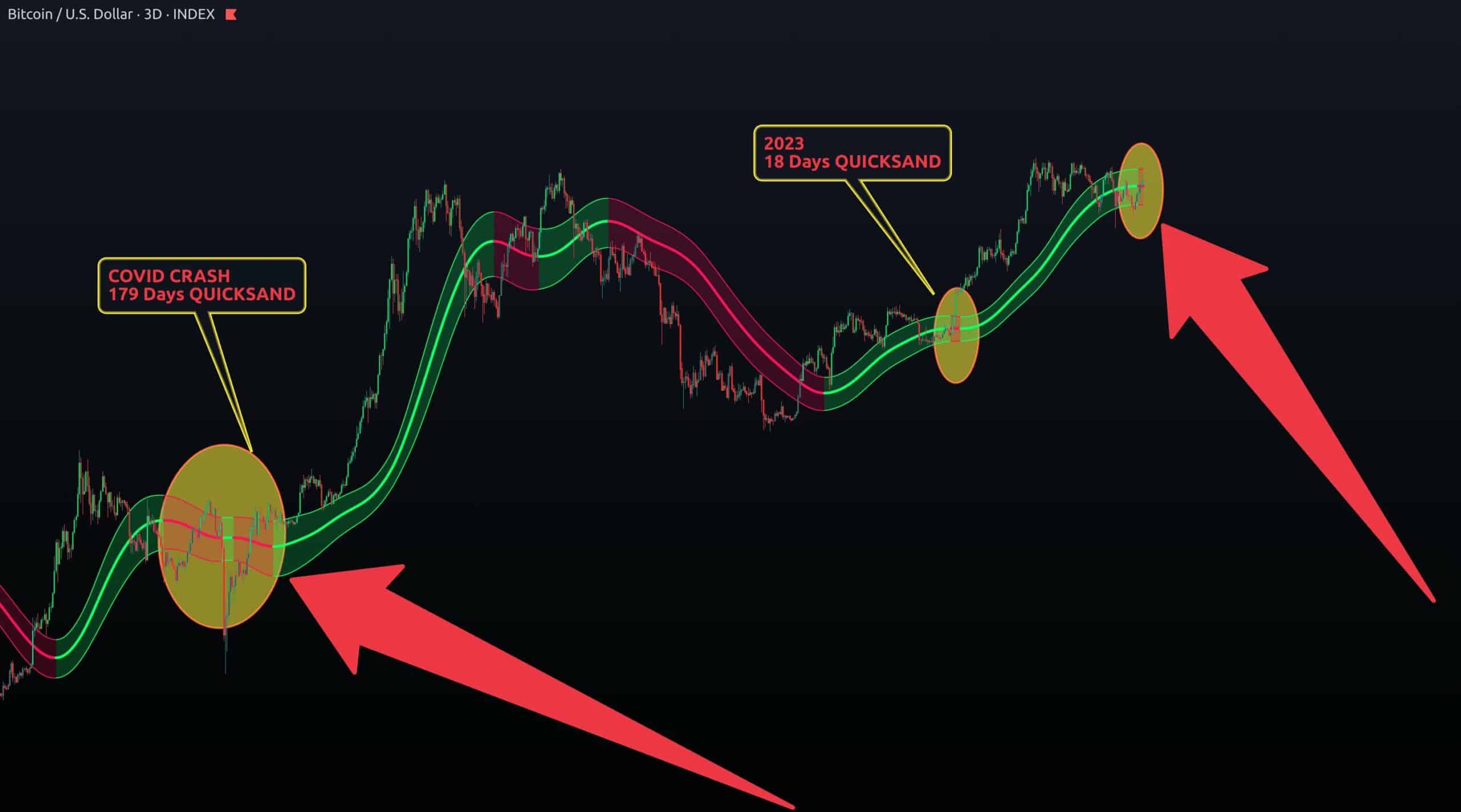

Covid19 crash pattern repetition

One key factor supporting this possibility is the repetition of the 2019 pattern. The Gaussian Channel on the 3-day BTC chart has turned red, which has historically occurred only twice – During the Covid crash and during Phase 2 of Bitcoin’s previous bull run.

When this pattern last emerged during Covid 19, it led to a significant rally, pushing Bitcoin to new ATHs. If history repeats itself, Bitcoin could be poised for another major upwards move, and potentially new highs in November.

However, market dynamics will ultimately determine the outcome, and it remains to be seen if this pattern will indeed lead to higher prices.

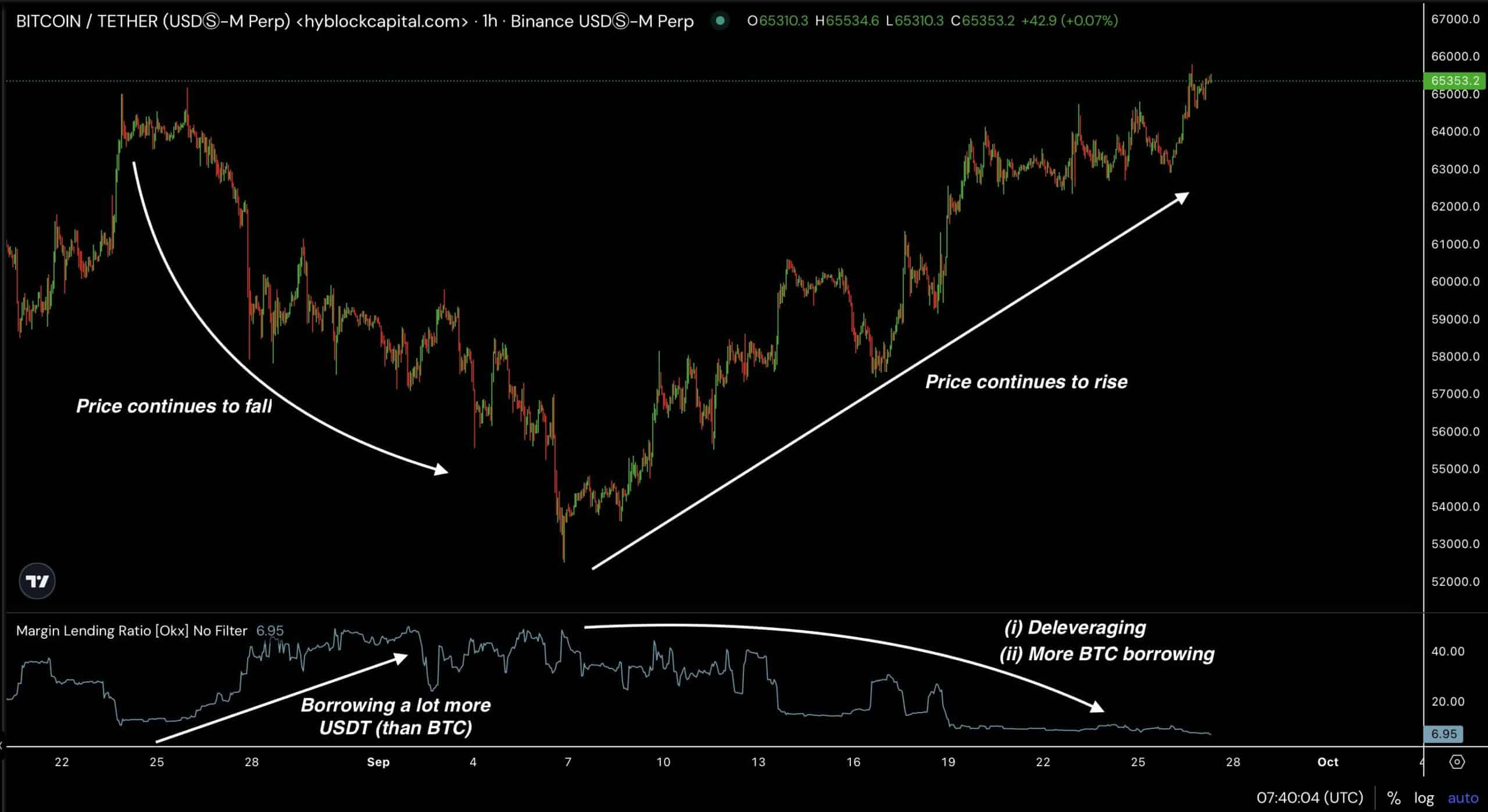

Potential impact of heavily borrowed USDT

Another factor that could propel Bitcoin higher is the impact of heavily borrowed USDT. Traders have been borrowing large amounts of USDT to buy Bitcoin. However, instead of pushing the price up, it initially led to a decline, causing over-leveraged traders to face losses.

This type of market behavior often precedes a significant rally. Especially as retail traders are shaken out through liquidations. If the current trend continues, this will create a perfect setup for Bitcoin to surge to new highs, potentially in November.

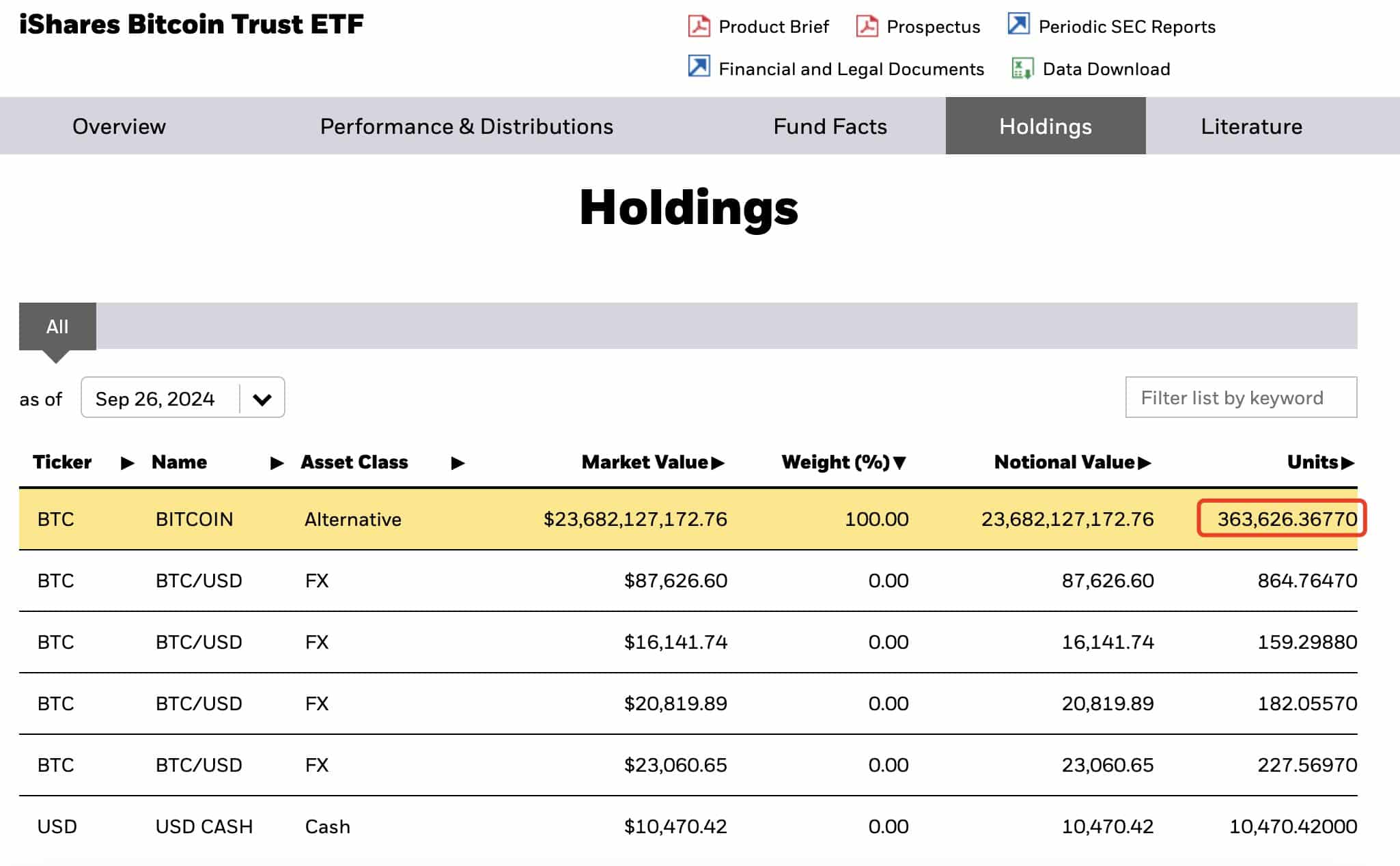

Blackrock continues to buy BTC

Moreover, BlackRock’s continued accumulation of Bitcoin lends further confidence to the bullish outlook. Earlier this week, BlackRock (IBIT) purchased 4,460 BTC, worth $289 million, increasing its total holdings to over 362,000 BTC.

This was followed by another purchase of 1,434 BTC worth $94.3 million. Recently, they added another 5,894 BTC, bringing their total holdings to 363,626 BTC, valued at $23.68 billion.

BlackRock’s significant and ongoing investment in Bitcoin means that they foresee substantial price appreciation, possibly as soon as November.

With historical patterns, market dynamics, and institutional support all aligning, Bitcoin’s price could hit new highs in the near future. The potential for a bullish run remains strong, and traders and investors will be closely monitoring developments as November approaches.

If these factors come together, Bitcoin may not only hit new ATHs but also establish itself firmly in higher price ranges for the rest of the year.