XRP Makes Its Biggest Move Since 2020, Gears to Climb By 200%

09/30/2024 14:26

XRP’s price has broken a key resistance, signaling a potential 200% rally. Rising open interest and whale accumulation support this.

The improvement in broader market sentiment observed over the past month has been favorable to Ripple’s XRP. Over the past 30 days, the altcoin’s price has grown by 14%, causing it to break above along-standing symmetrical triangle pattern for the first time since 2020.

This breakout has positioned XRP for a potential 200% price surge. But are market conditions favorable enough to support this move?

Ripple Makes a Bold Move

BeinCrypto’s assessment of XRP’s price movements on a weekly timeframe reveals that it had traded within a symmetrical triangle since July 2020. When an asset trades within this pattern, it marks a period where its price fluctuates between two converging trend lines, forming resistance and support levels

The gradual surge in XRP’s price over the past month eventually occasioned a rally above the upper line of this triangle on September 23. The breakout above this resistance indicates that XRP bulls have overpowered bearish forces, confirming the potential for further price gains.

Read more: How To Buy XRP and Everything You Need To Know

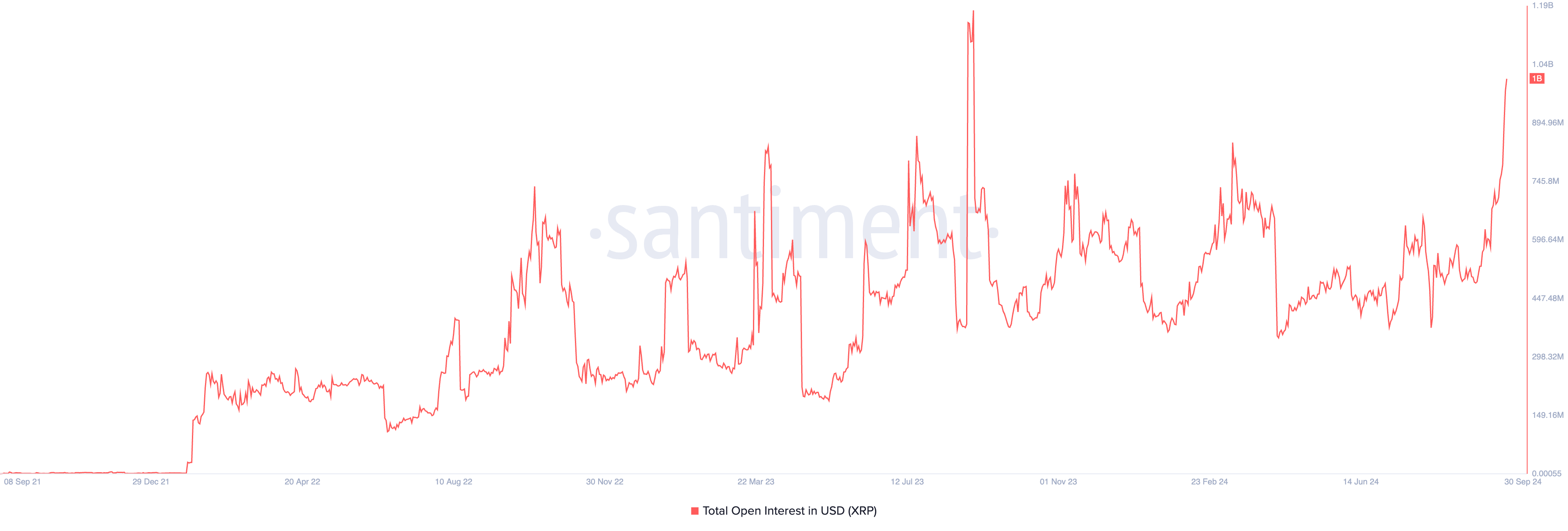

The jump in the token’s open interest over the past few days signals that market participants are keen on making this happen. As of this writing, XRP’s Open Interest stands at $1 billion, surging by 102% over the past 30 days. This is the first time since September 2023 that XRP’s open interest has surpassed $1 billion.

A spike in an asset’s open interest signals increased market activity. This is especially promising during a price rise, as it shows the rally has momentum and market participants are confident in the upward trend.

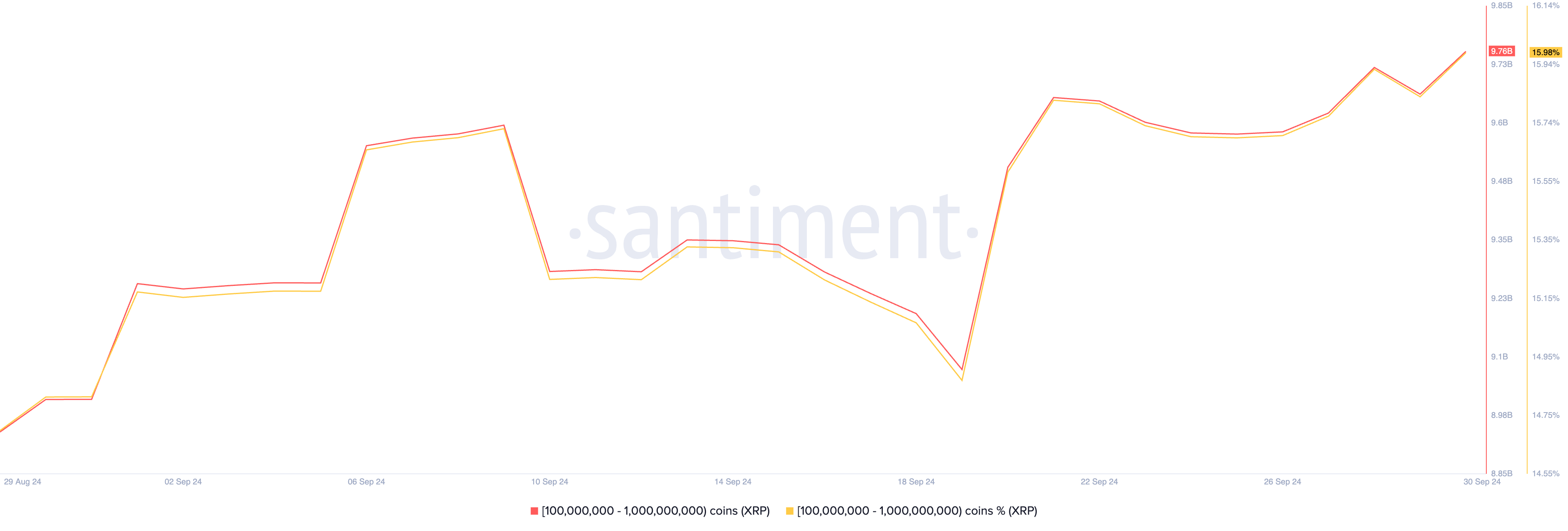

Furthermore, the steady rise in XRP whale accumulation also confirms the bullish outlook for the altcoin. A look at the activity of XRP holders with balances between 100 million and 1 billion tokens reveals that this group has accumulated 680 million XRP, valued at over $435 million at current market prices, in the past two weeks.

As of this writing, this group of XRP holders holds 9.76 billion tokens, 16% of the altcoin’s circulating supply.

XRP Price Prediction: Price May Reach $2

XRP’s rising Relative Strength Index (RSI) on the weekly chart signals a sustained demand for the altcoin, which may drive its rally. At press time, XRP’s RSI is 60.32, indicating that buying pressure outweighs selling activity among market participants.

Additionally, XRP’s moving average convergence/divergence (MACD) indicator, which identifies changes in its price trends, suggests the potential for a successful retest of the breakout line. Currently, XRP’s MACD line (blue) is positioned above its signal line (orange) and the zero line, indicating its price is gaining strength and upward price movement may continue.

If this trend continues, XRP’s price may climb by 203% to trade at $2 for the first time since the early days of the COVID-19 pandemic in 2020.

Read more: XRP ETF Explained: What It Is and How It Works

However, a decline in market interest and demand for the altcoin may lead to a failed retest of the breakout line. Should this happen, XRP’s price may drop below support to trade at $0.26.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.