XRP Rockets 800% in Fund Flows as XRP Price Goes Parabolic

09/30/2024 19:33

XRP sees explosive 800% growth in fund inflows, while XRP price enters what may be ultra bullish mode ahead of SEC v. Ripple appeal deadline

XRP sees explosive 800% growth in fund inflows, while XRP price enters what may be ultra bullish mode ahead of SEC v. Ripple appeal deadline

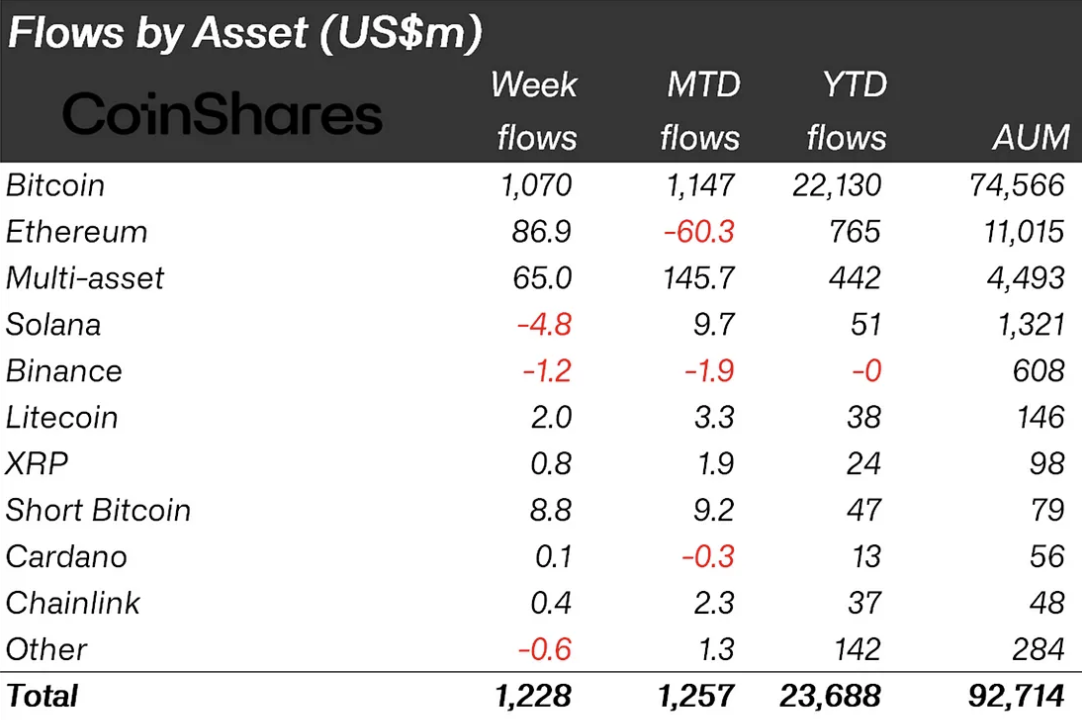

Another Monday brings a new weekly digital asset fund flows report from CoinShares, which tracks the movement of capital between cryptocurrency-focused exchange-traded products and funds. This week was particularly interesting, as it was revealed that the XRP-focused financial vehicles saw a staggering 800% increase in inflows over a week.

This means that $800,000 was added to XRP ETPs in the last seven days, and brings the total since the beginning of September to almost $2 million and since the beginning of the year to $24 million. This is one of the best results for crypto-focused investment products, on par with Solana (SOL) or Chainlink (LINK) ETPs.

XRP price outlook

Continuous flows into XRP ETPs are usually a good sign, accompanying or sometimes preceding positive price action on the seventh largest cryptocurrency.

This time it is more of the former case as, over the past week, the price of XRP surged more than 9.21%, breaking above 200 MA and taking over a crucial dynamic resistance level. As of now, the popular cryptocurrency is trading at $0.63 - the highest level in almost two months.

SEC v. Ripple deadline

What is driving investors to bet more on XRP? Maybe it is the anticipation of some major news like the deadline for the appeal in the SEC v. Ripple lawsuit.

According to several expert lawyers, the deadline is set around Oct. 7, which is just a week away. After that, there will be no way to appeal the recent ruling that recognized XRP as a nonsecurity and forced Ripple to pay $125 million in fines.

About the author

Gamza Khanzadaev

Financial analyst, trader and crypto enthusiast.

Gamza graduated with a degree in finance and credit with a specialization in securities and financial derivatives. He then also completed a master's program in banking and asset management.

He wants to have a hand in covering economic and fintech topics, as well as educate more people about cryptocurrencies and blockchain.

Advertisement

TopCryptoNewsinYourMailbox

TopCryptoNewsinYourMailbox