Chainlink exchange reserves hit 7-day low – What’s going on?

10/01/2024 10:00

Over 1.5M LINK tokens were withdrawn from exchanges last week as rising wallet profitability and RWA token boom drives interest in Chainlink.

- Over 1.5M LINK tokens were withdrawn from cryptocurrency exchanges in the last seven days.

- A rise in wallet profitability and a boom in RWA tokens have heightened the bullish narrative around LINK.

Chainlink [LINK] has dropped by 2.5% in the last 24 hours as most cryptos across the broader market retraced following subdued performance over the weekend.

LINK traded at $12.20 at press time. However, the altcoin is still up by 7% in the last seven days.

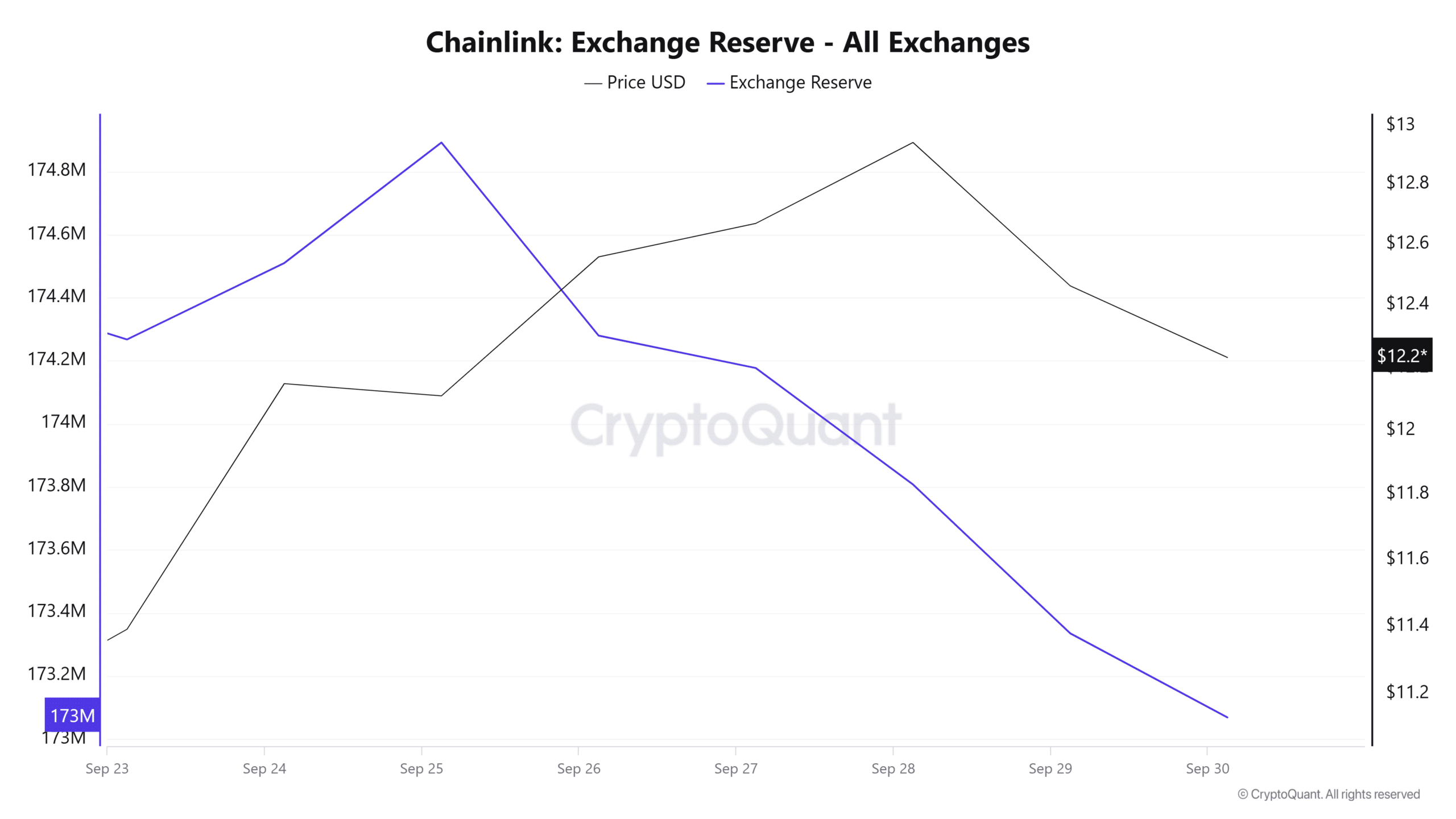

Despite this drop, exchange data shows that traders are not willing to sell after LINK exchange reserves plummeted to a seven-day low.

Data from CryptoQuant shows that last week, more than 1.5 million LINK tokens were withdrawn from exchanges.

A decline in reserves shows that traders are withdrawing their tokens from exchanges and possibly holding them for the long term.

A similar drop was further seen in exchange depositing addresses, which have also fallen from 546 on the 20th of September to 398 addresses. This shows that most traders who withdrew from exchanges are unwilling to sell.

The LINK exchange supply ratio stood at 0.173 at press time per CryptoQuant, showing that only 17.3% of LINK tokens are held on exchanges.

The declining ratio despite a lack of significant price gains suggests confidence in LINK’s long-term value. This metric also shows that supply could be shifting from short-term traders to holders.

So, what is behind the declining selling activity and increased interest in LINK?

Rise in wallet profitability

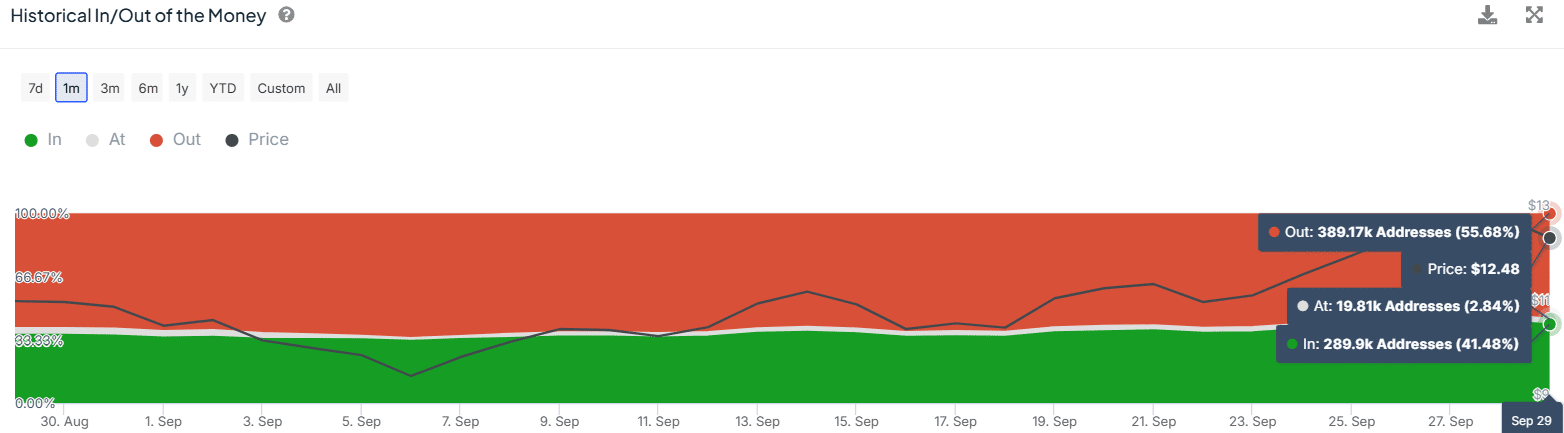

Data from IntoTheBlock showed a significant shift in LINK wallet profitability in the last month. In late August, 60% of LINK token holders, equivalent to 423,000 addresses at the time, were in losses.

This figure has since dropped to 55%.

At the same time, the percentage of LINK wallets in profits has also increased from 35% to 41% within one month.

This metric makes a bullish case for LINK. When traders who were initially in losses start making profits, they might choose to continue holding to maximize their profitability.

A rise in wallet profitability could also attract the attention of new buyers.

Growing interest in RWA tokens

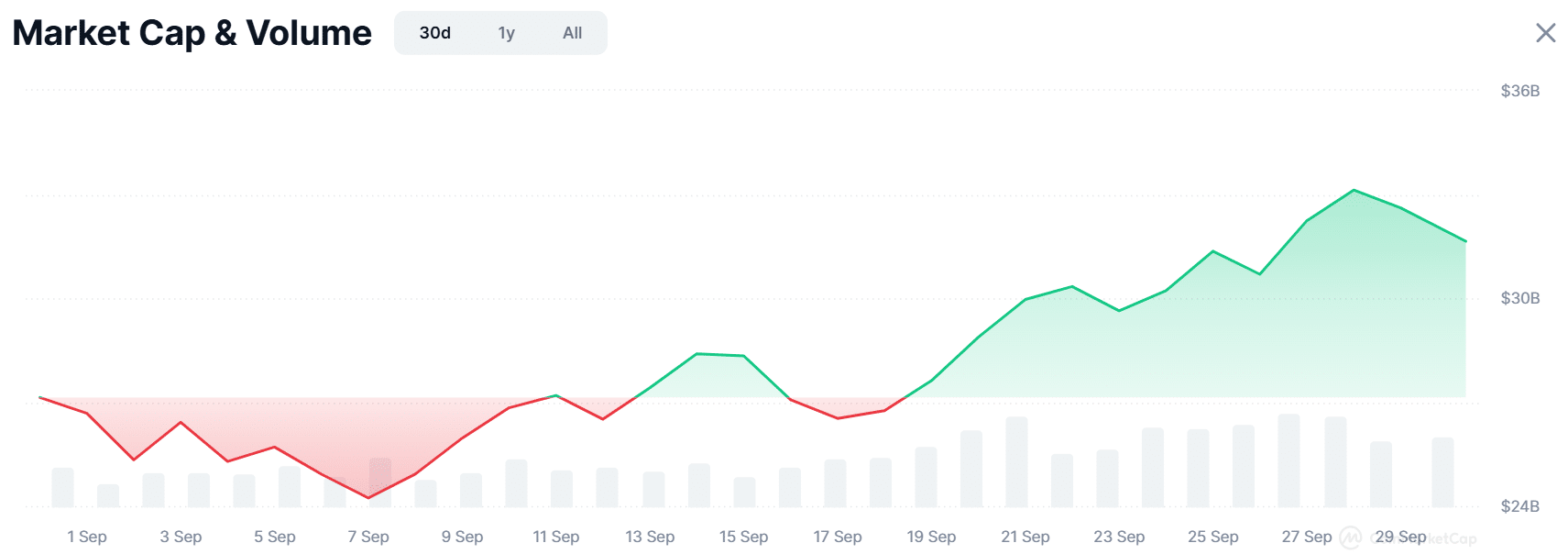

The other reason that could be driving a long-term bullish sentiment around Chainlink is the boom in Real World Asset (RWA) tokens.

Data from CoinMarketCap shows that in the last 30 days, the total market capitalization for RWA tokens has increased from $27 billion to $31 billion.

LINK accounts for 24% of the RWA market with $7.65 billion in market cap. This places the token in a unique position to benefit from a boom in this industry.

Read Chainlink’s [LINK] Price Prediction 2024–2025

While the long-term trend is bullish, data from Coinglass shows that interest in Chainlink could be dropping. LINK’s Open Interest had dropped by 4% at press time to $185M, suggesting that some traders are closing their positions.

However, given that funding rates are still positive, it shows that long positions are still more than short positions, suggesting that more traders are optimistic.