Uniswap: Mixed signals emerge as UNI holds steady at $7 – What now?

10/03/2024 03:30

Uniswap is displaying mixed signals, as bulls struggle to defend the $7 price level amid an increase in exchange inflows.

- UNI dropped by 8% in 24 hours as it succumbed to bearish pressure across the broader cryptocurrency market.

- Despite an increase in exchange inflows, UNI’s long/short ratio showed traders are still bullish.

Uniswap [UNI] traded at $7.21 at press time after an 8% drop in 24 hours. The recent price decline coincided with bearish sentiment across the broader cryptocurrency market as most cryptos edged lower due to traders reacting to the geopolitical climate in the Middle East.

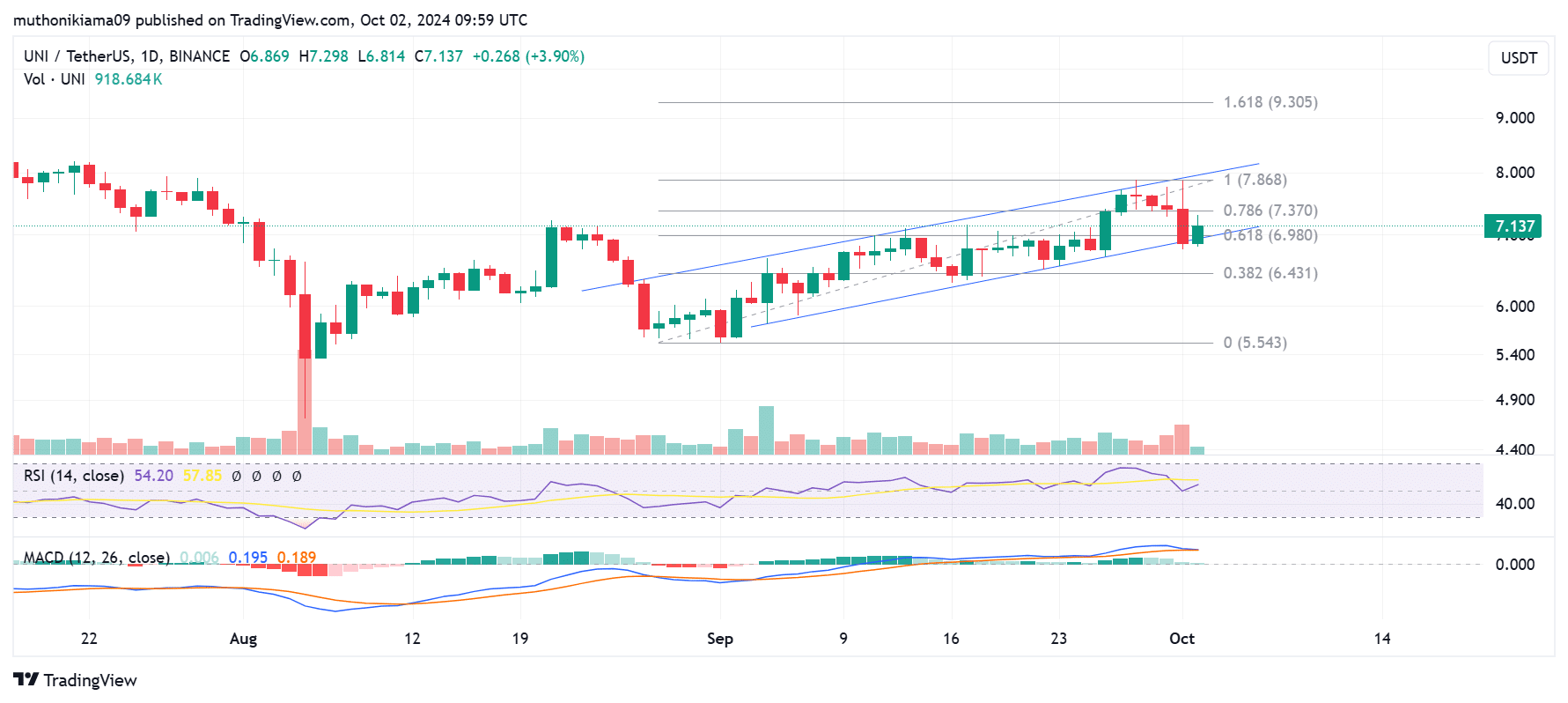

On the daily chart, UNI showed mixed signals as the price tested the lower boundary of the ascending parallel channel. A drop below this channel will suggest that buying pressure has weakened and the trend is reversing.

A look at the green volume histogram bars suggests that buyers are still more than sellers. Additionally, the Relative Strength Index (RSI) is at 56 while the RSI line is moving north suggesting that some traders could be buying the dip.

If the RSI crosses above the signal line, it will create a buy signal that could take UNI prices higher. If this happens, UNI will rise to test resistance at the 0.786 Fibonacci level ($7.37).

However, the Moving Average Convergence Divergence (MACD) line shows a contrasting image. The MACD line has converged with the signal line and if it crosses below, it will flip the overall momentum to bearish.

An influx of sellers due to bearish pressure could drop UNI prices lower to test support at the 0.382 Fib level ($6.43).

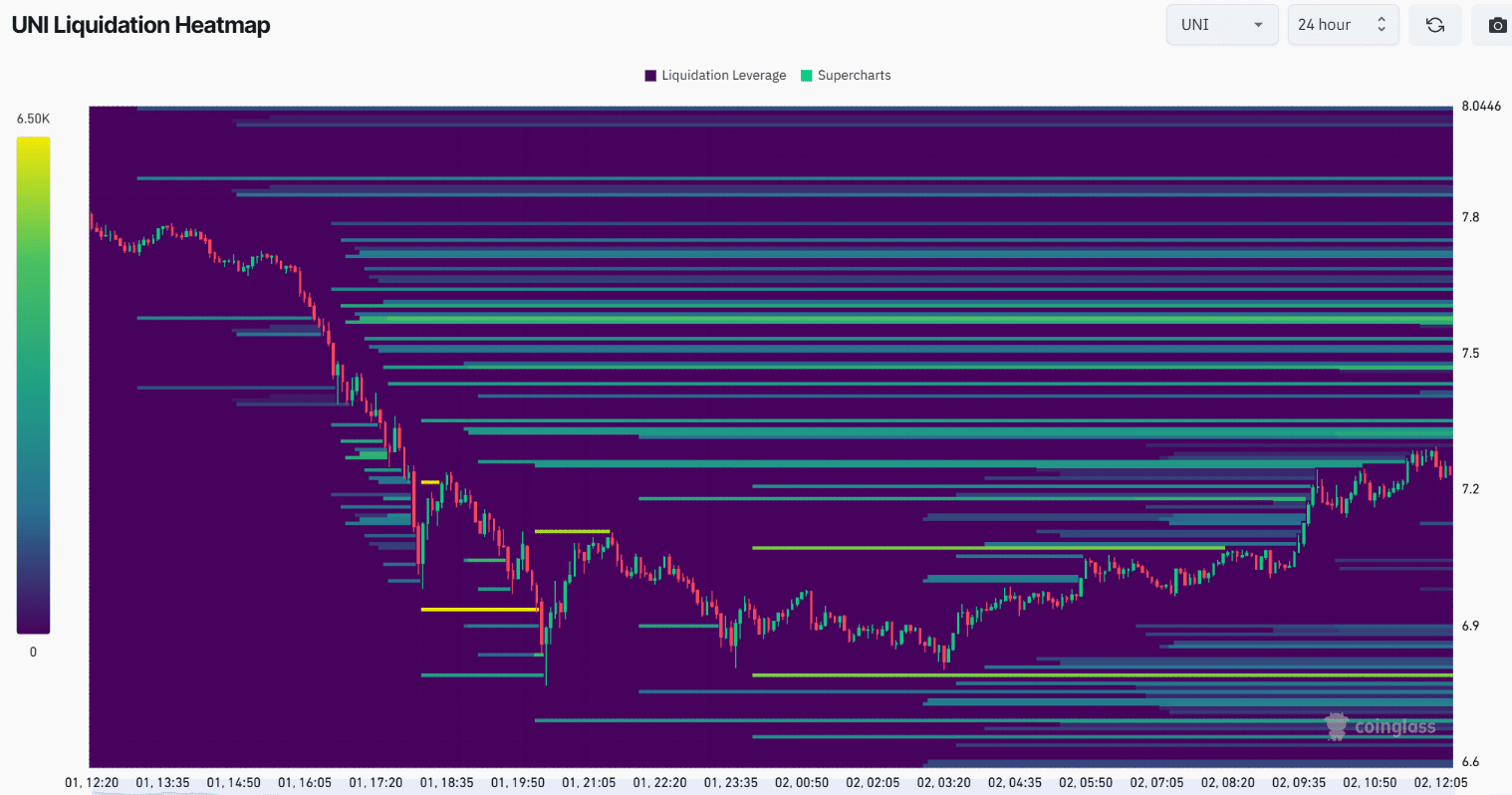

A look at Uniswap’s liquidation heatmap suggests that there is a cluster of liquidations above the current price. This suggests that the $7.30-$7.80 zone is a strong resistance level.

If UNI gains and hits these liquidation levels, it could force short-sellers to close their positions. A short squeeze will increase the buying momentum and take prices higher.

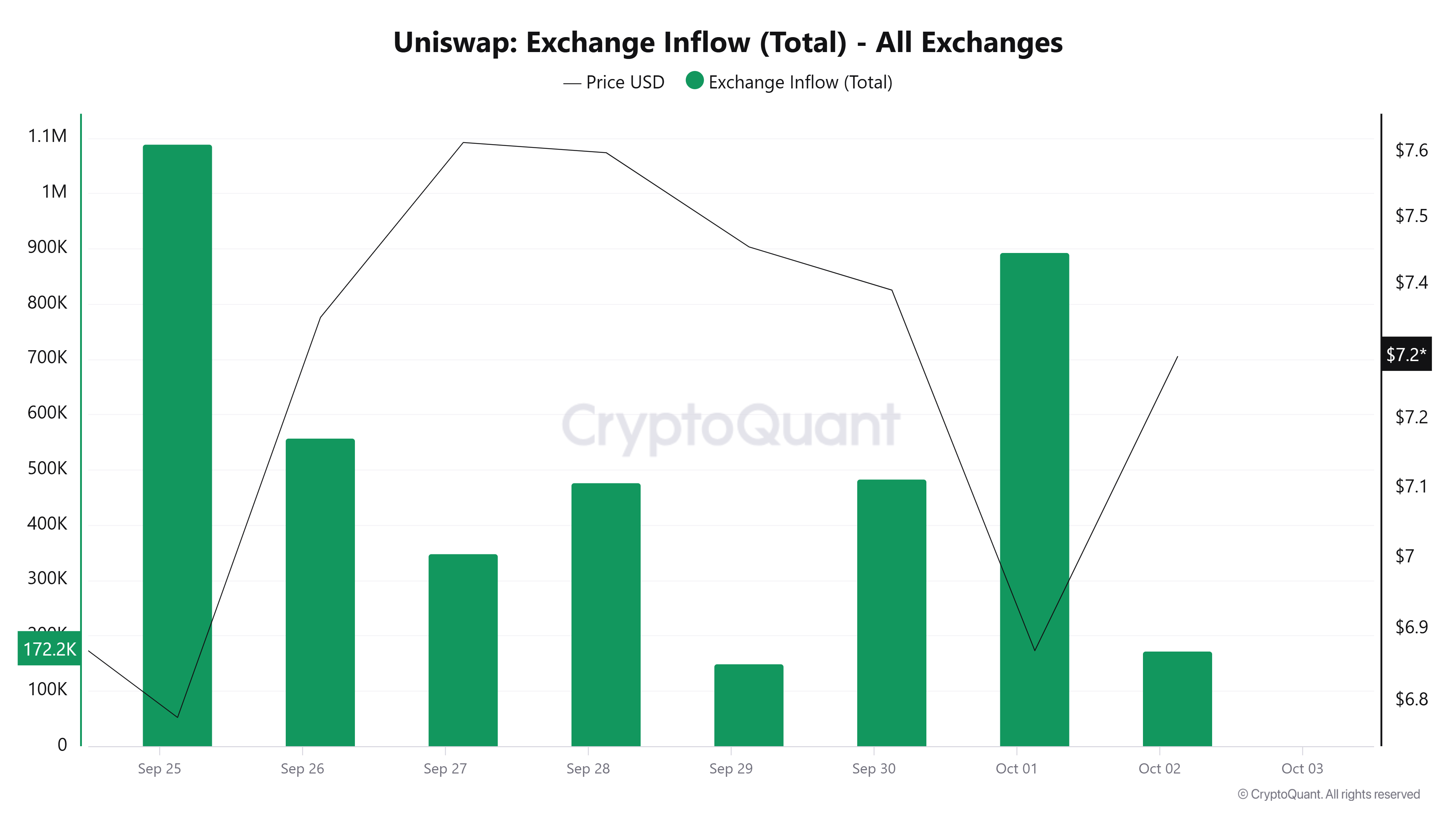

Uniswap exchange inflows spike

Data from CryptoQuant shows that on 1st October, the amount of UNI deposited to exchanges approached a weekly high.

Uniswap exchange inflows reached 893,000, which was nearly double the inflows recorded the previous day.

A high number of UNI tokens deposited to exchanges increases the selling pressure, which, in turn, strengthens the bearish thesis.

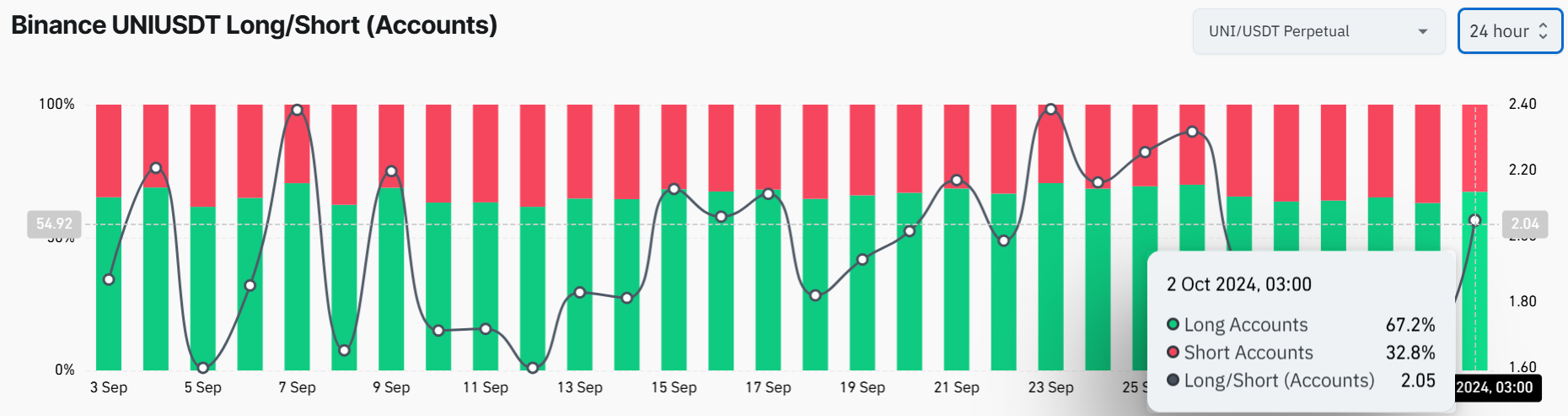

However, on Binance, 67% of traders have taken long positions on Uniswap, while only 32% are short-sellers per Coinglass. This suggests a strong bullish bias towards Uniswap’s future price movements.