4 Crypto Stocks With Most Upside Before the Next Bitcoin Rally

10/05/2024 02:26

Stocks like HOOD, BLK, CME and NVDA are poised to gain once the Bitcoin rally resumes.

The cryptocurrency market, which was trying to rebound after the Federal Reserve announced a rate cut in September, has again started facing roadblocks. Bitcoin (BTC), which surged past $63,000 in the days following the rate cut announcement, has retreated this week and fell below $60,000.

Several factors have been responsible for this sudden decline. However, Bitcoin still has a lot of potential and the recent decline is temporary. With the Federal Reserve indicating more rate cuts in the near term, the crypto market is poised to benefit.

Given this scenario, it would be ideal to invest in Bitcoin-centric stocks such as Robinhood Markets, Inc. HOOD, BlackRock, Inc. BLK, CME Group Inc. CME and NVIDIA Corporation NVDA, which have strong growth potential in the near term.

Bitcoin Price Retreats From Recent Highs

Bitcoin was trading at $61,136.95 on Thursday. However, the cryptocurrency had slipped below $60,000 earlier in the day after the second straight day of outflows from the U.S. spot Bitcoin ETFs, down 4.5% from last week.

Bitcoin’s price has now declined for the sixth consecutive day amid the ongoing crisis in the Middle East owing to the Iran-Israel conflict.

Bitcoin’s price remained rangebound under $57,000 following the halving event after the cryptocurrency hit an all-time high of $73,750 on March 14. Bitcoin tried to stage a comeback after the Federal Reserve announced a 50-basis-point rate cut, the first since March 2020. Despite the recent decline, Bitcoin has returned 44.6% year to date.

Cryptocurrency Stocks Poised to Grow

Bitcoin’s sharp rebound from below $60,000 to nearly $61,200 on Thursday follows Federal Reserve Chairman Jerome Powell’s dovish comments. Powell hinted at more rate cuts this year noting that inflation has been steadily declining.

Lower interest rates generally benefit growth assets like cryptocurrencies, as they reduce the opportunity cost of holding assets that don't generate yields. In a low-interest-rate environment, investors tend to look for assets with higher potential returns, even if they involve more risk.

Investors are optimistic about a total rate cut of 50 basis points this year, which is a positive sign for the cryptocurrency market.

4 Crypto Stocks With Growth Potential

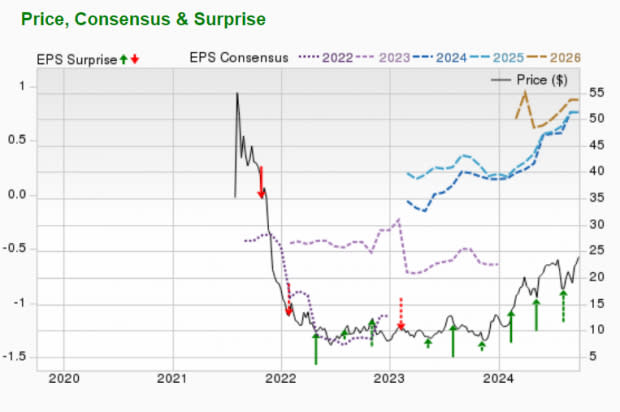

Robinhood Markets

Robinhood Markets operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin and other cryptocurrencies using its Robinhood Crypto platform.

Robinhood Markets’ expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings has improved 33.3% over the past 60 days. Robinhood Markets currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

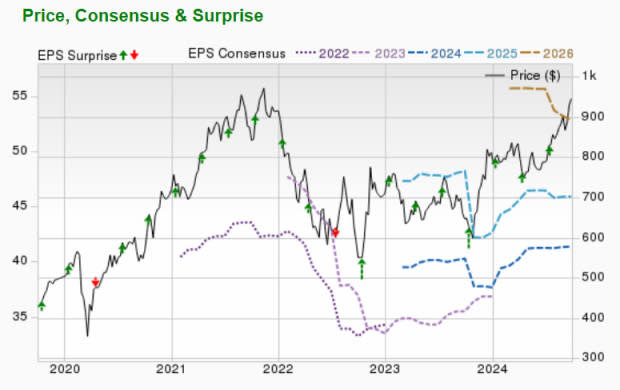

BlackRock

BlackRock is one of the world’s largest investment managers and is publicly owned. BLK was one of the first companies from the traditional market to join the Bitcoin ETF race back in June 2023.

BlackRock’s expected earnings growth rate for the current year is 9.6%. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the past 60 days. BlackRock currently carries a Zacks Rank #3.

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

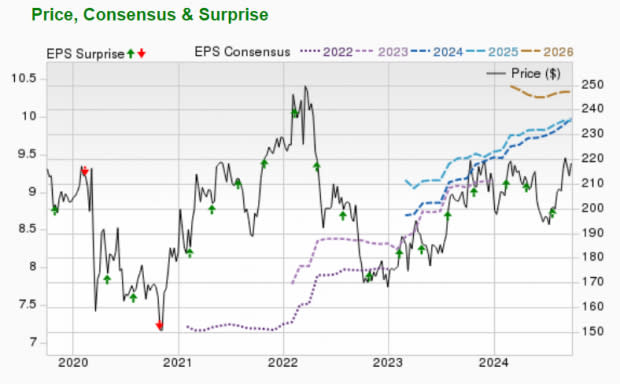

CME Group

CME Group Inc.’s options give the buyer of the call/put the right to buy/sell cryptocurrency futures contracts at a specific price at some future date. CME offers Bitcoin and ether options based on the exchange's cash-settled standard and micro-Bitcoin and Ethereum futures contracts.

CME Group’s expected earnings growth rate for the current year is 7.3%. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last 60 days. CME presently has a Zacks Rank #3.

Image Source: Zacks Investment Research

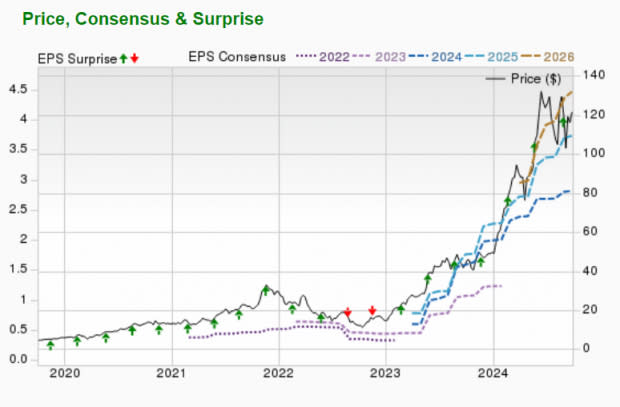

NVIDIA

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

NVIDIA has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.5% over the past 60 days. NVDA presently carries a Zacks Rank #3.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report