Bitcoin sentiment in fear zone – Is now the time to buy BTC?

10/05/2024 12:00

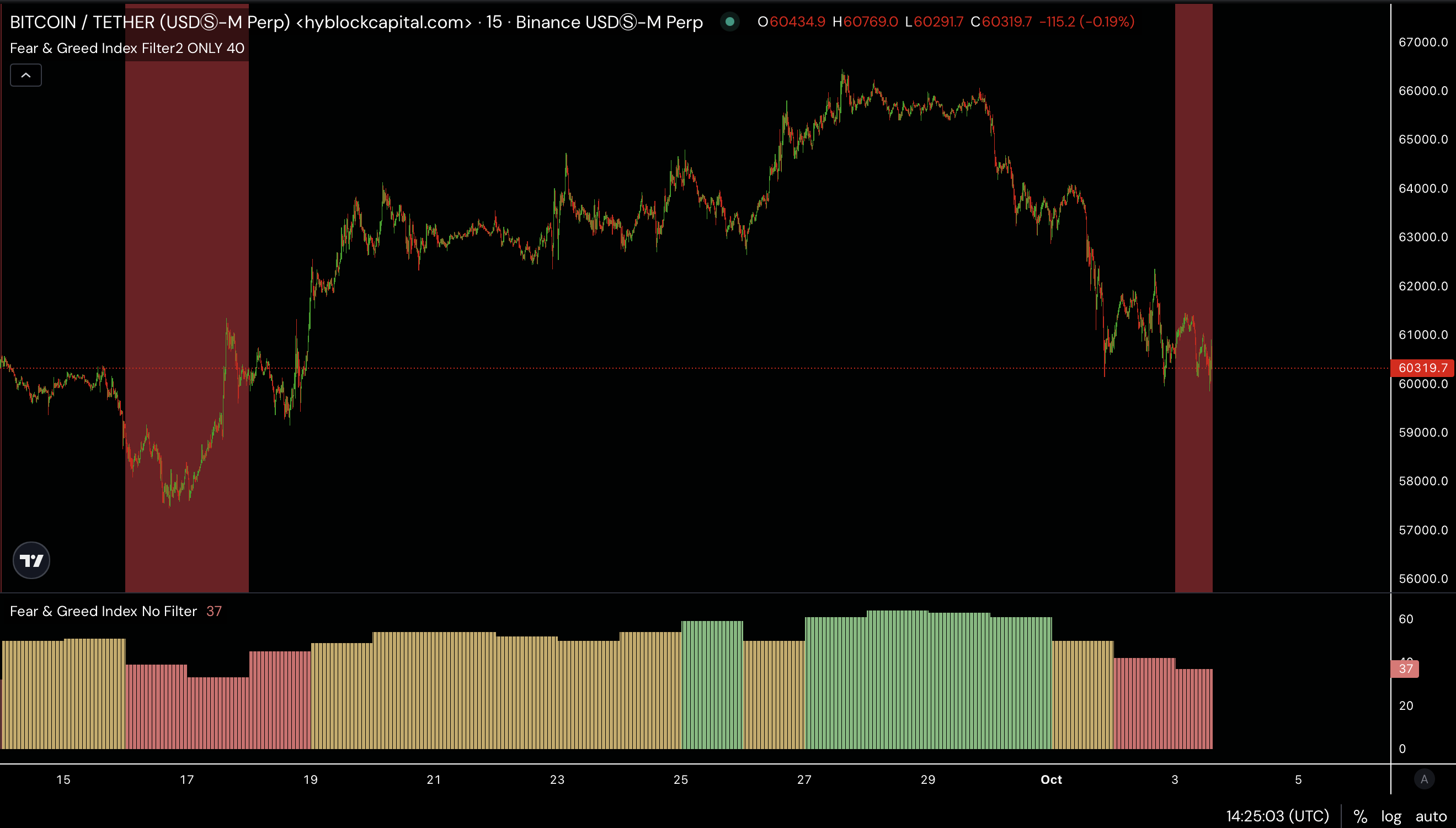

Historically, when Bitcoin enters this fear zone, it signals an opportunity for investors to "buy the fear" and sell during periods of greed.

- The market sentiment is back to fear for Bitcoin.

- BTC holding above the mean threshold of the channel.

The cryptocurrency market remains highly sensitive to global events, especially Bitcoin [BTC], with sentiment constantly shifting between fear and greed.

Recently, geopolitical disturbances, particularly in the Middle East, have triggered fear among investors, pushing BTC sentiment back into the fear zone.

Historically, when Bitcoin enters this fear zone, it signals an opportunity for investors to “buy the fear” and sell during periods of greed. As we approach the last quarter of the year, many are asking: is now the time to buy Bitcoin?

As September came to a close, Bitcoin had reached the $66K price mark, moving sentiment to a neutral stance. However, recent geopolitical tensions between Israel and Iran have reversed this progress, dropping Bitcoin back into the fear zone.

Despite this, the broader crypto market, including Bitcoin, remains above key support levels, prompting some to believe it may be time to buy BTC in anticipation of further gains in the coming months.

Bid-ask ratio insights

Analyzing the bid-ask ratio helps determine whether buyers or sellers dominate the market. Recent data shows that spot bids have outweighed asks, indicating that traders have been accumulating Bitcoin during the market pullback.

This pullback, caused largely by the geopolitical tensions, seems to have established a temporary bottom around the $60,000 level.

Bitcoin has been holding steady around this point, battling against selling pressure. As BTC begins to reclaim key moving averages, this could be a sign that now is the right time to buy.

BTC holding above the trend channel equilibrium

Bitcoin’s price has shown strength despite facing resistance. After briefly rising above $66K, it encountered rejection but continues to trade near crucial levels.

BTC has been moving within a trend channel for over seven months, and now has found support near its mean threshold. If Bitcoin manages to break and sustain levels above the upper trendline, it could be poised to reach new all-time highs.

However, failure to break this key resistance could see BTC continuing to range throughout the rest of the year.

Source: TradingView

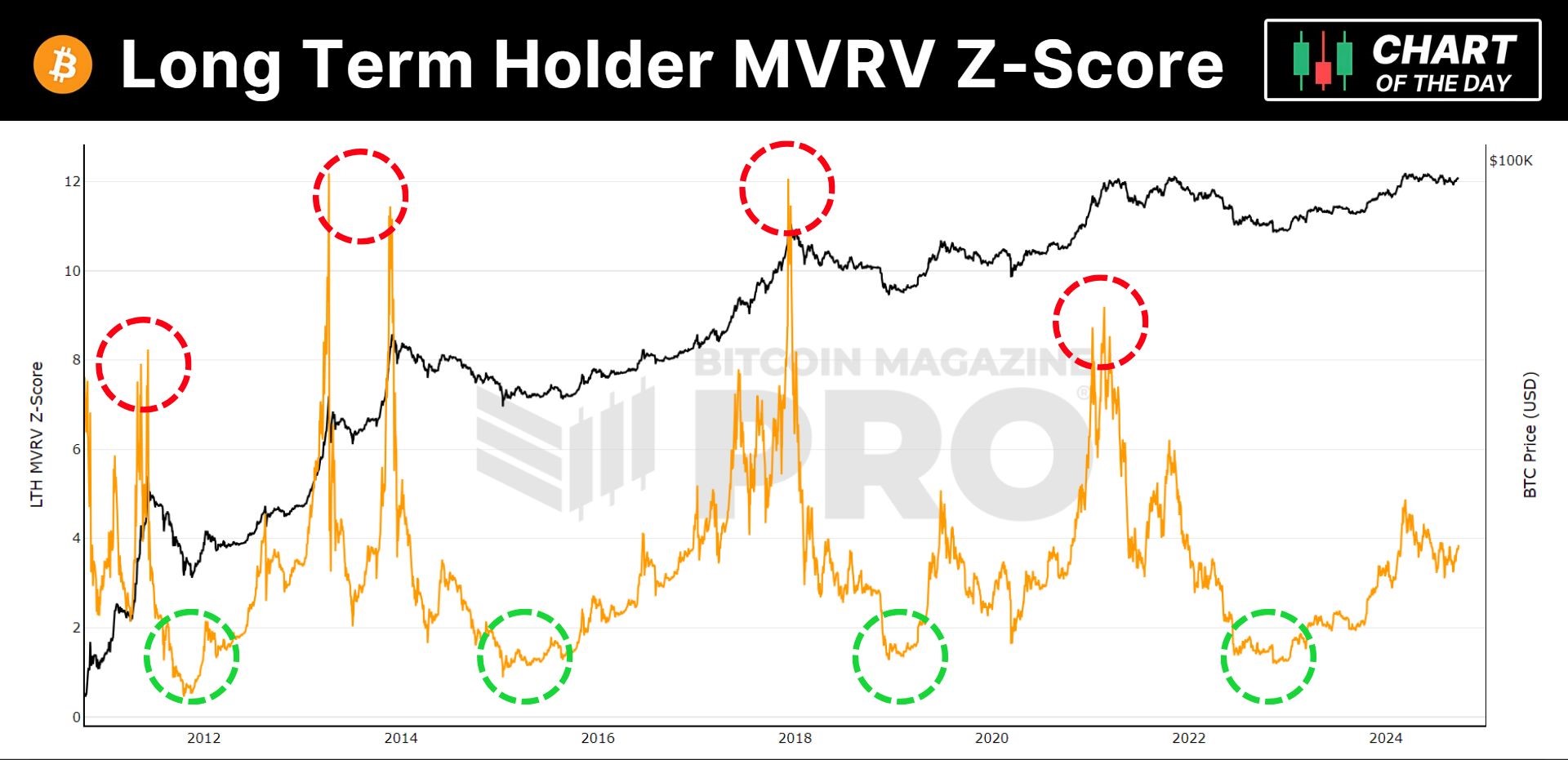

Long-Term holder MVRV Z-Score

One key metric that has proven effective in predicting Bitcoin market cycles is the Long-Term Holder MVRV Z-Score. This indicator highlights whether Bitcoin is overvalued or undervalued, offering insight into potential bottoms and peaks.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Currently, the Z-Score suggests that BTC has considerable room for upward movement, reinforcing the idea that now could be the right time to buy, especially as market sentiment leans toward fear.

With fear gripping the market, now may be the perfect opportunity to accumulate Bitcoin. The metrics, price action, and bid-ask ratio all indicate potential upside, making this an ideal time for investors to consider buying BTC before prices climb higher.