Bitcoin’s short-term focus – Does this explain changing holder behaviour?

10/06/2024 03:00

Bitcoin's market sentiment has changed significantly over the last few weeks. In fact, there were expectations that BTC will maintain its...

- Bitcoin holders shift guard in favor of short-term profit-taking, contrary to recent market expectations

- Such a transition could have a major impact on BTC’s price

Bitcoin’s market sentiment has changed significantly over the last few weeks. In fact, there were expectations that BTC will maintain its bullish momentum from September in October too. However, those expectations were far from the reality of things.

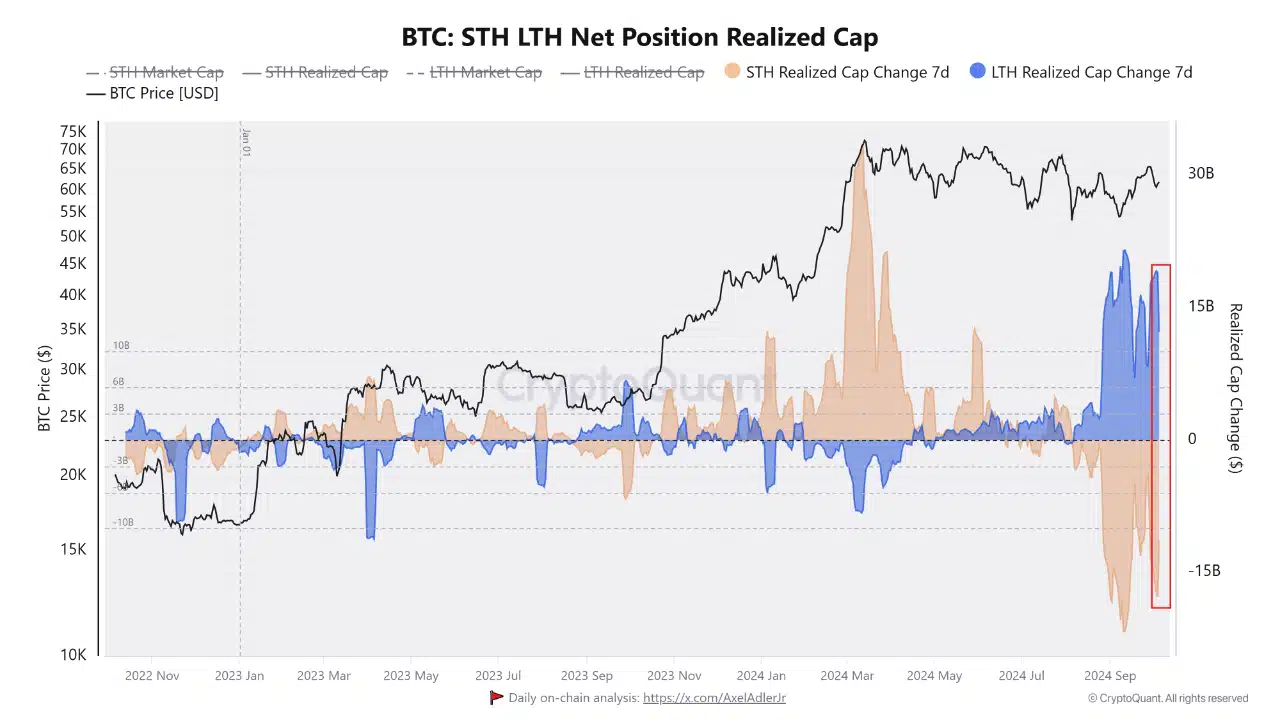

According to data, there is a growing trend that may limit the cryptocurrency’s ability to soar to new highs, at least in the short-term. A recent CryptoQuant analysis underlined the same, highlighting the changes in long term holder (LTH) and short term holder (STH) dynamics.

According to the analysis, LTH’s realized cap recently dropped by $6 billion. This suggested that LTHs have been taking profit. By extension, it also implied that they do not expect price to extend into new highs, at least in the short term.

The same analysis highlighted a surge in short term holder realized cap by roughly the same amount ($6 billion). According to the analysis, this shift by STHs could mean that they are accumulating, but with a focus on short-term profits.

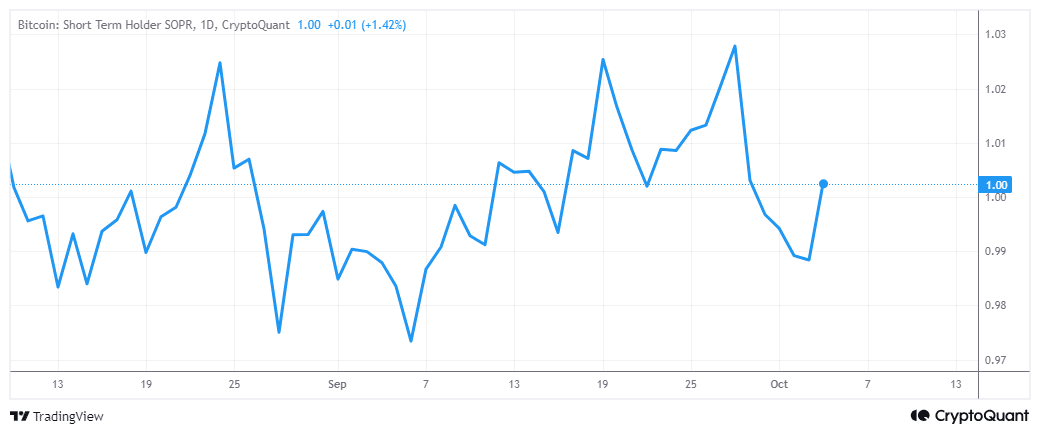

The analysis aligned with Bitcoin’s latest price action, which has been characterized by short term swings. In other words, it could be a while before Bitcoin experiences a major breakout. This is also in line with the recent observations in BTC’s short-term holder SOPR.

The short-term holder SOPR’s upticks confirmed the shift in favor of short term profit-taking. This is historically aligned with every top in shorter-term periods.

How long will this Bitcoin short term focus last?

The shift in favor of short term profit-taking is largely dependent on the prevailing market sentiment. This has lately been driven by market events. Right now, the most significant upcoming event that could have a major impact on Bitcoin is the U.S election cycle.

Uncertainties tend to support a short-term focus, which may explain why investors have shifted to their current short term profit-taking approach. The U.S election’s outcome may also trigger a major response, one that could be enough to push BTC from its current range. Note that this could either be bullish or bearish, depending on the outcome.

As far as short term expectations are concerned, Bitcoin traders should keep an eye out for liquidations. A short term profit-taking approach encourages more leverage, which may in turn lead to more exposure to liquidation events.