Japan’s Metaplanet expands Bitcoin portfolio with latest purchase

10/07/2024 17:00

Metaplanet boosts BTC holdings as Bitcoin ETFs near Satoshi Nakamoto's level, marking institutional interest growth.

- Metaplanet expands BTC holdings, securing 108.78 more Bitcoin amid bullish market sentiment.

- U.S. Bitcoin ETFs now hold 4.6% of the supply, which is nearing Satoshi’s total holdings.

Bitcoin’s [BTC] recent price activity has drawn attention as it fluctuated from nearly $66,000 at the end of September, dipping to $60,000 on 1st October, before bouncing back.

Trading at $63,480 at press time, up by 2.3% over the last 24 hours according to CoinMarketCap, the cryptocurrency is showing strong bullish signs.

Metaplanet’s new Bitcoin accumulation

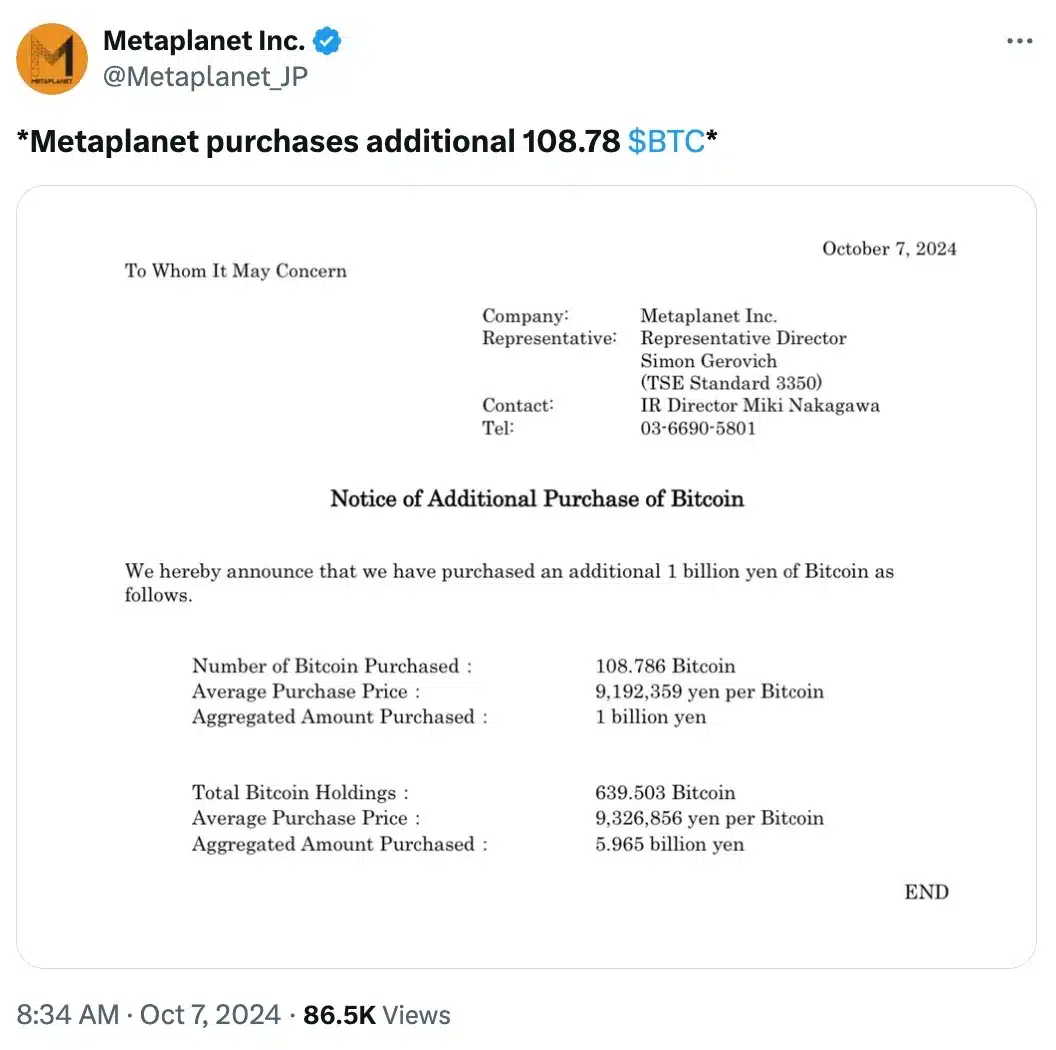

Riding on this momentum, Japanese investment firm Metaplanet announced its acquisition of an additional 108.78 BTC for $6.7 million (1 billion yen), bringing its total holdings to 639.5 BTC, valued at approximately $40 million.

Remarking on the same an X user noted,

“Nice investment choice!”

Additionally, Bitcoin Treasuries data revealed that Metaplanet initiated its BTC acquisitions on 23rd April.

Hence the recent purchase made on 7th October marks its thirteenth purchase, with the recent accumulation, being of 107.9 BTC, valued at 1 billion yen ($6.9 million).

Metaplanet’s strategy explained

These recent purchases reflect Metaplanet’s consistent strategy to expand its BTC holdings amid renewed optimism in the crypto market’s outlook for the year’s final quarter.

That being said, Metaplanet has gained attention for its proactive Bitcoin acquisition approach, drawing comparisons to MicroStrategy and earning the title – “Asia’s MicroStrategy” due to its institutional-level commitment to BTC.

Thus, by adopting BTC, Metaplanet seeks to navigate Japan’s challenging economic landscape marked by negative interest rates and extensive quantitative easing.

Bitcoin ETFs to surpass Satoshi Nakamoto’s Bitcoin holdings?

Needless to say, the introduction of Bitcoin ETFs has marked a turning point, shifting mainstream sentiment—especially within Wall Street—from seeing BTC as a risk to viewing it as a strategic opportunity.

Subsequently, institutional interest in BTC has surged, with U.S. Spot Bitcoin ETFs now holding 4.6% of BTC’s total supply, equating to $58 billion and approaching the holdings of Bitcoin’s largest owner, Satoshi Nakamoto.

This was further confined by data from SoSoValue which showed that BTC ETFs have amassed $57.73 billion in total assets, with BlackRock leading the charge, managing $22.91 billion in its Bitcoin ETF alone.

Remarking on the same, Eric Balchunas, Bloomberg’s Senior ETF Analyst in a recent tweet had noted,

“U.S. bitcoin ETFs had good day yesterday pushing YTD flows to new high water mark of $17.8b. They’re now 92% of the way to owning 1million bitcoin and 83% of way to passing Satoshi as top holder. Tick tock..”

Hence, with the increasing adoption of BTC, it will be intriguing to observe whether Nakamoto will maintain his status as the top Bitcoin holder or if things take a u-turn.