Crypto Investment Outflows Hit $147 Million as US Jobs Data Signals Strong Economy

10/07/2024 20:27

Crypto investment outflows hit $147 million as strong US jobs data fuels economic confidence, impacting Bitcoin and Ethereum flows.

Crypto investments recorded outflows reaching $147 million last week, interrupting a steady series of positive flows since September 9.

The change in sentiment comes on the back of signs of a booming US economy, diluting the previously concentrated expectation of significant rate cuts from the Federal Reserve (Fed).

Crypto Investment Inflows Series Interrupted

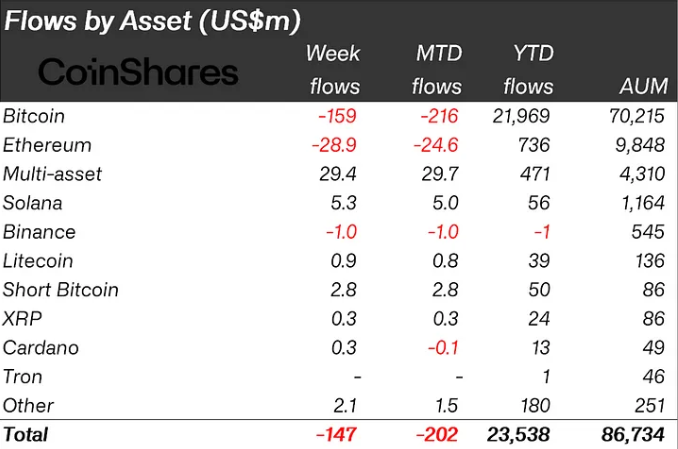

The latest CoinShares report shows digital asset investment outflows reached $147 million last week. Bitcoin was at the forefront of the negative flows, recording $159 million in outflows. Ethereum (ETH) also saw outflows of $28.9 million.

With the US leading by outflows on regional metrics, the research ascribes the change in sentiment to strong economic data in the country.

“Digital asset investment products saw minor outflows totaling $147 million last week. Higher than expected economic data last week, reducing the probabilities for significant rate cuts are the likely reason for the weaker sentiment amongst investors,” a paragraph in the report read.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

A key highlight in last week’s US economic data was the positive jobs report released on Friday. The US economy added 254,000 non-farm payroll jobs in September, nearly double the 142,000 reported in August. This figure surpassed economists’ predictions, who expected up to 140,000 jobs.

The unemployment rate also dropped to 4.1%, defying expectations of 4.2%, similar to August’s data. Strong job growth and rising wages signal a tightening labor market, which could exert further pressure on inflation.

These reports put US jobs data back in focus as the Federal Reserve considers its next interest rate decision. The Fed’s dual mandate includes maximum sustainable employment and price stability.

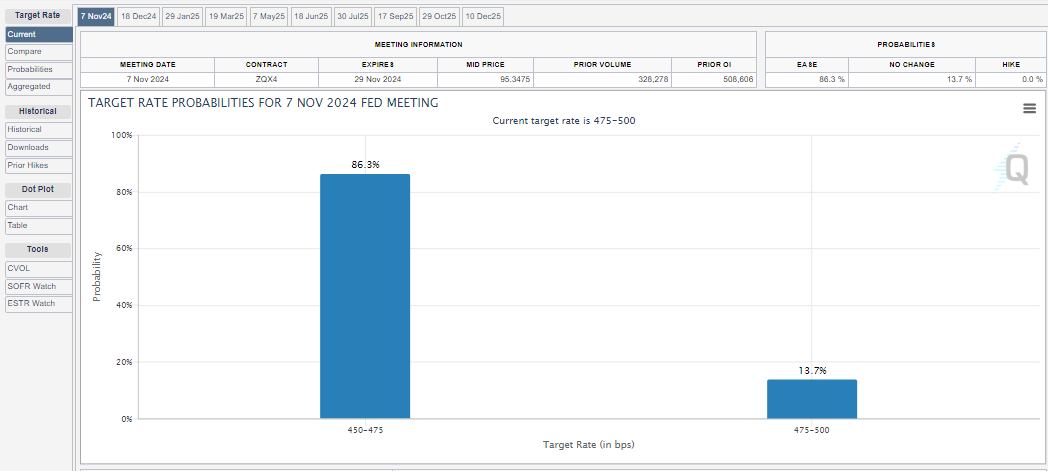

In response, the CME FedWatch Tool shows an 86.3% probability of a 50 basis point (0.5%) rate cut, compared to 13.7% for a 25 bps cut. After the last 50 bps cut, the market expects another significant policy adjustment to address economic pressures.

However, traders should monitor additional Fed signals and key economic data this week, including the Consumer Price Index (CPI), Producer Price Index (PPI), and initial jobless claims. If the data points to a strengthening economy, odds could shift towards a 25 bps rate cut in November.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency.

While Bitcoin and Ethereum recorded negative outflows, multi-asset investment products (multi-coin) extended their streak to 16 consecutive weeks of inflows, totaling $29 million last week. This continued interest comes as macroeconomic data presents a mixed picture for cryptocurrencies.

Positive economic indicators, such as strong job growth and falling inflation, typically boost risk assets like Bitcoin. However, rising oil prices and geopolitical tensions in the Middle East are fueling renewed inflation concerns, adding uncertainty to the market. These dynamics help explain Bitcoin’s stall around the $63,000 mark, as investors shift toward multi-asset products.

“Since June, multi-asset products have been a favorite among investors who prefer to invest in a diversified basket of assets rather than individual ones,” the CoinShares report concluded.

BeInCrypto data shows Bitcoin trading at $62,988, reflecting a modest 1.38% gain since Monday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.