Bitcoin miners face uncertain future amidst BTC’s fluctuations

10/09/2024 11:00

Bitcoin miners face mixed metrics amid price volatility, with balances dropping and fewer holdings moved to exchanges.

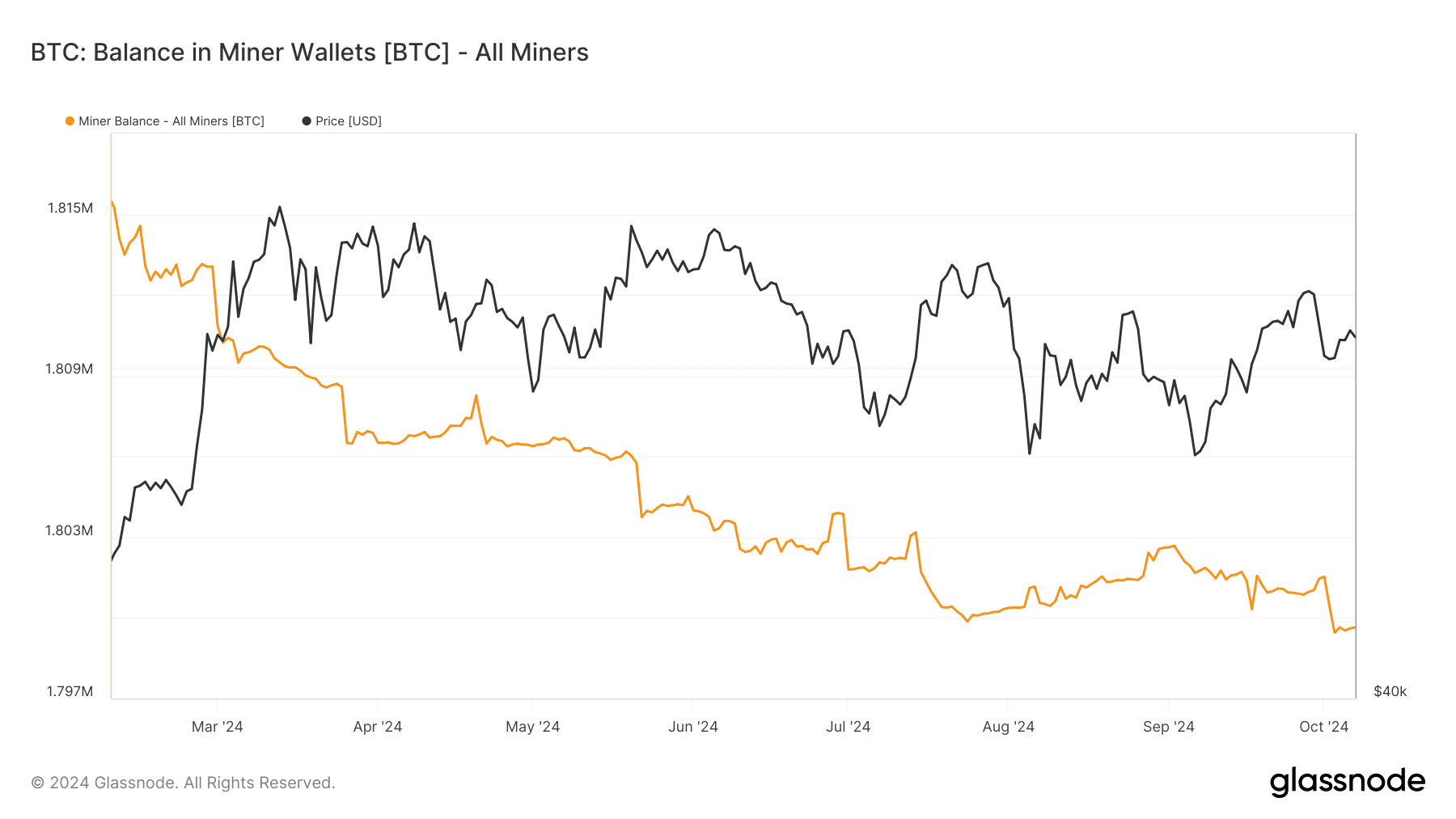

- Bitcoin miners saw a decline in their balances, dropping to around 1.799 million BTC in September.

- Despite volatility, Bitcoin miners’ revenue remained stable, with a slight increase to around 2.5%.

Bitcoin [BTC] miners experienced mixed performance in September as Bitcoin’s price showed significant volatility. Despite holding onto their BTC, miners saw a decline in revenue compared to August.

Bitcoin miners’ balances decline

In September, Bitcoin Miners’ balances gradually decreased. At the start of the month, the total balance was around 1.802 million BTC, but it had dropped to 1.801 million BTC by the end of the month.

This slight increase from a mid-month low of 1.800 million BTC reflected a brief upward trend.

However, as of this writing, the miners’ balance has declined further to approximately 1.799 million BTC, per data from Glassnode. This level is similar to where it stood in July when miners experienced a notable drop.

Fewer holdings moved to exchanges

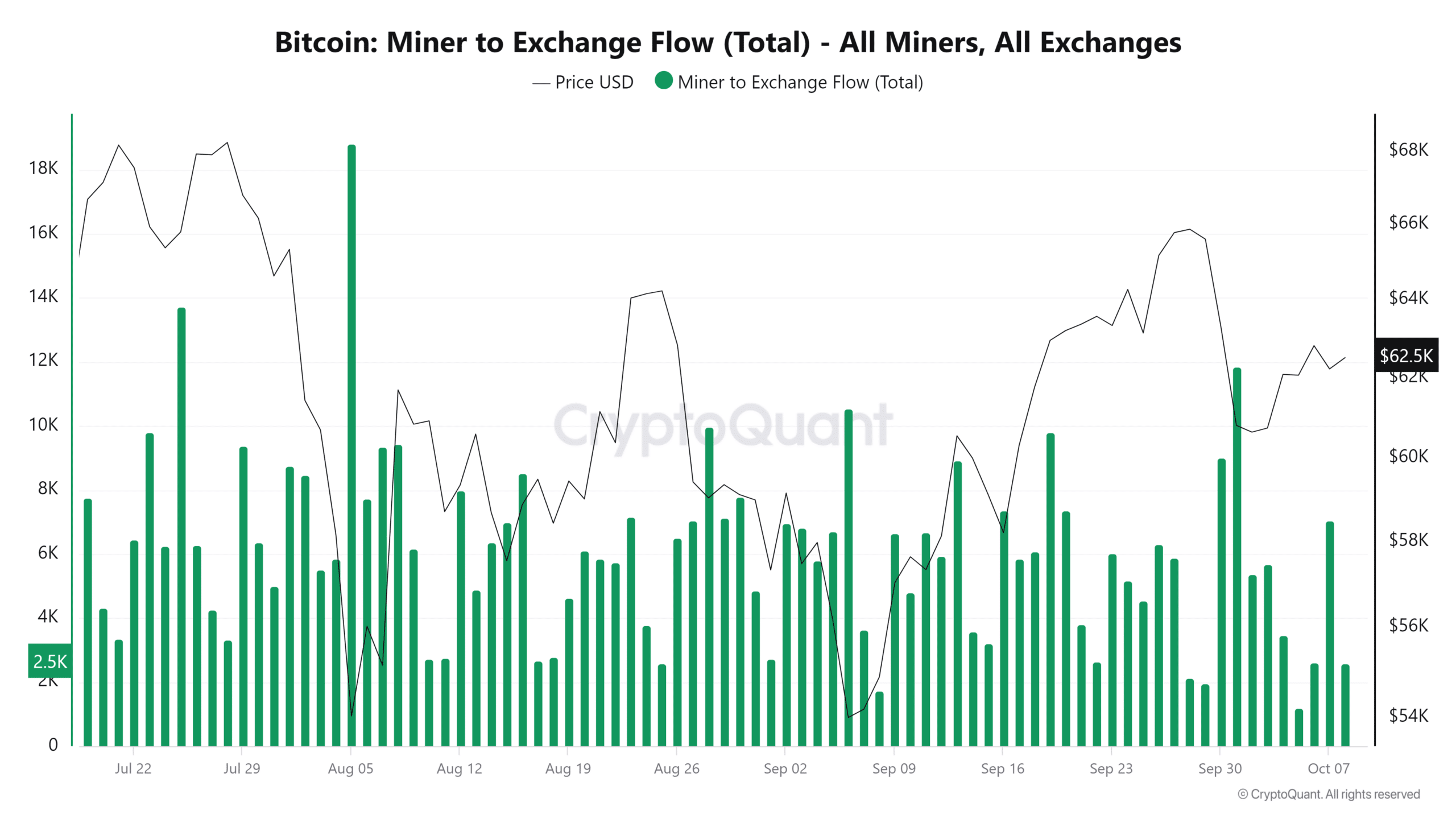

Despite Bitcoin’s price volatility in September, miners moved fewer holdings to exchanges compared to August. While there were transfers, they were notably lower than the previous month.

The largest single transfer in September was 11,842 BTC, compared to over 18,000 BTC moved in August.

Additionally, Bitcoin Miners’ revenue metrics for the past month showed no significant spikes or declines.

Although there were small fluctuations, revenue increased by up to 2.5% on certain days, which was far less dramatic than the 18% spikes seen in August.

The lowest point in miners’ revenue during September was around 1.2%; as of this writing, revenue has stabilized at around 2.5%.

Bitcoin remains volatile

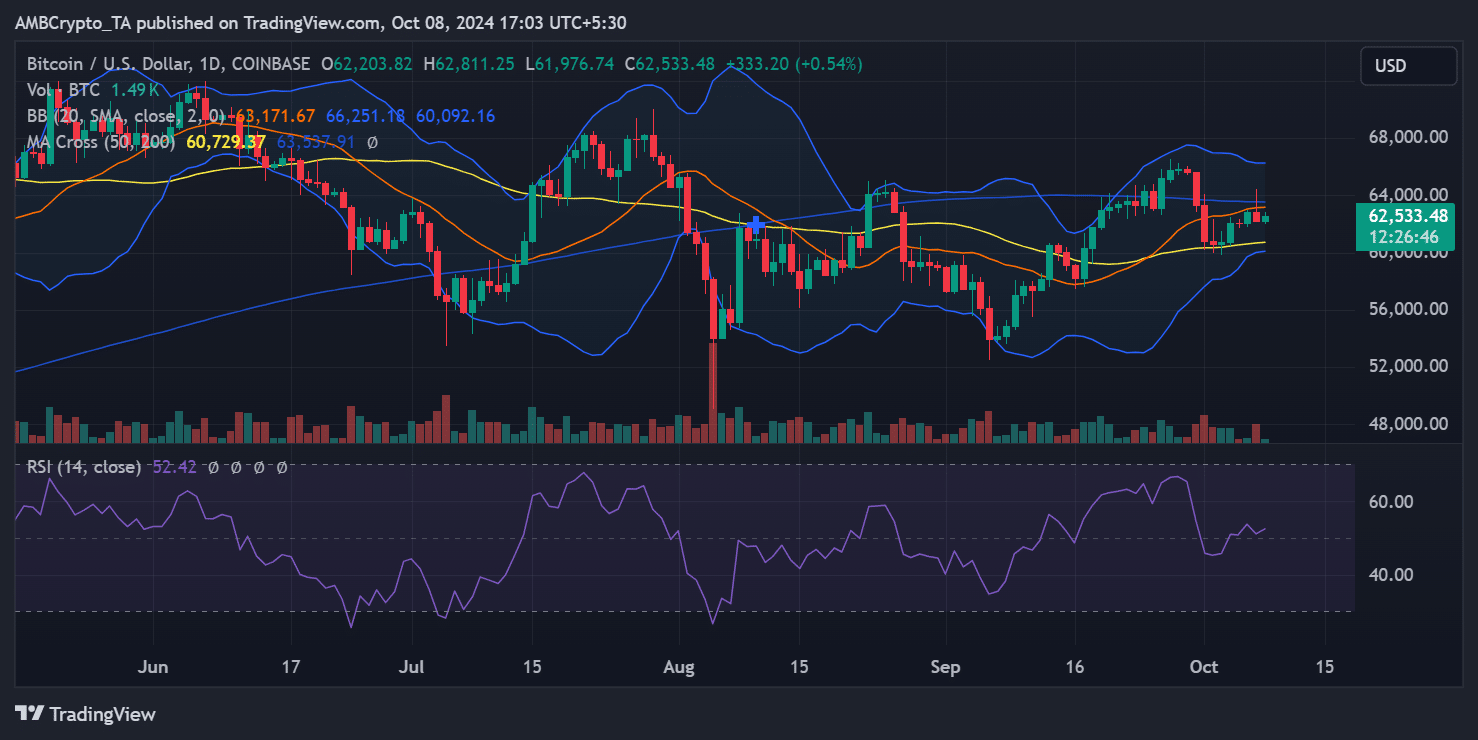

Bitcoin’s price volatility continued into October. The highly anticipated “Uptober” trend has yet to fully materialize, as the daily price chart shows Bitcoin struggling to recover after early-month declines.

A Bollinger Bands analysis indicates that price swings are still wide, signaling continued volatility.

This ongoing volatility could mean that Bitcoin Miners will continue to experience mixed metrics in the coming weeks.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As of now, Bitcoin is trading at around $62,480, showing a slight increase of less than 1%. Its 50-day moving average serves as a solid support level, while its 200-day moving average at $63,700 remains a resistance point.

Miners have faced a combination of declining balances and relatively stable revenues amidst price volatility. With Bitcoin’s continued unpredictability, miners may see fluctuating performance in the near term.