Bitcoin Faces Selling Pressure from US Institutional Investors in October

10/09/2024 13:54

Bitcoin struggles under selling pressure from US institutional investors in October, with the Coinbase Premium Index reflecting the trend.

Bitcoin (BTC) is hovering around $62,000, caught in a temporary balance between bullish and bearish forces. Data indicates that Bitcoin is still under selling pressure from US institutional investors.

This pressure has been holding back Bitcoin’s momentum in October.

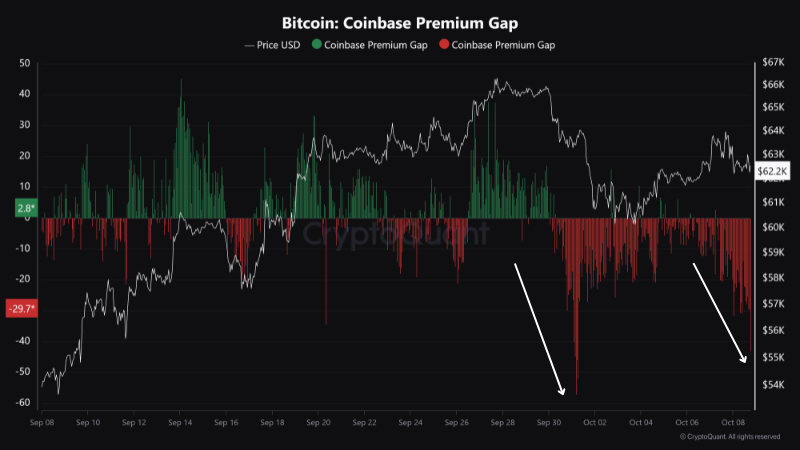

Coinbase Premium Index Remains Negative

The Coinbase Premium Index, a metric that tracks the price difference of Bitcoin between Coinbase and Binance, has stayed in negative territory so far in October. Coinbase, one of the leading crypto exchanges in the US, is a major platform for institutional investors to trade cryptocurrencies.

Read more: Coinbase vs. Coinbase Pro: Which Is Right for You?

A negative index suggests that Bitcoin prices on Coinbase are trending lower than on Binance, indicating stronger selling pressure from US investors, especially institutional investors.

“The Coinbase Premium has fallen to -$41, signaling strong selling pressure from US institutions.” On-chain analyst Maartunn said

Historically, periods of positive Coinbase Premium Index readings have been followed by Bitcoin price gains, while negative readings have coincided with price declines. The continuous negative trend in early October has raised concerns of an impending Bitcoin correction.

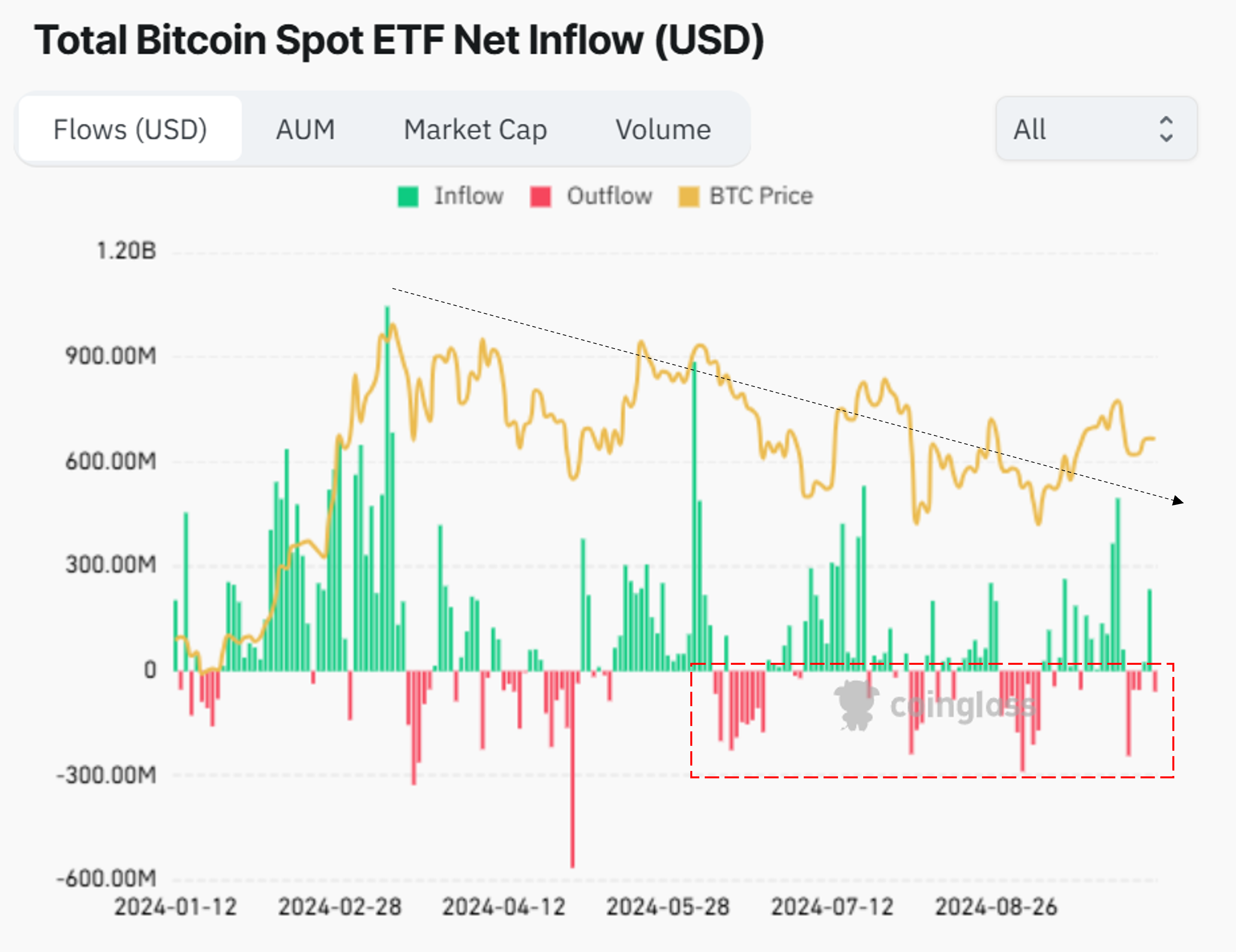

Bitcoin ETFs Experience Outflows in October

Another data point supporting the argument that US investors are selling is the net outflow from US-based spot Bitcoin ETFs. The chart below shows that inflows into Bitcoin ETFs have been declining lately, and their assets under management (AUM) are slowing in growth.

In October alone, four out of the first six days recorded net outflows, with over $408 million being withdrawn. In contrast, only around $260 million flowed into ETFs since the start of the month. Recently, a wallet linked to BlackRock also recorded significant withdrawals.

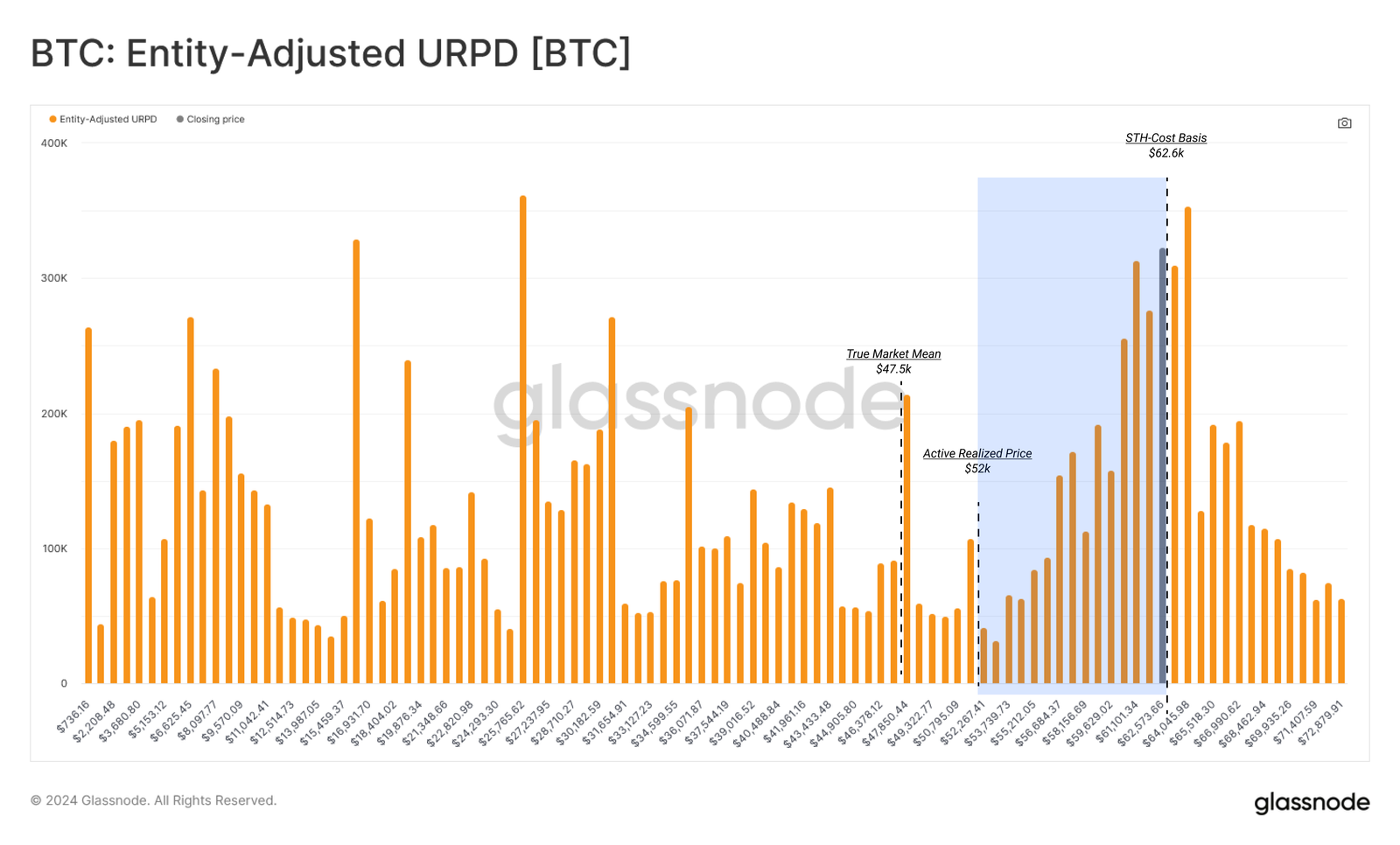

URPD Data Reveals Bitcoin in a Sensitive Price Zone

The UTXO Realized Price Distribution (URPD) tool, which measures the amount of Bitcoin traded on-chain at different price levels, highlights a sensitive price zone for Bitcoin.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

According to data from Glassnode, $62,600 is a key level where a large volume of BTC has been traded. Below this price, support weakens.

If Bitcoin fails to hold around $62,600 and drops below $60,000, it could decline toward $52,000. However, Bitcoin could also quickly surge past $72,000 if it breaks through the resistance level at $64,000.

“This paints a picture of a market which rests on delicate ground, with a large volume of supply likely to be sensitive to the next major market move.” Glassnode reported

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.