Bitcoin unlikely to surge from Fed cuts alone, expert predicts

10/11/2024 03:00

According to Andrew Kang, the market has overweighted the impact of Fed rate cuts and China stimulus on BTC.

- Analysts downplayed the positive impact of Fed rate cuts on Bitcoin.

- Andrew Kang stated that BTC could remain range-bound until a key crypto catalyst emerges.

There’s an overall market optimism that Bitcoin [BTC] could explode in Q4 2024, especially given the ongoing U.S. Fed rate cuts and China stimulus package.

These factors have been viewed as net positive for global liquidity and risk assets, including BTC. The aggressive 50 bps Fed rate cut in September was deemed as the catalyst for BTC’s rally to $66K.

Contrarian view Fed rate cuts

But Andrew Kang, co-founder of crypto investment firm Mechanism Capital, has taken a cautious and contrarian stance.

According to Kang, the impact of the Fed rate cuts and China’s policy might be overstated. He said,

“I believe crypto market participants as a whole have overstated the impact of fed rate cuts and China stimulus.”

Kang argued that Fed rates are just one of the many factors influencing global liquidity. He added that even global liquidity is just one of the many factors influencing crypto prices.

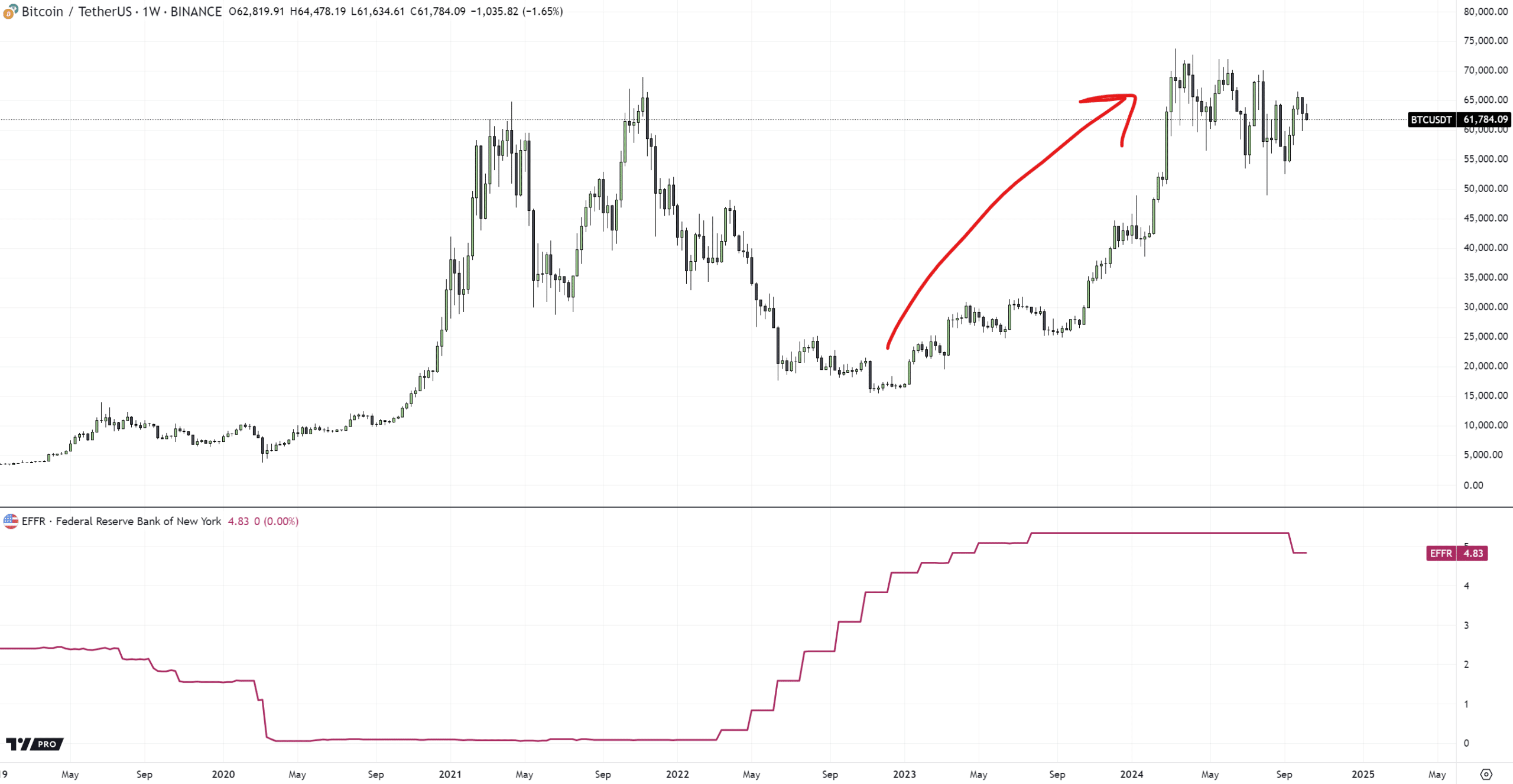

To back his argument, Kang cited BTC’s wild rally since 2023, when Fed rates hiked to record highs.

“It seems nonsensical to see BTC rally 4.5x during a period where rates were going to and at multi-decade highs – showing little correlation between rates and BTC, and then expect a strong inverse correlation to present itself as soon as rates start going down.”

Although he acknowledged Fed rates’ importance, he felt the market overemphasized it.

SwissOne Capital, a crypto-focused asset manager, supported the projection.

The firm added that altcoins stand to benefit more than BTC during the Fed rate cut cycle, as BTC dominance always declines during these periods.

“During the previous rate-cutting cycle that began midway through 2019, Bitcoin dominance then fell to 38%.”

China stimulus

Kang also claimed China’s stimulus was more bullish for shares than crypto. He cited recent trading discounts between USDT and the Chinese Yuan (CNY).

“Those in China have noted a migration from crypto to A shares. The data backs this up – since Chinese stimulus was announced, USDT has traded at a discount to CNY. Still at 3% as of recent.”

Although the Chinese stock rally stalled temporarily, market pundits projected an extra stimulus package from the Chinese government could reignite the uptrend.

If so, crypto investors might reallocate capital to stocks, as Kang noted.

Ergo, he predicted that BTC could remain range-bound between $50K and $72K until a strong crypto catalyst triggers the market.

“This is not to say I am bearish; I just think that some people have gotten over their skis a little. I still believe we are in a $50k-$72k range until there is a meaningful catalyst for crypto.”

In the meantime, BTC was still below the 200-day MA (Moving Average), reinforcing that it was yet to front a convincing market structure shift to bullish.