Ethereum Classic’s short-term looks bearish: Will ETC decline further?

10/11/2024 03:30

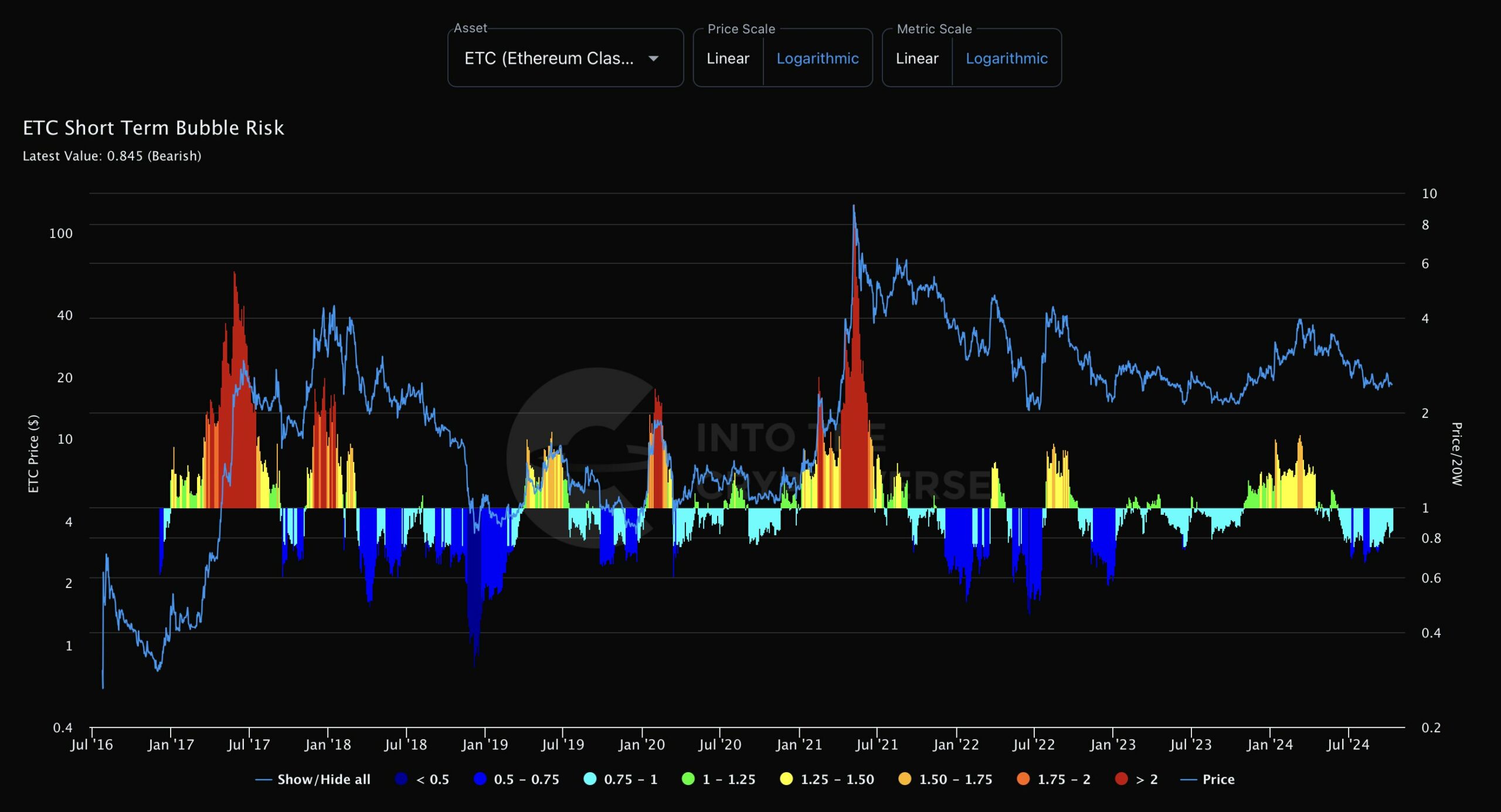

Recent analysis reveals that the short-term bubble risk for ETC has turned bearish, potentially indicating continuation of the downtrend.

- ETC faces bearish risk amid Short-Term Bubble signal.

- ETC continues its struggle against Bitcoin.

Ethereum Classic [ETC] has maintained its original blockchain history since the DAO hack, unlike Ethereum [ETH], which created a new version of the network.

Priced at $18 at press time, ETC significantly lagged behind Ethereum’s value of $2300.

Recent analysis reveals that the short-term bubble risk for ETC has turned bearish, potentially indicating continuation of the downtrend.

This negative outlook is seconded by several indicators pointing towards further decline. Since peaking at $186 in April 2021, ETC has been in a consistent downtrend.

ETC’s valuation against Bitcoin [BTC], the leading cryptocurrency, has also been declining. This trend mirrors Ethereum’s performance, emphasizing BTC’s dominance across the market.

While the crypto market generally tends to experience gains in the final quarter of the year, ETC’s weak valuation suggests it may not follow this pattern.

Historically, Bitcoin’s strength often influences other cryptocurrencies, but ETC seems vulnerable to continued decline despite the usual optimism in Q4.

ETC below weekly MAs, but trendline broken

Further signs of ETC’s weakness are evident in its moving averages. It was trading below all its simple moving average (SMA) at press time, including the 8-day SMA, which indicated a bearish trend.

This downward movement highlighted increased risk for traders holding Ethereum Classic or considering entering the market for potential Q4 gains.

For Futures traders, shorting ETC might be a viable option, especially since trading below moving averages typically signals a bearish trend direction.

However, there is still a glimmer of hope for Ethereum Classic. A technical analysis of the ETC/USDT pair shows a recent break above a descending trendline, which had been suppressing its price since May 2024.

Trendline breaks often signal potential market reversals, and ETC’s move above $18 suggests the possibility of a bottom forming. If the price holds above this level, it could rally to $25, offering potential gains of more than 40%.

On the flip side, if ETC fails to hold its current support and falls below the key $18 level, the decline may continue. A break below this critical level would likely lead to further price deterioration.

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

While Ethereum Classic faces considerable bearish risks, there remains a possibility of a short-term rally if broader market conditions improve.

As always, Ethereum Classic’s future largely depends on market dynamics and the performance of other major cryptocurrencies.