Bitcoin to $55K again? Stablecoins have their say as weak demand…

10/12/2024 03:00

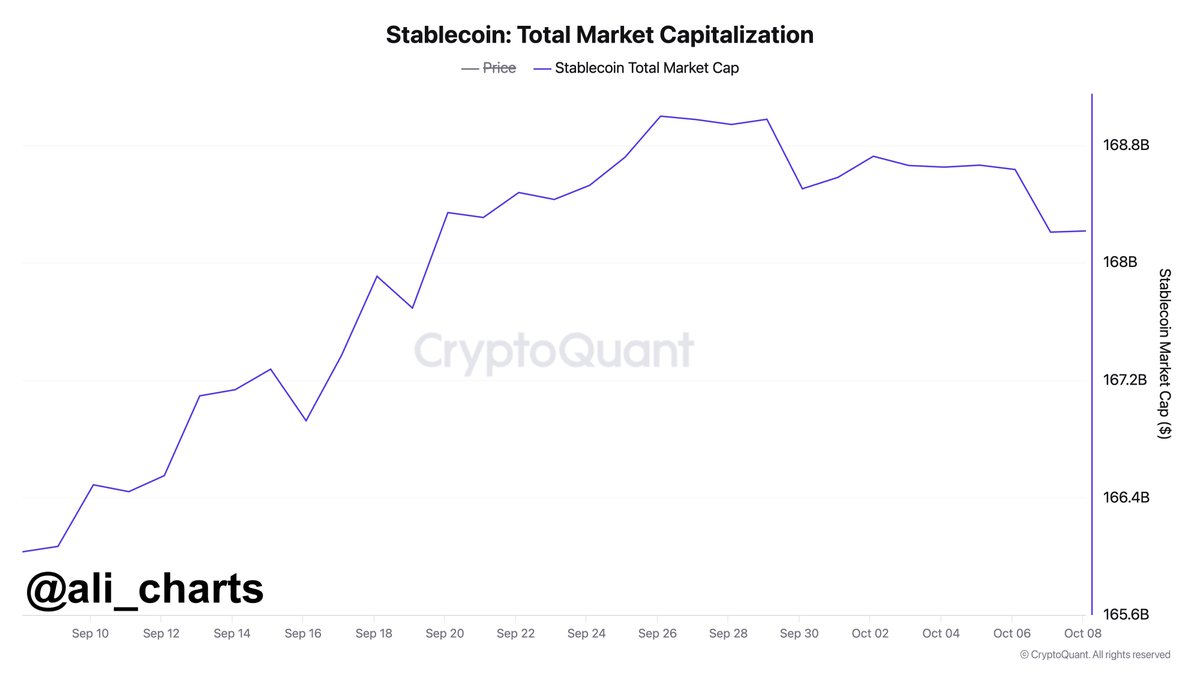

The recent $780 million drop in stablecoins' market capitalization may be a sign of reduced buying power. This decline could lead to...

- Bitcoin may be affected by the drop in stablecoins’ market cap

- RSI signalled potential reversal, despite BTC’s price declining on the charts

Bitcoin (BTC) has recorded significant price fluctuations recently, fueling mixed reactions in the crypto market. In light of such volatility, it’s worth looking at stablecoins. This asset class plays a crucial role in cryptocurrency trading, providing liquidity and exposure to the market.

However, the recent $780 million drop in stablecoins’ market capitalization may be a sign of reduced buying power. This decline could lead to weaker demand for cryptocurrencies, potentially causing price stagnation or further declines.

Bitcoin, as the market’s leading crypto, is expected to be heavily affected, possibly entering an extended accumulation period or continuing its ongoing downtrend.

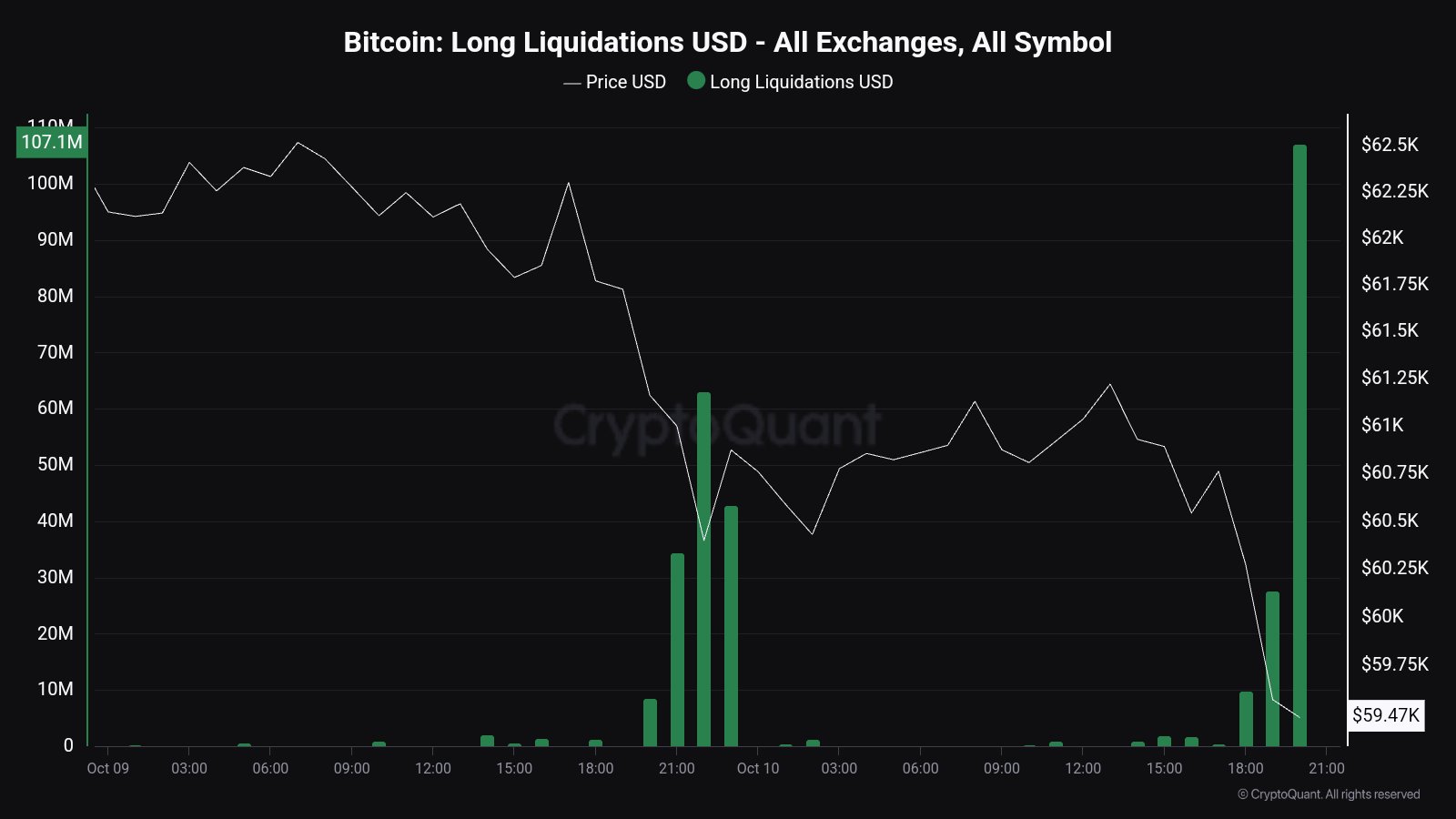

Declining price amidst liquidations

Analyzing the price action of BTC/USDT on the 2-hour timeframe revealed that Bitcoin has already tapped into liquidity at the $59.5k–$60k range, even dropping below $59.5k.

While there’s hope for a reversal, if one doesn’t occur, BTC could drop further, potentially testing $55k or lower levels.

Although this correction might not be widely anticipated, the drop in stablecoins’ market cap suggests that weaker demand could drive Bitcoin lower before any reversal.

The likelihood of BTC dropping to $55k is rather high as it has broken below critical support levels, including the 100 Day Moving Average (DMA).

This indicator has acted as both support and resistance in recent months when BTC has been in a range. Breaking below it is a sign of bearish momentum.

Additionally, Bitcoin also dipped under the 200 Exponential Moving Average (EMA), further supporting the case for sustained downside pressure. During this decline, over $107 million worth of BTC longs were liquidated when the price dropped below $59.5k.

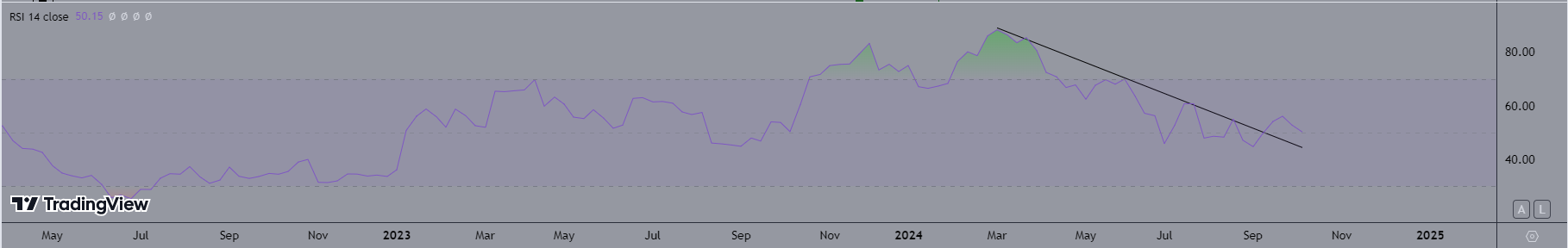

BTC’s RSI breaks above trendline

Despite these bearish signals, there may still be a glimmer of hope for a BTC recovery before the year ends.

Bitcoin’s Relative Strength Index (RSI) broke out of a 200-day downtrend. It seemed to be retesting this breakout level at press time.

If BTC manages to hold above this trend line, it could signal a reversal and provide some relief for traders and investors who are anticipating a long-term uptrend for Bitcoin.

Source: TradingView

Staying ahead of these market moves is crucial, especially as Bitcoin’s price remains at a pivotal point.

While further declines are possible, the potential for a reversal is also present, making this a critical time for traders and investors to watch BTC closely.