Bitcoin’s next price target – Here’s why BTC can hit $78K next!

10/12/2024 19:00

After a drop to $60k, Bitcoin [BTC] bulls have again gained control of the market in the last 24 hours as its price surged 3%...

- Analyst believes the world’s largest cryptocurrency might next target $78k

- Buying pressure has been rising lately, alluding to an upcoming price hike

After a drop to $60k, Bitcoin [BTC] bulls have again gained control of the market over the last 24 hours. What next though? Well, some analysts believe that the world’s largest cryptocurrency might soon chart a path towards $78k now.

Tracking Bitcoin’s path

AMBCrypto reported previously that Bitcoin has been in a consolidation phase lately. In fact, CryptoQuant Founder and CEO Ki Young Ju noted that we are on course to have the longest sideways price action in a halving year.

On top of that, Ali, a popular crypto analyst, also shared a tweet revealing BTC’s possible path. As per the tweet, BTC’s price has been consolidating inside a channel. While the coin dropped to $60k initially, it then touched $66k on the charts.

Following the same, the coin once again plummeted to $57k. At press time, Bitcoin was showing signs of recovery as its value surged by 3% in the last 24 hours alone.

If this recently gained bullish momentum lasts, this just might be the beginning of the road towards $78k.

BTC’s road ahead

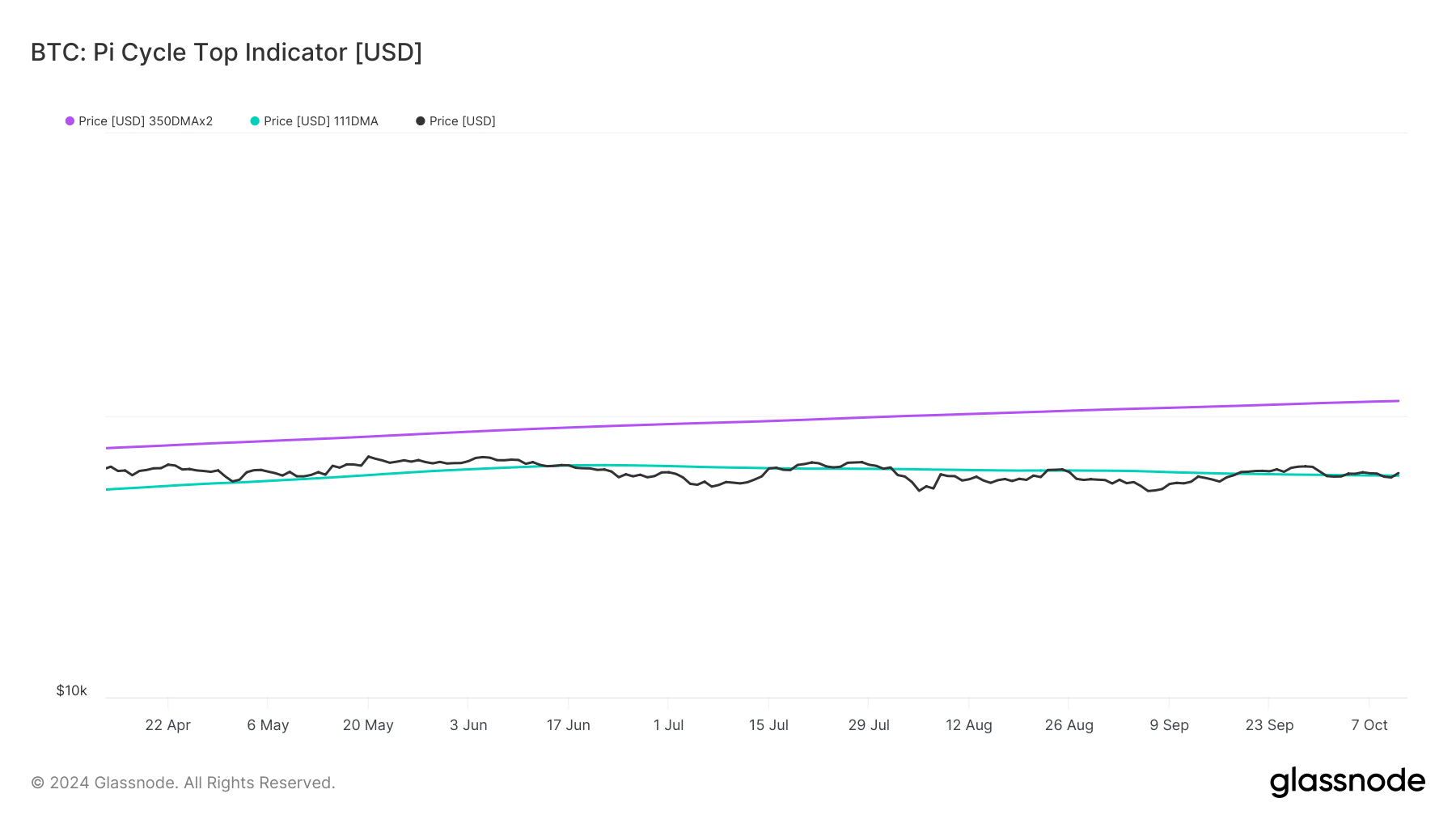

Since the aforementioned analysis pointed to the possibility of a breakout towards $78k, AMBCrypto planned to check BTC’s on-chain data. As per our analysis of Glassnode’s data, Bitcoin just crossed above its potential market bottom.

If the Pi Cycle Top indicator is to be believed, then the chances of Bitcoin going above its current ATH are high right now. This may be the case, especially as the metric underlined a possible market top at $112k.

Bitcoin’s NVT ratio also dropped over the past week. A decline in the metric means that an asset is undervalued, suggesting that it might soon begin a bull run.

Apart from this, AMBCrypto’s analysis of CryptoQuant’s data revealed yet another bullish signal. Bitcoin’s exchange reserves have been dropping. What this suggested was that that buying pressure on BTC has been rising – A finding that often results in price upticks.

On the derivatives front too, everything seems pretty optimistic right now.

For example, the coin’s taker buy/sell ratio turned green. This clearly meant that buying sentiment was stronger among Futures investors. Additionally, the coin’s funding rate also rose.

Read Bitcoin’s [BTC] Price Prediction 2024-25

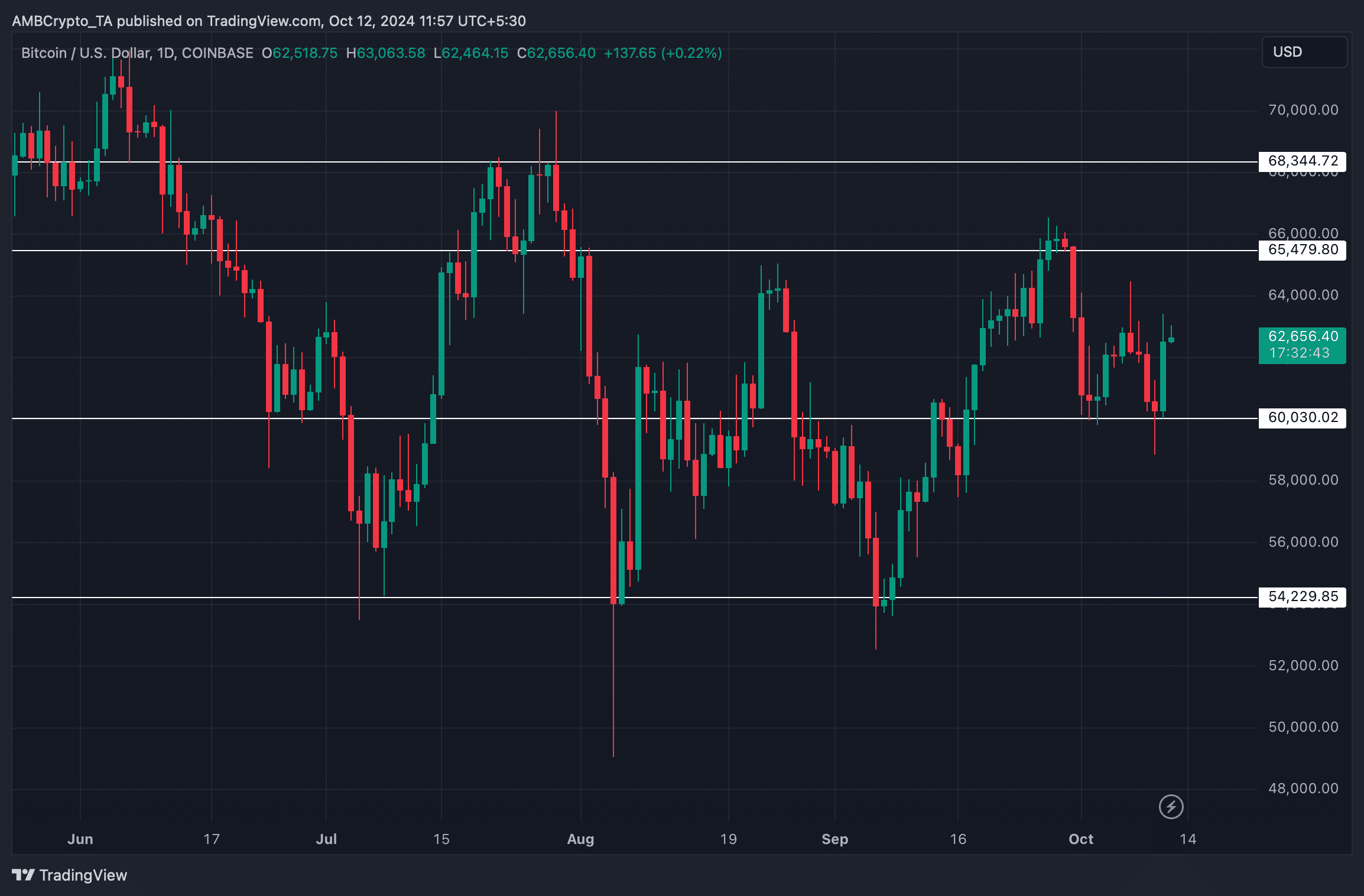

Finally, AMBCrypto checked Bitcoin’s daily chart to find out if there are any crucial resistance levels ahead before it retests its ATH.

We found that Bitcoin may be on the right track as it seemed to be approaching its resistance near $65.4k. A successful breakout would push the coin towards $68k. In case the coin manages to jump above that, then investors might see BTC retesting its ATH again.