Bitcoin ETFs have attracted $19 billion in net flows since their launch, significantly outpacing gold ETFs, which have seen $1.4 billion in net flows despite gold hitting record highs 30 times compared to Bitcoin’s five times, according to Bloomberg’s Senior ETF Analyst Eric Balchunas.

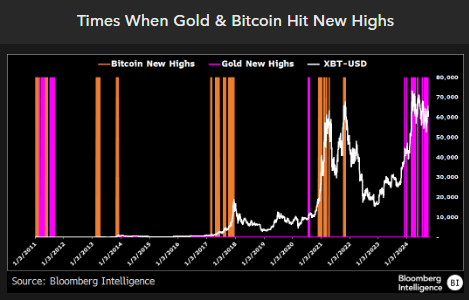

Data from Bloomberg Intelligence’s chart “Times When Gold & Bitcoin Hit New Highs” illustrates that while gold has more frequent record highs this year, Bitcoin experiences sharper price surges over shorter periods.

Historically, gold’s major new highs, particularly in 2020, correlate with economic uncertainties and inflation concerns, reinforcing its role as a traditional safe-haven asset. Despite this, the substantial investment in Bitcoin ETFs suggests a strong investor appetite for assets with higher volatility and potential for rapid appreciation.

The contrasting investment flows into Bitcoin and gold ETFs may reflect shifting investor perceptions amid changing macroeconomic conditions. Bitcoin’s growing mainstream adoption and its positioning as a digital store of value appear to be attracting significant capital, even as gold continues to perform strongly.