$75,000 Bitcoin (BTC) Target Draws Huge Bets as Open Interest Hits Historic High

10/15/2024 21:00

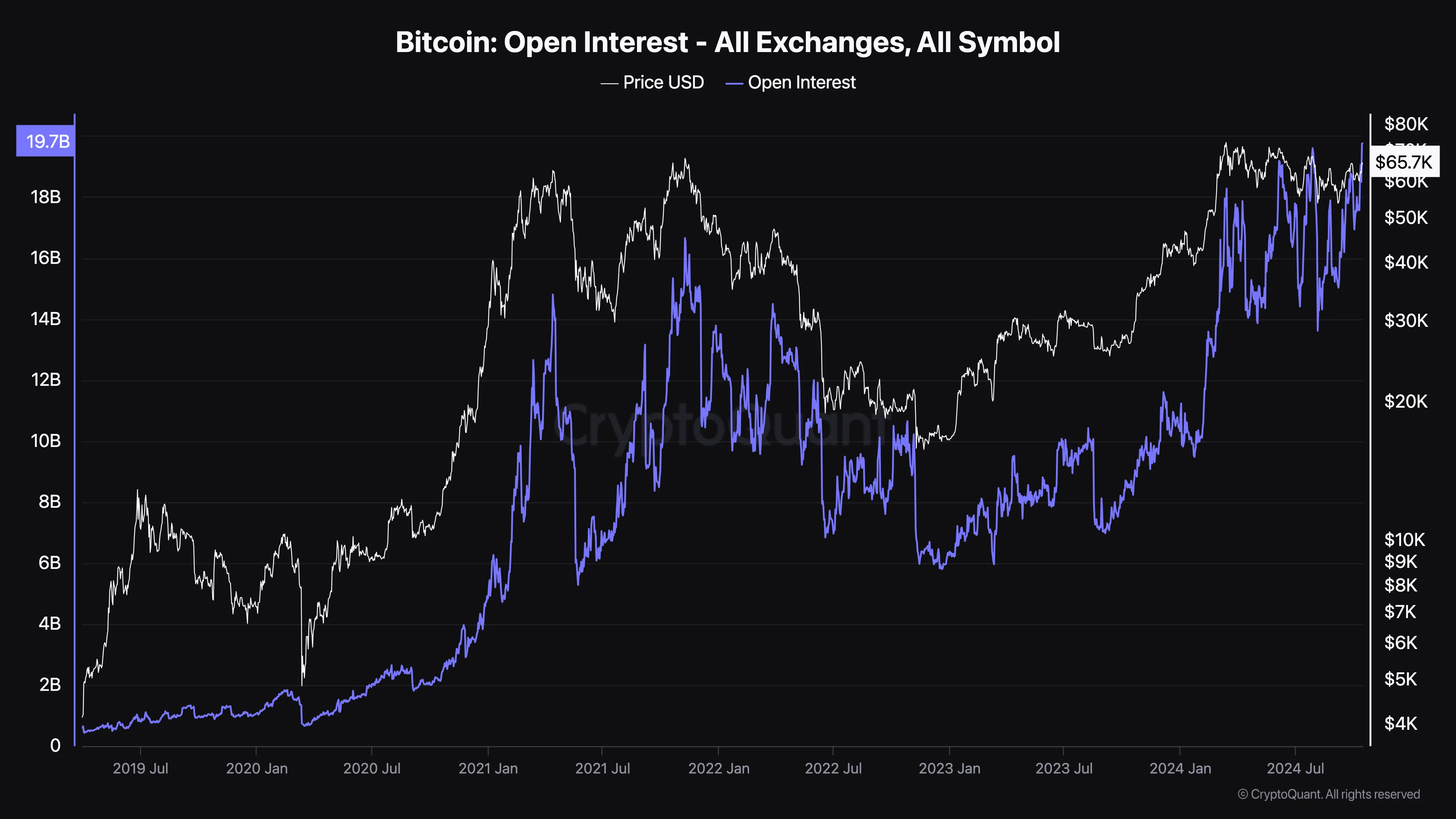

Bitcoin’s Open Interest hits a record $19.8 billion, reflecting bullish trader sentiment as funding rates point toward a $75,000 target.

Bitcoin’s (BTC) brief surge to $66,000 has attracted a surge in bullish predictions, with traders betting on an increase that could see the price surpass its all-time high. Although Bitcoin hasn’t yet set a new record, its Open Interest (OI) has reached a peak, signaling that interest in the leading cryptocurrency is at its highest level in a considerable time.

The surge in OI, alongside the price spike to $66,000, signals growing trader confidence in a potential breakout. How high can BTC go?

Bitcoin Open Interest Reaches New All-Time High

Typically, OI reflects the number of open contracts in the market. When it rises, it indicates that traders are actively entering positions, often in anticipation of significant price movements. A decrease, on the other hand, indicates reduced exposure to the coin.

According to CryptoQuant, Bitcoin’s Open Interest has reached a new all-time high of $19.80 billion. The last time the metric went this high was in July. During that period, the coin’s price almost retested $68,000.

Given the current market sentiment, it’s not unreasonable to consider that Bitcoin could challenge its all-time high of around $73,750. But that will only happen if growing interest in the asset persists.

Read more: Where to Trade Bitcoin Futures: A Comprehensive Guide

Regarding this development, crypto analyst EgyHashX opined that the rising liquidity could positively affect Bitcoin’s price in the short term.

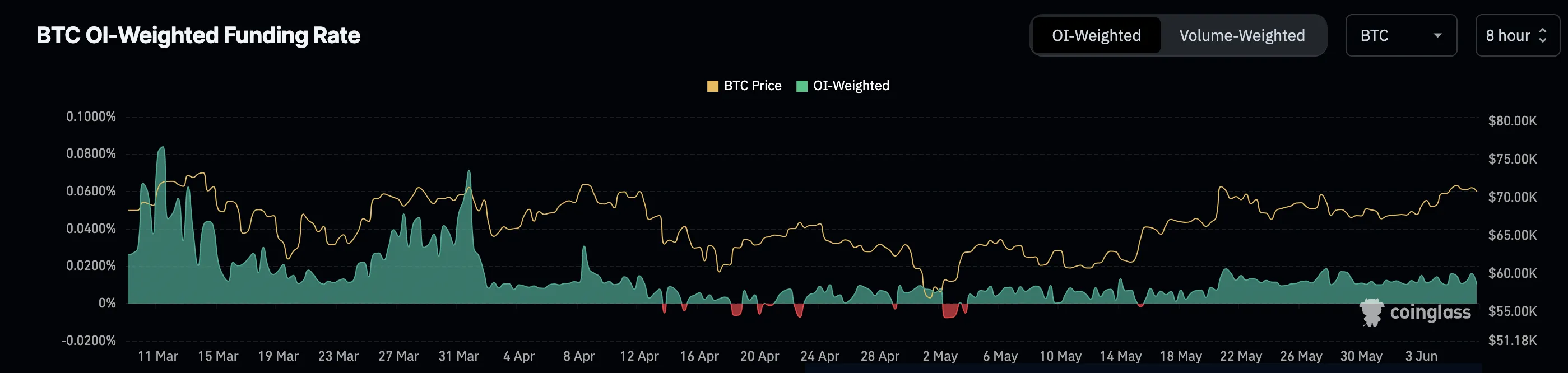

“This upward trend in the derivatives market indicates a growing influx of liquidity and increased attention in the cryptocurrency space. The rise in funding rates further points to a bullish sentiment among traders,” EgyHashX highlighted via CryptoQuant.

In addition, the recent surge in Bitcoin’s Funding Rate reinforces bullish sentiment in the market. The Funding Rate measures the cost of holding long versus short positions in futures contracts. When positive, it suggests that more traders are leaning toward long positions, anticipating an upward price movement.

A negative Funding Rate would indicate a bearish outlook, with more traders favoring short positions. Since the Funding Rate has been at its highest level since August and remains positive, it signals that traders are expecting Bitcoin’s price to rally, with data showing anticipation toward $75,000.

BTC Price Prediction: 14% Increase to Start With

For the past few months, Bitcoin’s price has been trading within a descending channel. This channel ensured that the coin remained range-bound and found it challenging to break out.

But yesterday, October 14, BTC finally rose past that resistance at $65,234. In the process, the coin climbed to $66,474 before recently pulling back. Despite that, BTC has refrained from re-entering the descending channel, indicating that the bullish thesis could still be strong.

If this remains the case, Bitcoin could break the overhead resistance at $70,738. Should that happen, the coin might climb to $75,002 before the end of this quarter.

Read more: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2024

On the flip side, the inability to jump above $66,009 again could invalidate the bias. In that circumstance, Bitcoin could decline to $60,272. Brian Quinlivan, Lead Analyst at Santiment, suggested caution, saying that Bitcoin might have hit a local top.

“One thing that is still slightly concerning is how bullish the crowd is currently at this BTC rally. The ratio of positive vs. negative comments over the past 2 days is the highest we’ve seen all year long, which can often align with short-term top signals,” Quinlivan told BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.