MANEKI crypto climbs 62% in 4 days – Should bulls wait for more gains?

10/16/2024 02:00

MANEKI is up by just over 60% within a week and the bulls eagerly await a move beyond the September highs to resume the uptrend.

- Sentiment and momentum around MANEKI crypto were bullish.

- The lack of accumulation in recent weeks was a worry for bulls.

MANEKI [MANEKI], the beckoning cat memecoin on the Solana [SOL] network, saw a 62.15% rally in the past four days. Since the 14th of October, the token is up 32% and counting.

At press time, the indicators reflected bullishness.

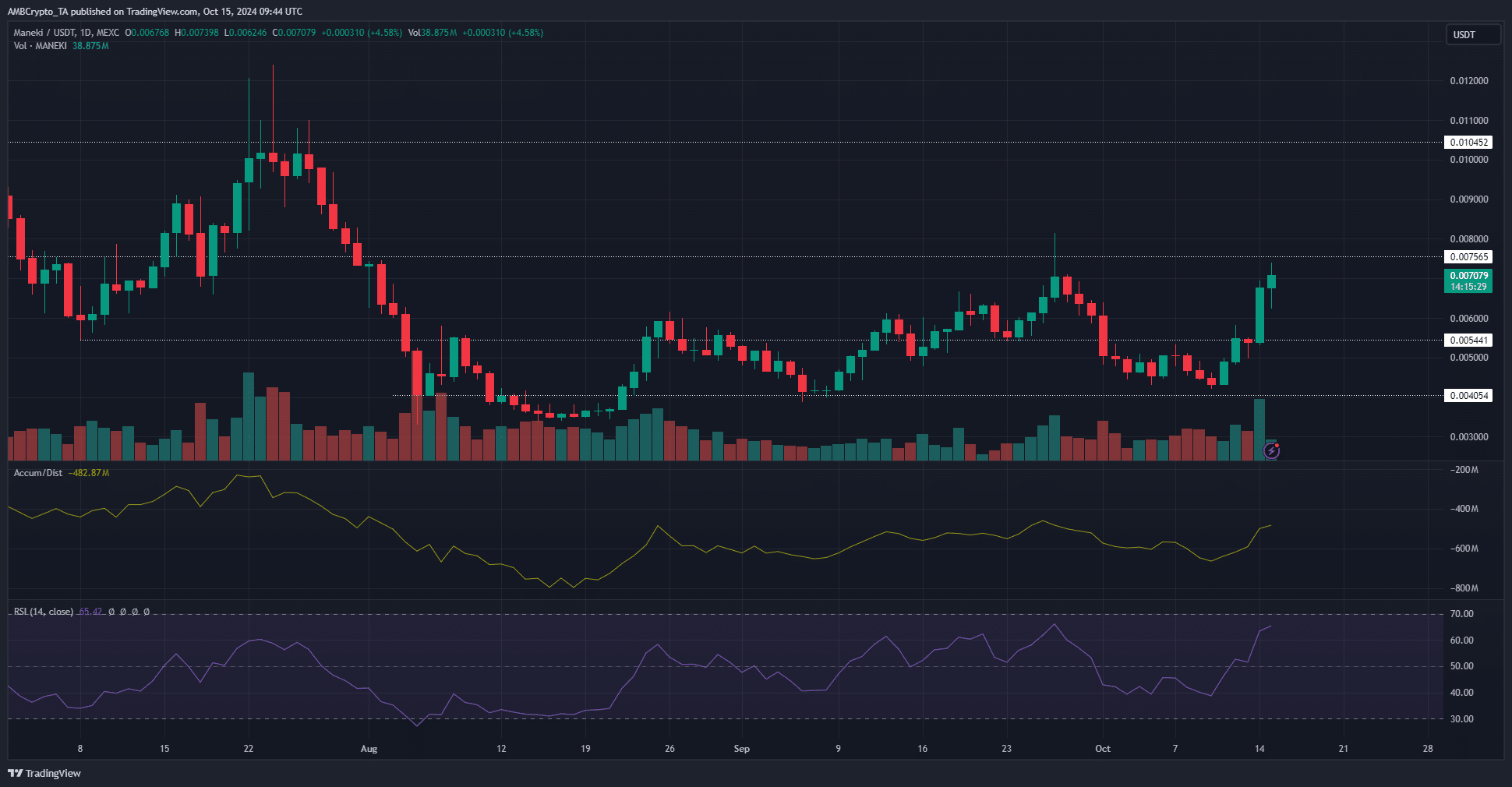

Yet, Bitcoin [BTC] has reached a resistance zone around $66k. MANEKI bulls also contended with the supply zone at $0.00756.

Caution is better than FOMO for now

The daily market structure for MANEKI was bullish. The breach of the $0.054 resistance last weekend saw this former supply zone flipped into a demand zone. From there, a large rally ensued on Monday.

The bullish push of the past two days brought the price to the threshold of the $0.0075 resistance level. On the 27th of September, this level rebuffed MANEKI bulls.

It is possible that a similar scenario would play out once more, as the A/D indicator failed to make new highs even though MANEKI was at a significant resistance.

This showed that the buying pressure likely wasn’t high enough for a sustained rally, despite the bullish momentum of the past few days.

Market expectations are more tempered

Like the price, the Open Interest also approached the highs it made toward the end of September. However, the OI was almost $1 million lower than three weeks ago.

Is your portfolio green? Check out the MANEKI Profit Calculator

This suggested that the bullish speculators were fewer.

The A/D indicator and the OI chart together showed market misgivings about a sustained MANEKI rally. Hence, traders could book profits and be prepared for a potential reversal.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion