Chainlink: How 3 updates may help LINK push past $13 resistance

10/16/2024 16:00

Chainlink [LINK] has shown impressive gains in recent days, following key developments within its ecosystem.

- LINK was gaining momentum, with technical indicators pointing to a possible breakout above $13.

- Market sentiment has improved, supported by rising network activity and decreasing exchange reserves.

Chainlink [LINK] has shown impressive gains in recent days, following key developments within its ecosystem.

The introduction of staking, expansion of its data oracle network, and the launch of Secure Mint have all contributed to LINK’s bullish momentum.

As of press time, LINK was trading at $11.53, representing a 4.80% increase in the past 24 hours. The critical question now is whether this momentum will be enough for LINK to surpass the key resistance level at $13.

Is Chainlink signaling the next bullish breakout?

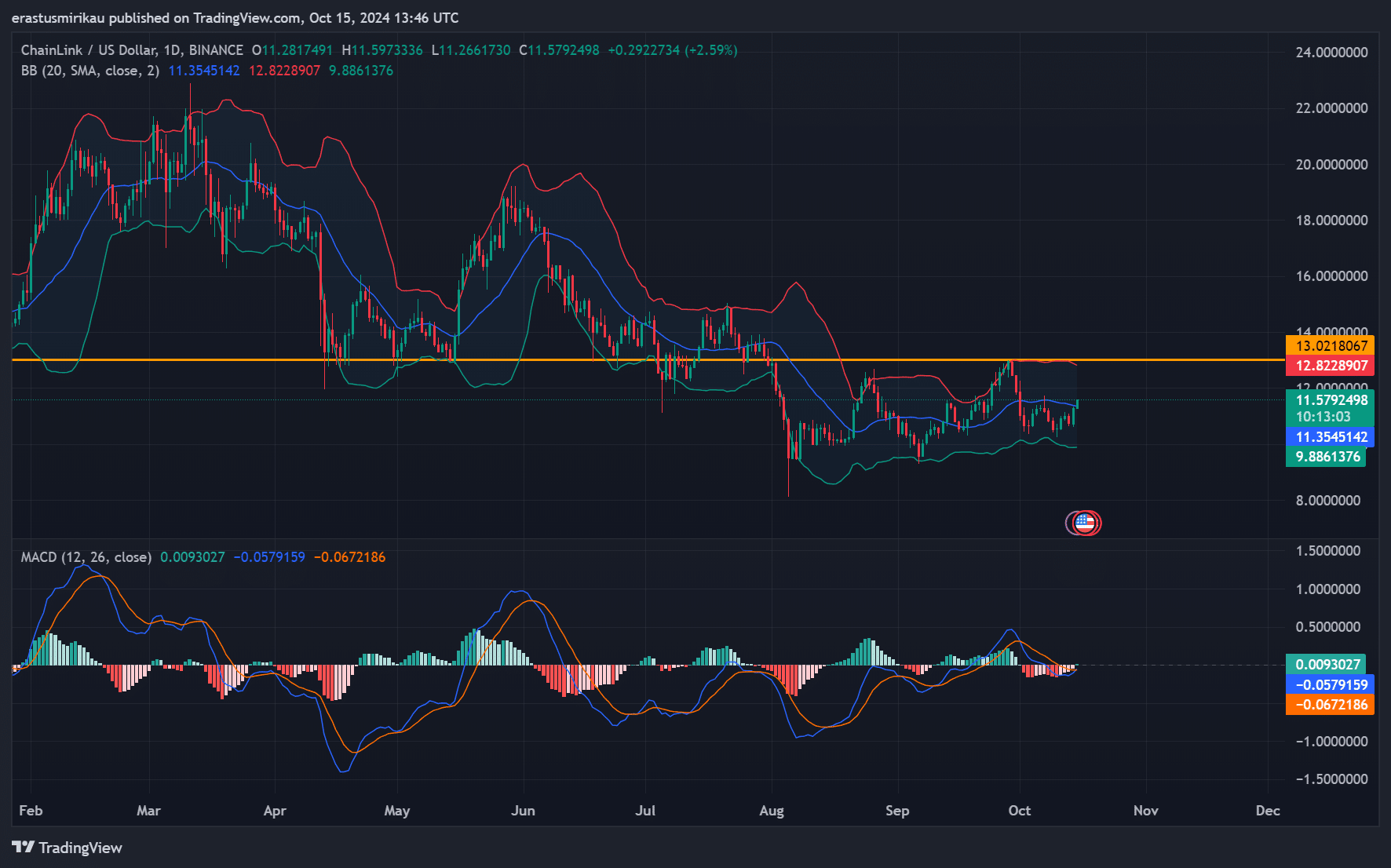

The price of LINK has struggled to maintain any long-term movement above $13. The current technical analysis showed the Bollinger Bands tightening, suggesting that a potential breakout could be imminent.

Additionally, the MACD was edging toward bullish territory, hinting at an upcoming upward push. However, the $12.82 resistance must be broken decisively.

If LINK can clear this level, it will likely trigger a rally beyond $13.

Growing network activity boosts bullish sentiment

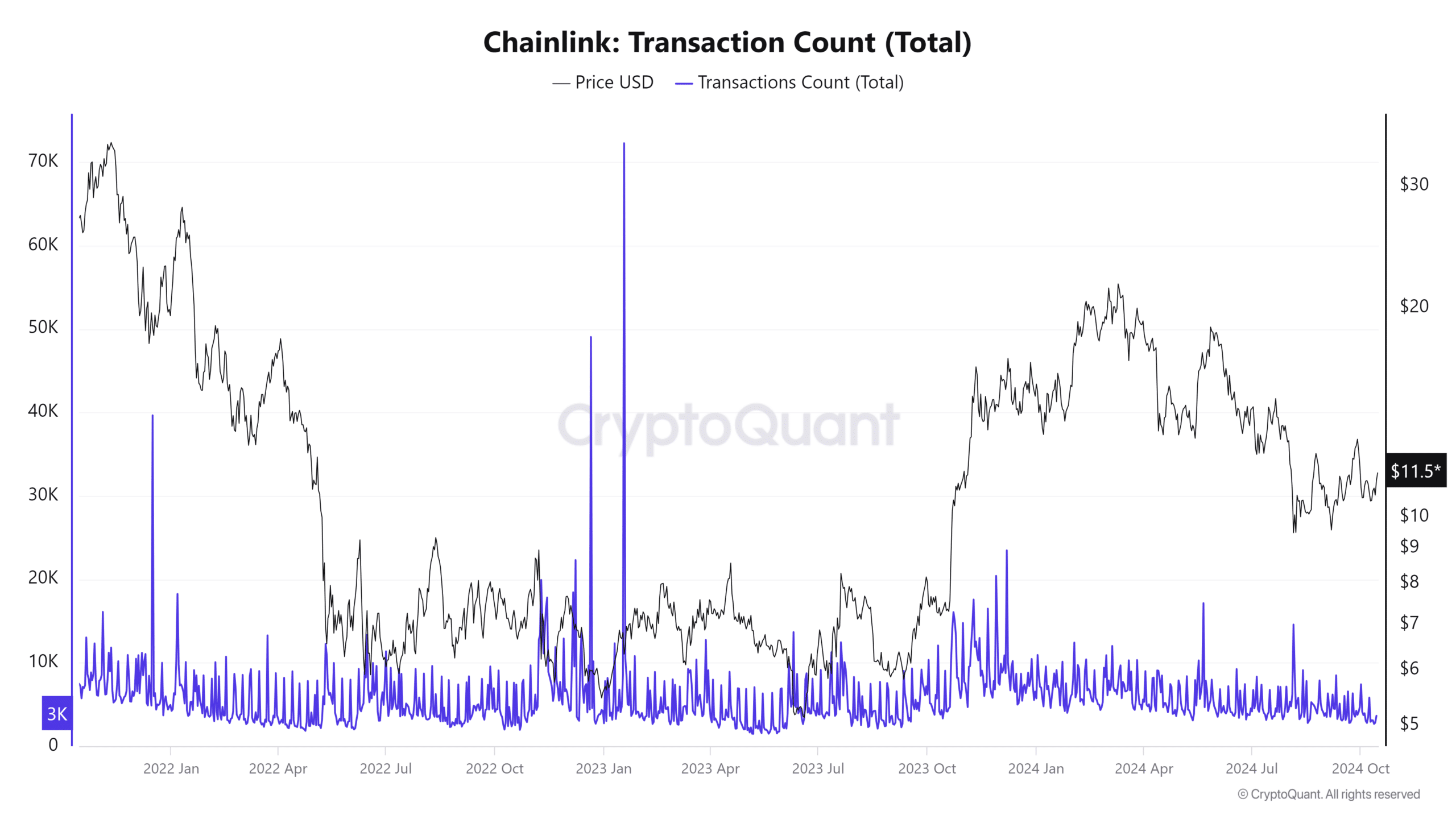

Chainlink’s on-chain activity has been steadily rising. The number of active addresses increased by 1.25% over the last 24 hours, reaching 178.91K, indicating a surge in network participation.

Moreover, the transaction count grew by 1.28%, with 4.05K transactions recorded during the same period as per CryptoQuant data.

These rising figures reflect an increasing demand for LINK and suggest that the network is experiencing healthy growth, further bolstering the case for a potential breakout.

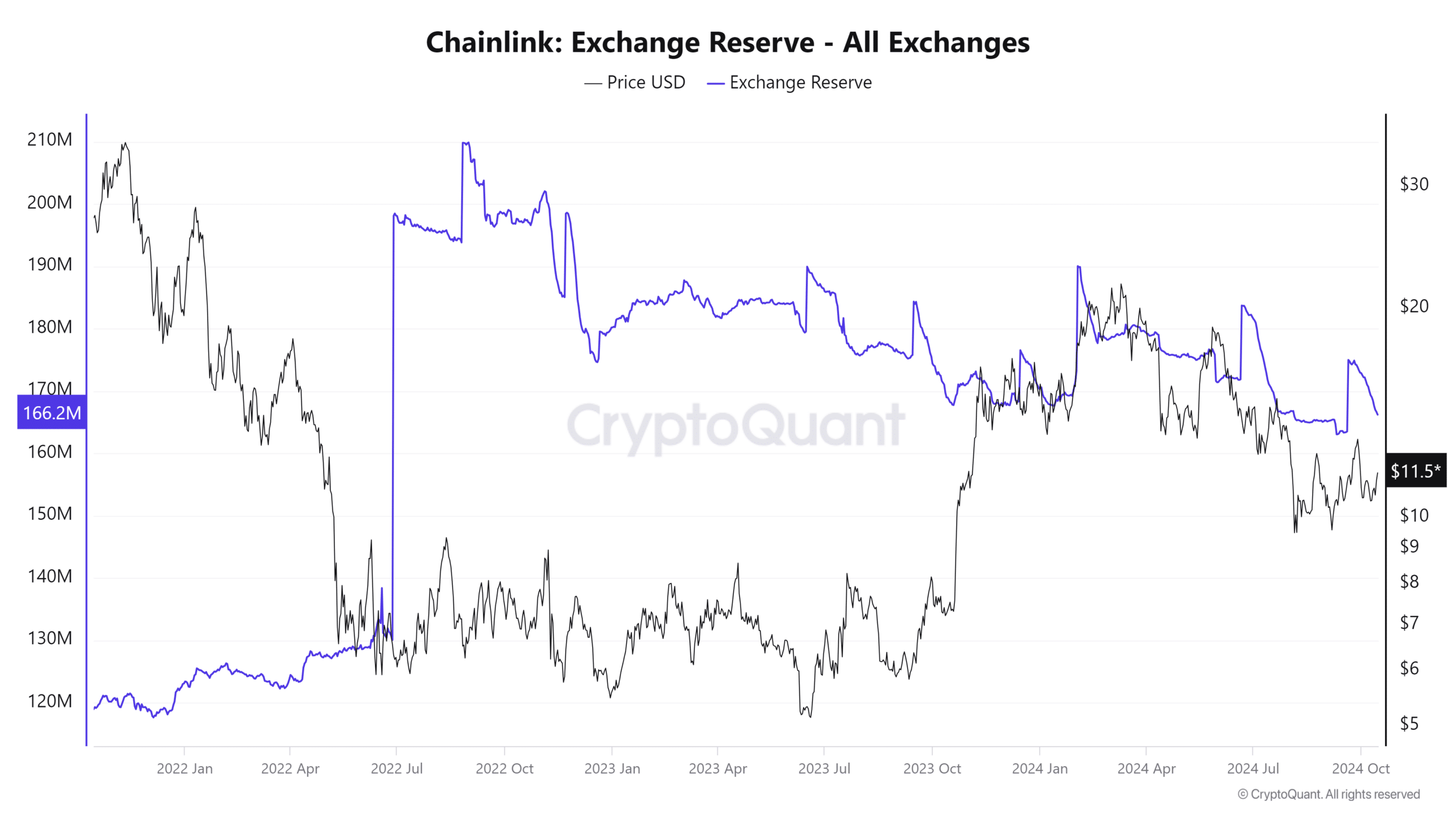

Exchange reserves decline as selling pressure weakens

Another positive sign for LINK’s price is the decrease in exchange reserves, which dropped by 0.26% to 166.21M LINK in the last 24 hours.

This decline signals that fewer tokens are being held on exchanges, reducing selling pressure and creating a favorable environment for price appreciation.

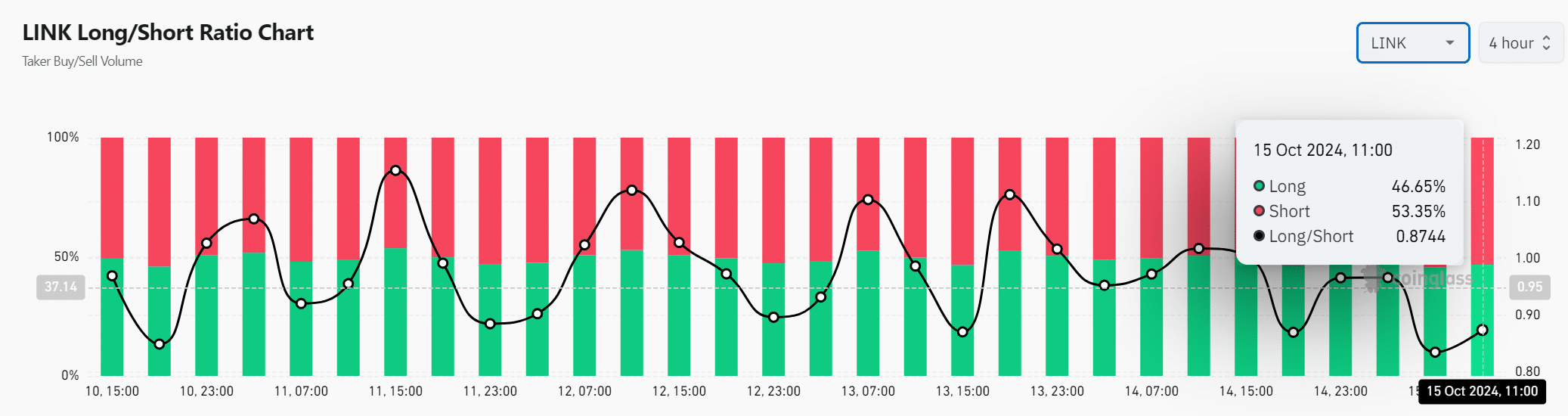

Chainlink’s shorts outweigh longs, but for how long?

Currently, 53.35% of traders are short on LINK, while 46.65% are holding long positions.

However, if LINK manages to break through the $13 resistance, this imbalance could trigger a short squeeze, forcing short sellers to buy back LINK quickly.

This could lead to rapid price appreciation, pushing LINK to even higher levels.

Is your portfolio green? Check out the LINK Profit Calculator

Chainlink’s recent price surge, combined with improving on-chain metrics and declining exchange reserves, points to a potential breakout.

If LINK can overcome the $12.81 resistance, the token may experience a swift rally. However, continued buying momentum and market support will be crucial in determining whether this breakout will materialize.