Vitalik Buterin on why Ethereum centralization is a problem: ‘Higher risk of…’

10/20/2024 20:00

Vitalik Buterin has cited the growing ETH market and block creation as current risk factors to network centralization.

- Vitalik Buterin marked block creation and staking as key centralization risks.

- The team was exploring some solutions to address these risk factors.

Vitalik Buterin, co-founder of Ethereum [ETH], has explored the network’s centralization risks and potential solutions the team was exploring.

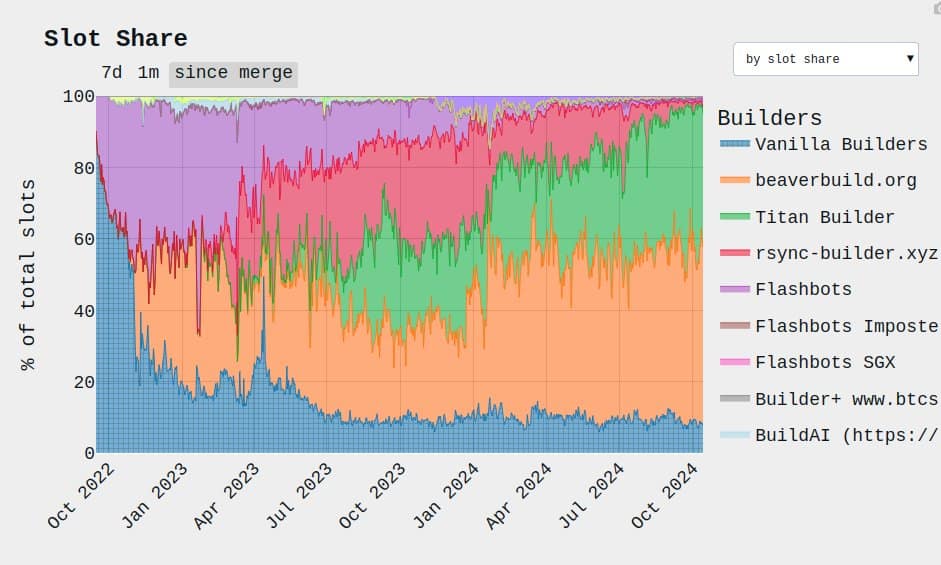

Buterin marked block creation and staking as key centralization risk factors. To put the dire scenario in perspective, two entities (Beaver and Titan) created nearly 90% of ETH blocks in October.

What could possibly go wrong with such a level of centralization?

Buterin also highlighted that large stakers’ dominance could elevate network attacks and censorship risks. He stated,

“This (large stakers dominance) leads to higher risk of 51% attacks, transaction censorship, and other crises. In addition to the centralization risk, there are also risks of value extraction: a small group capturing value that would otherwise go to Ethereum’s users.”

Possible solutions

Since last year, the risks mentioned above have hiked amid a rise in the use of specialized algorithms (MEV, maximum extraction value) by block proposers to maximize revenue.

“Larger actors can afford to run more sophisticated algorithms (“MEV extraction”) to generate blocks, giving them a higher revenue per block.”

For the block creation issue, Buterin cited the inclusion lists approach as a likely solution, in which proposers and builders share the task.

“The leading solution is to break down the block production task further: we give the task of choosing transactions back to the proposer (i.e. a staker), and the builder can only choose the ordering and insert some transactions of their own. This is what inclusion lists seek to do.”

The team was exploring various nuances of inclusion lists with different trade-offs and was to settle on a single approach.

On staking risk, 34M of 120M circulating supply is staked, which is nearly 30% of ETH in supply.

According to Buterin, the ongoing staking growth could potentially make one liquid staking token (LST) more dominant and reduce liquidity.

To solve this, the team explored reducing staking rewards and capping the amount of ETH that could be staked.

Overall, Buterin reiterated the intention to prevent value extraction from users at the expense of centralized control and keep limiting the network from going the centralization route.

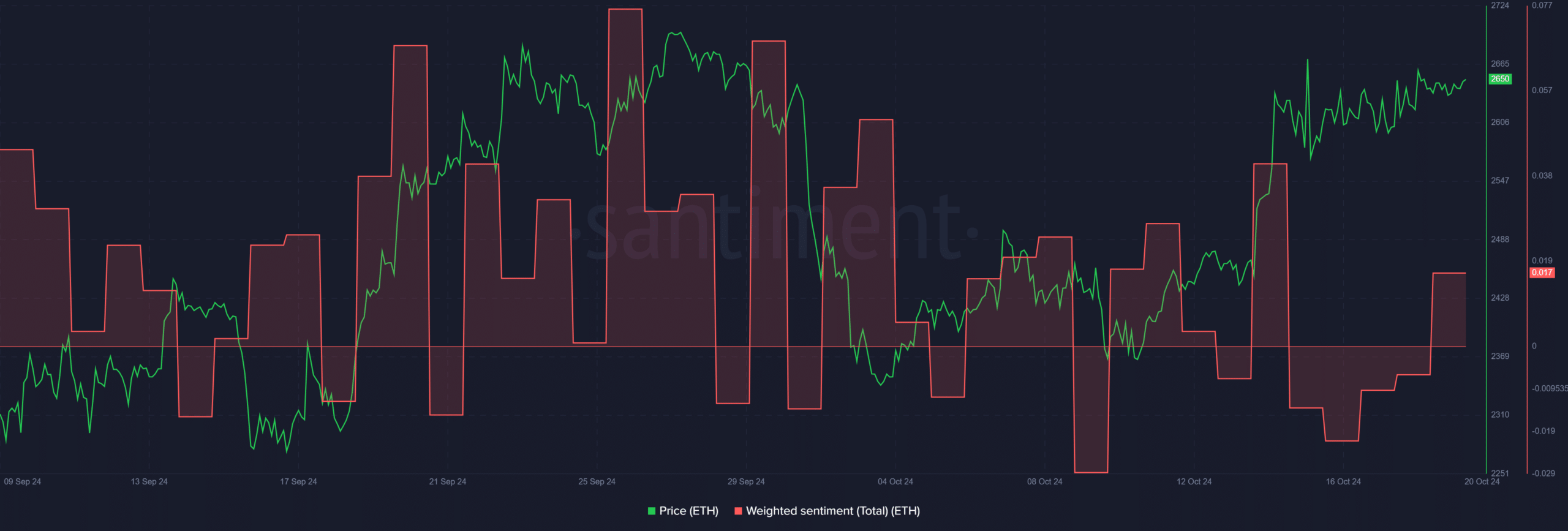

A few hours after the update, ETH’s sentiment positively surged, suggesting that market participants were hopeful about the altcoin’s price prospects.

Although it remains to be seen which solutions the team will settle on to address the issues raised, the move could bolster ETH value in the long run.

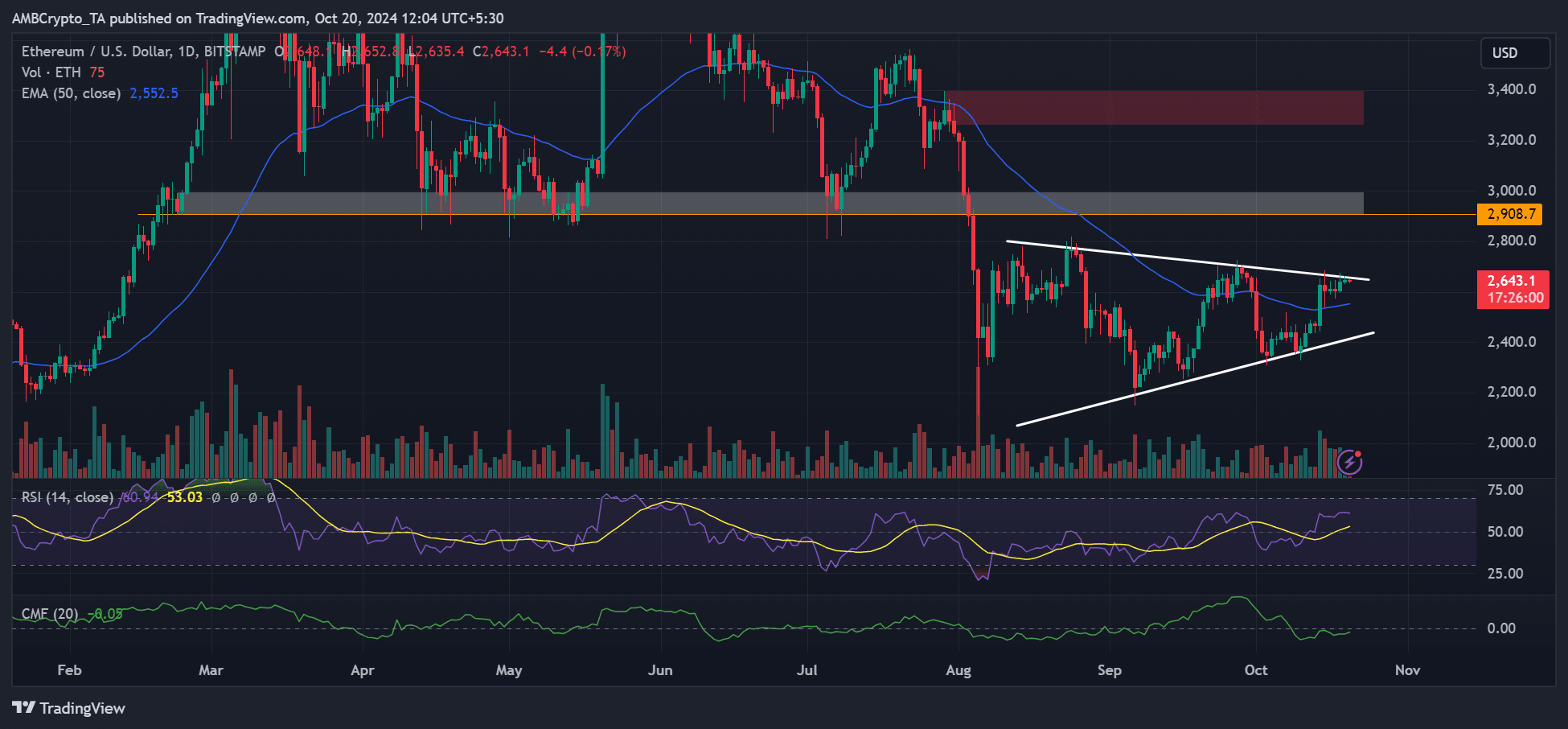

At press time, ETH’s price was $2.6K, below a key roadblock away from its $2.9k bullish target.