Cardano: Why ADA’s buying momentum might not avoid a plummet

10/22/2024 01:00

ADA's buying momentum falls as it nears a critical supply zone. Key metrics hint at a breakout, but the RSI raises the risk of decline

- While ADA has been trading within a bullish symmetrical channel, momentum is building toward a breakout—but significant supply looms ahead.

- On-chain metrics indicate ADA could surpass this level if momentum continues to strengthen.

Cardano [ADA] has seen in stagnation over the past week and month, posting similar gains of 3.65% and 3.69%, respectively. Yet, a shift may be underway, with ADA up 4.94% in the last 24 hours.

The key question now: How long can this rally last? ADA is approaching a critical supply zone that could determine its next direction.

A move up or down? What the technical chart suggests

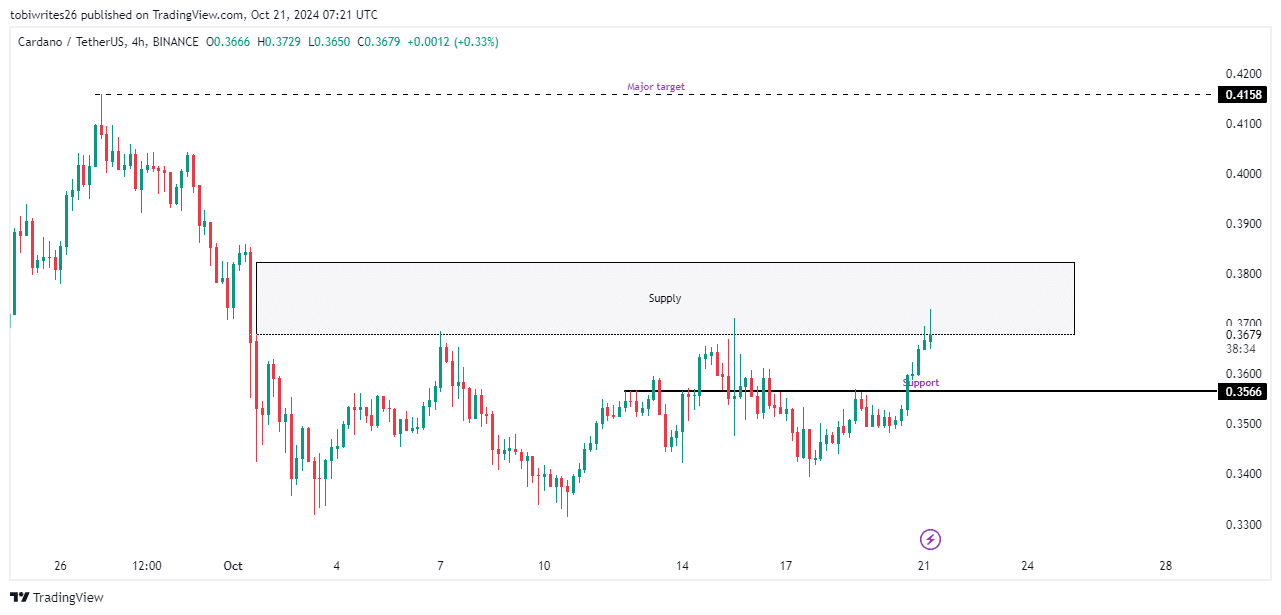

ADA has now entered a supply zone on the chart, a key level where heavy selling pressure could trigger a price decline.

This supply zone ranges from $0.3680 to $0.3823, which ADA must break through to reach its target of $0.4158.

If ADA fails to breach this level, downward momentum could push the price to $0.3566, a level likely to act as support for a potential rebound.

Currently, AMBCrypto has found that traders remain predominantly bullish, and ADA may attempt to break through the supply zone.

Foundational bullish momentum on the rise

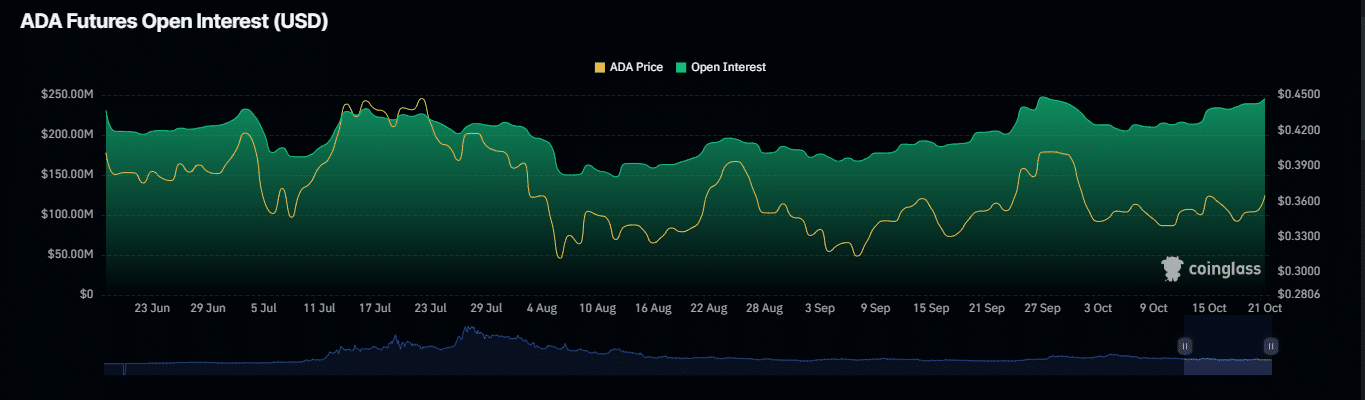

Key indicators of ADA’s bullish momentum, such as Open Interest and Funding Rate, have seen significant increases, which points to a potential upward price move.

At press time, Open Interest (OI) has risen by 6.49%, reaching $252.62 million. This increase suggests continued bullish momentum, historically correlated with upward price trends.

OI represents the number of unsettled derivative contracts on an asset, reflecting market sentiment. A percentage increase, as seen with ADA, is a bullish signal.

Additionally, the funding rate, which measures the periodic payments between traders in perpetual futures, is currently positive for ADA at 0.0132%, according to Coinglass. This further reinforces the asset’s bullish outlook.

Market decline expected for ADA

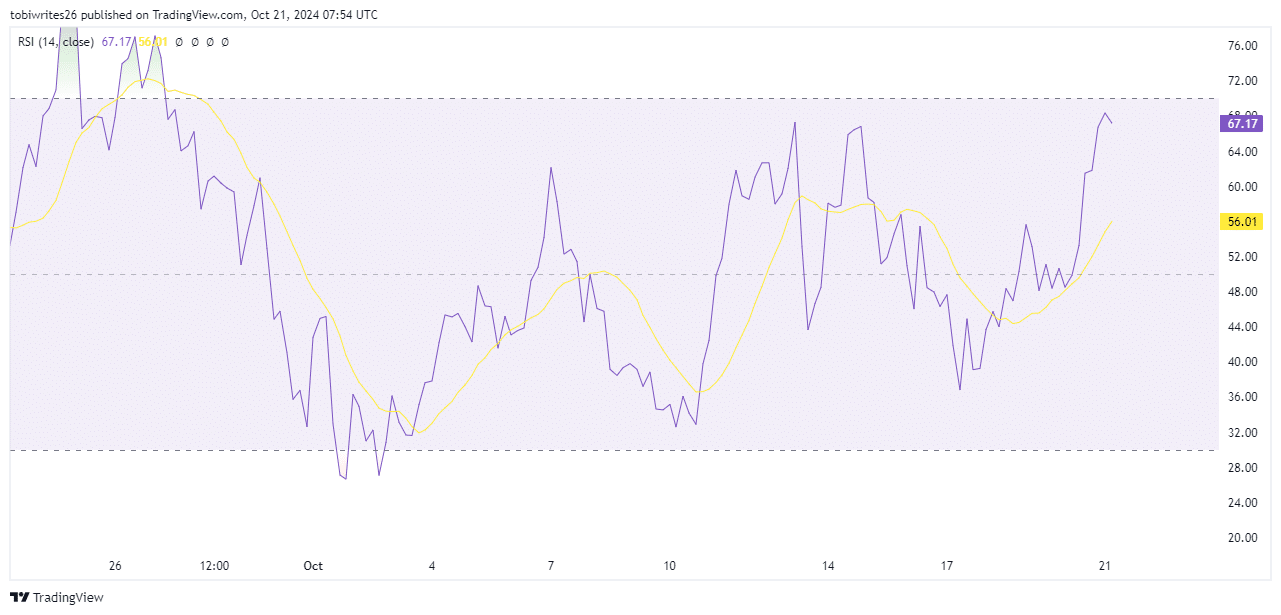

According to the Relative Strength Index (RSI), ADA may face a decline in the upcoming trading sessions.

The RSI currently sits at 67.36, approaching the overbought zone above 70. If ADA crosses this threshold, a price drop is likely.

If this plays out, we could see a fall from the current supply zone, pushing ADA toward a lower support level.