Stacks upgrade: Unpacking ‘Nakamoto’ and its effect on STX

10/22/2024 13:09

Bitcoin’s [BTC] layer 2, Stacks [STX], has been preparing for a major upgrade for multiple months, which will bring many benefits

- The Nakamoto upgrade will help increase transaction speed.

- Market sentiment, however, remained bearish on the token.

Bitcoin’s [BTC] layer 2, Stacks [STX], has been preparing for a major upgrade for multiple months. The date of that happening is drawing closer, and only a week is left. However, while the L2 was getting ready for this upgrade, the token’s price action turned bearish. Will this upgrade stir up enough bullish sentiment to push the token up to $2?

All about Stacks upgrade

Firstly, named for Satoshi Nakamoto, the anonymous developer of Bitcoin, the Nakamoto upgrade will separate Stacks’ block production schedule from Bitcoin’s. The upcoming Stacks upgrade will be pushed on the 29th of October.

As per the official document, “The Nakamoto Release is an upcoming hard fork on the Stacks network designed to bring several benefits, chief among them are increased transaction throughput and 100% Bitcoin finality.”

Production of Stacks blocks would no longer be dependent on miner elections under Nakamoto. Rather, miners generate blocks at a predetermined rate, and the set of PoX Stackers depends on miner elections to decide when to switch from one miner to another.

Will STX cross $2?

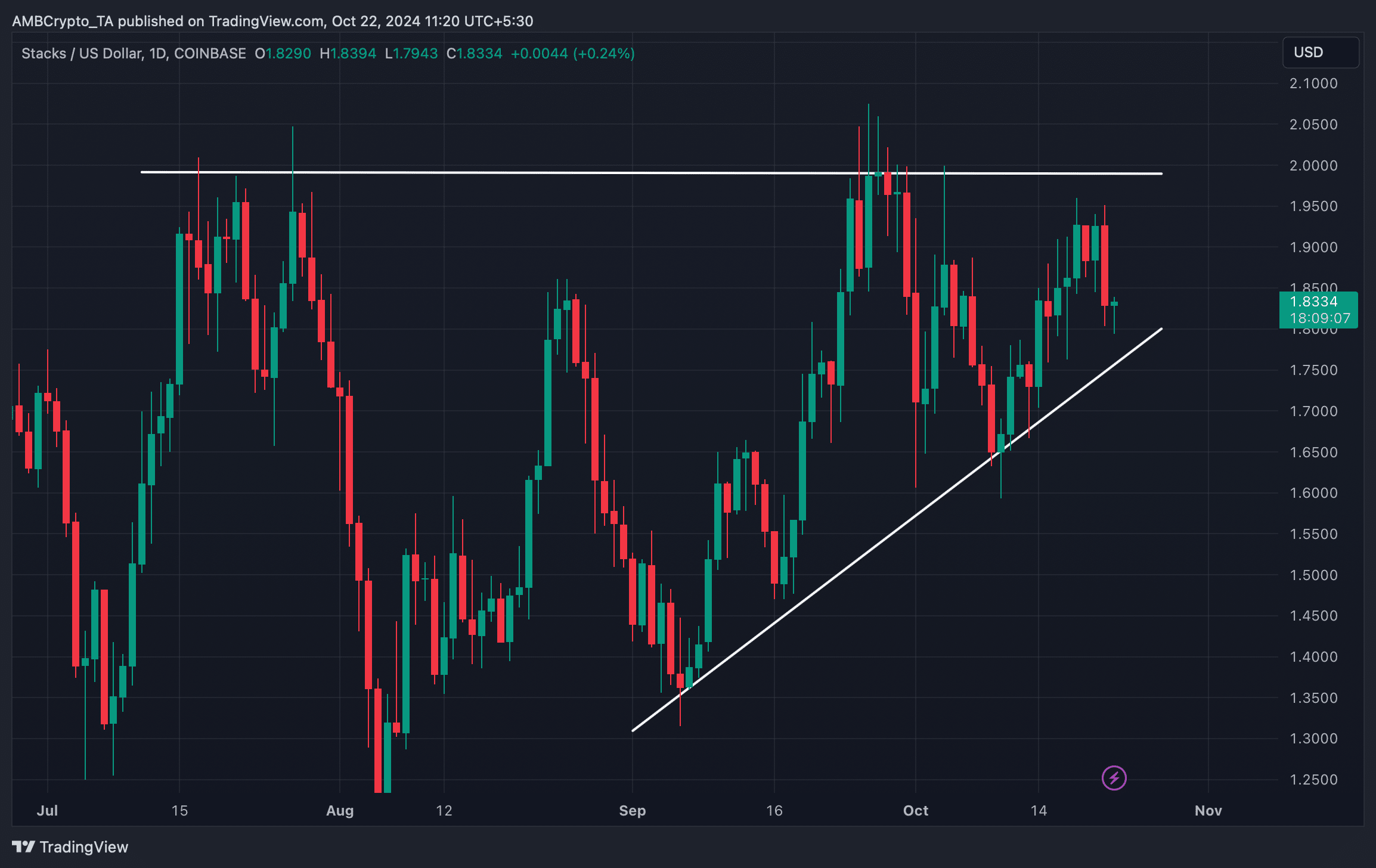

Though the blockchain was preparing for a major upgrade, its token, STX, didn’t benefit. CoinMarketCap’s data revealed that STX’s price dropped by more than 5% in the last 24 hours. At press time, Stacks was trading at $1.84 with a market capitalization of over $2.75 billion. The bad news was that the token’s trading volume increased while its price dropped, which legitimized the price drop.

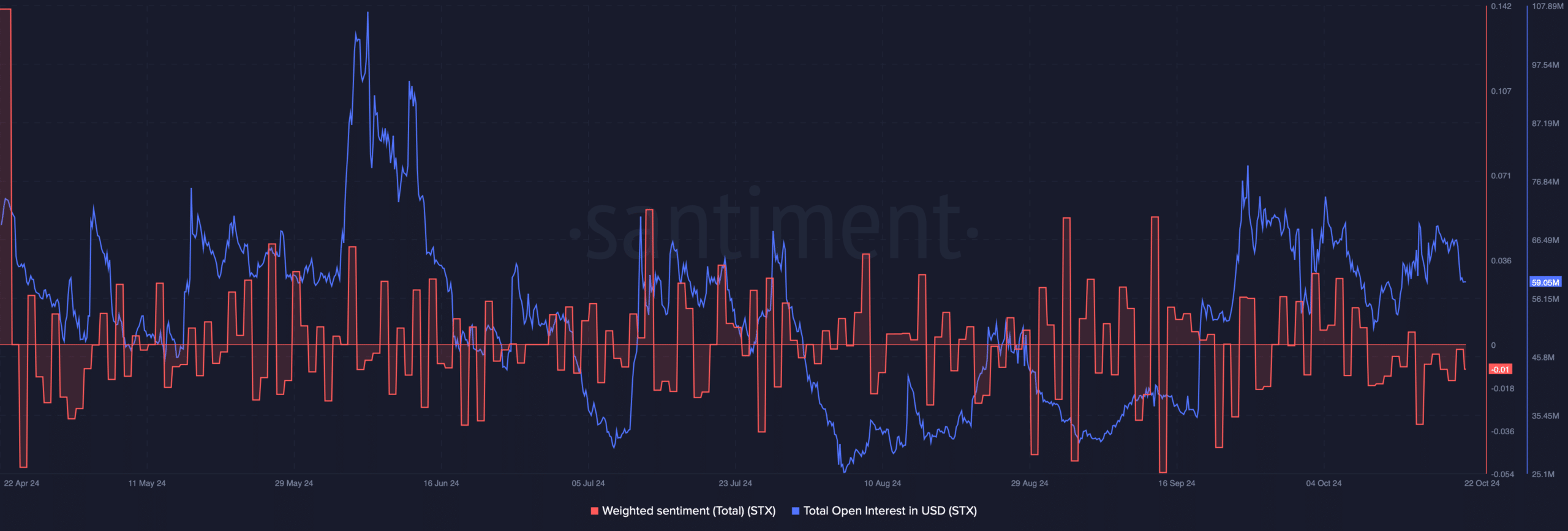

Therefore, AMBCrypto chose to dig deeper into STX’s current state to find out whether it’s viable to expect the token to touch $2 in the coming days. As per our analysis of Santiment’s data, STX’s weighted sentiment dropped significantly last week. This meant that bearish sentiment around the token was rising, hinting at a lack of confidence among investors regarding a price rise.

As per Coinglass’ data, STX’s long/short ratio also dipped. Whenever the metric drops, it means that there are more short positions in the market than long positions, which can be considered a bearish sign.

Nonetheless, Stacks’ open interest also declined. This indicated that the on-going bearish price trend might as well change in the coming days. We then took a look at STX’s daily chart to better understand what to expect.

Read Stacks [STX] Price Prediction 2024-25

As per our analysis, STX’s price was moving inside a rising triangle pattern. The latest price decline could have been because the token was consolidating inside the pattern. A breakout above the rising triangle could push the token well above $2 in the coming days.