Retail Crypto Investors Pivot to Derivatives as Market Momentum Grows

10/22/2024 17:00

Retail crypto investors turned active in October, focusing on derivatives and stablecoins as Bitcoin demand grew by 13%.

The market regained momentum in October, with market capitalization rising 13%, from $2 trillion to $2.3 trillion. Several data points indicate that retail investors are becoming more active in trading.

However, instead of focusing on spot trading on exchanges, they are opting for derivatives trading.

Retail Crypto Investors’ On-Chain Activity Surged

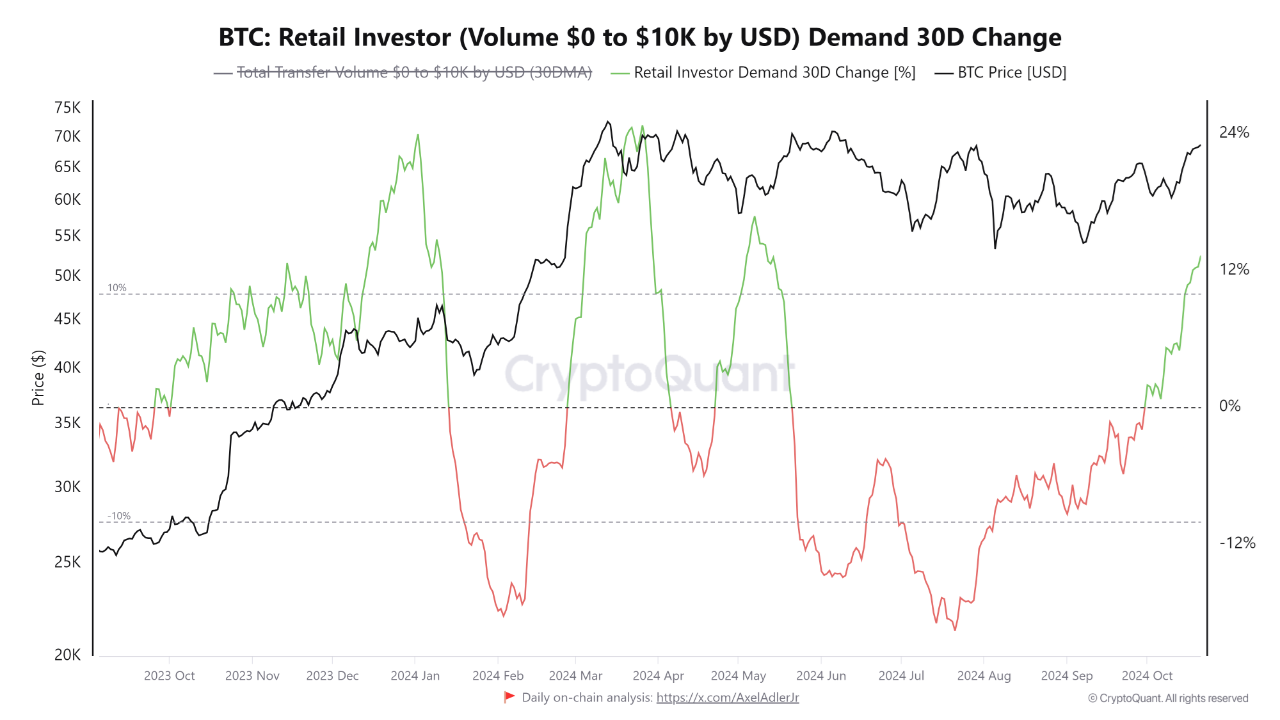

By tracking Bitcoin transactions valued under $10,000, it’s possible to gauge retail investor demand. Data from CryptoQuant suggests that retail demand tends to fuel Bitcoin’s price increase.

Read more: Top 6 Spot Trading Crypto Exchanges

Over the past 30 days, retail demand grew by 13%, following four consecutive months of negative growth. Analyst Caueconomy suggests that this mirrors the scenario seen in March.

“In the last 30 days, retail demand grew by about 13%, highlighting a scenario that was only seen in March, when we were close to the last historical high… This recent rise in Bitcoin is causing small investors to return to trading, signaling the beginning of a pattern of lower risk aversion,” Caueconomy commented.

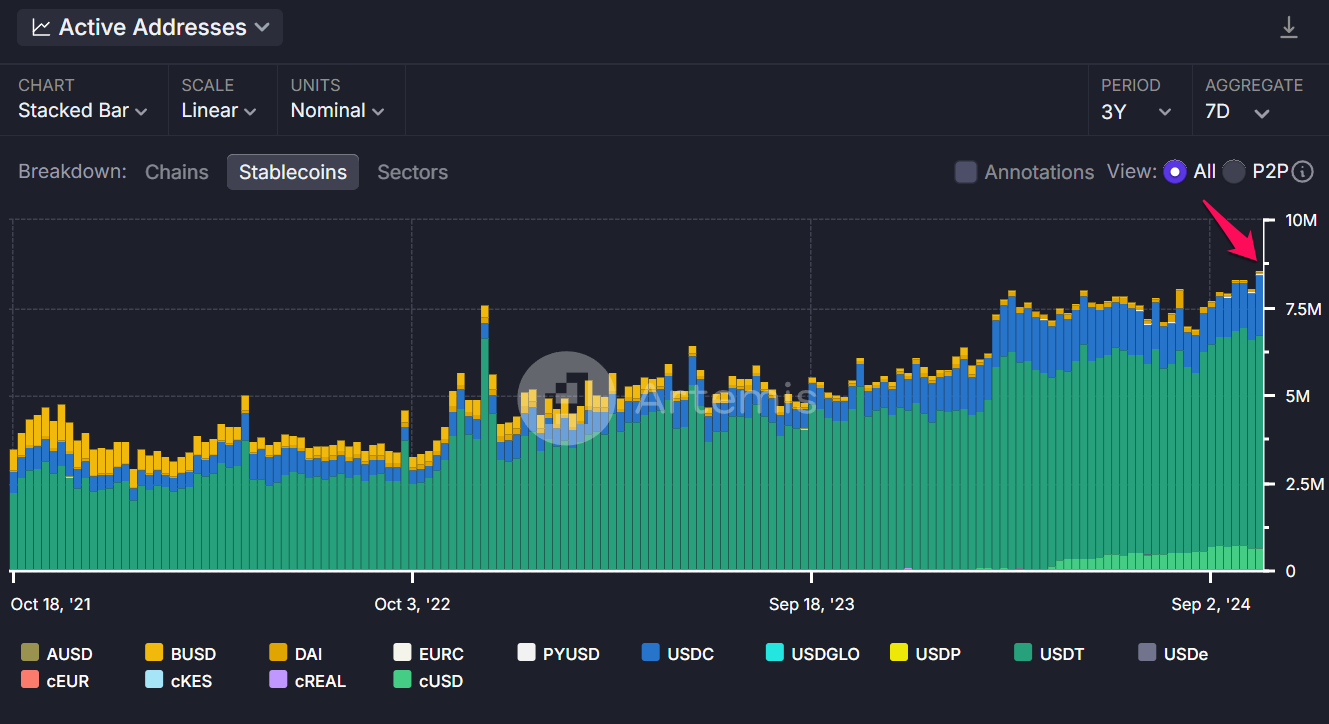

Additionally, the number of active stablecoin addresses per week in October reached a new three-year high.

The weekly active stablecoin addresses reflect the vibrancy in stablecoin trading. This figure consistently remained above 8 million per week in September, peaking at 8.6 million last week.

Derivatives Trading Spikes in October

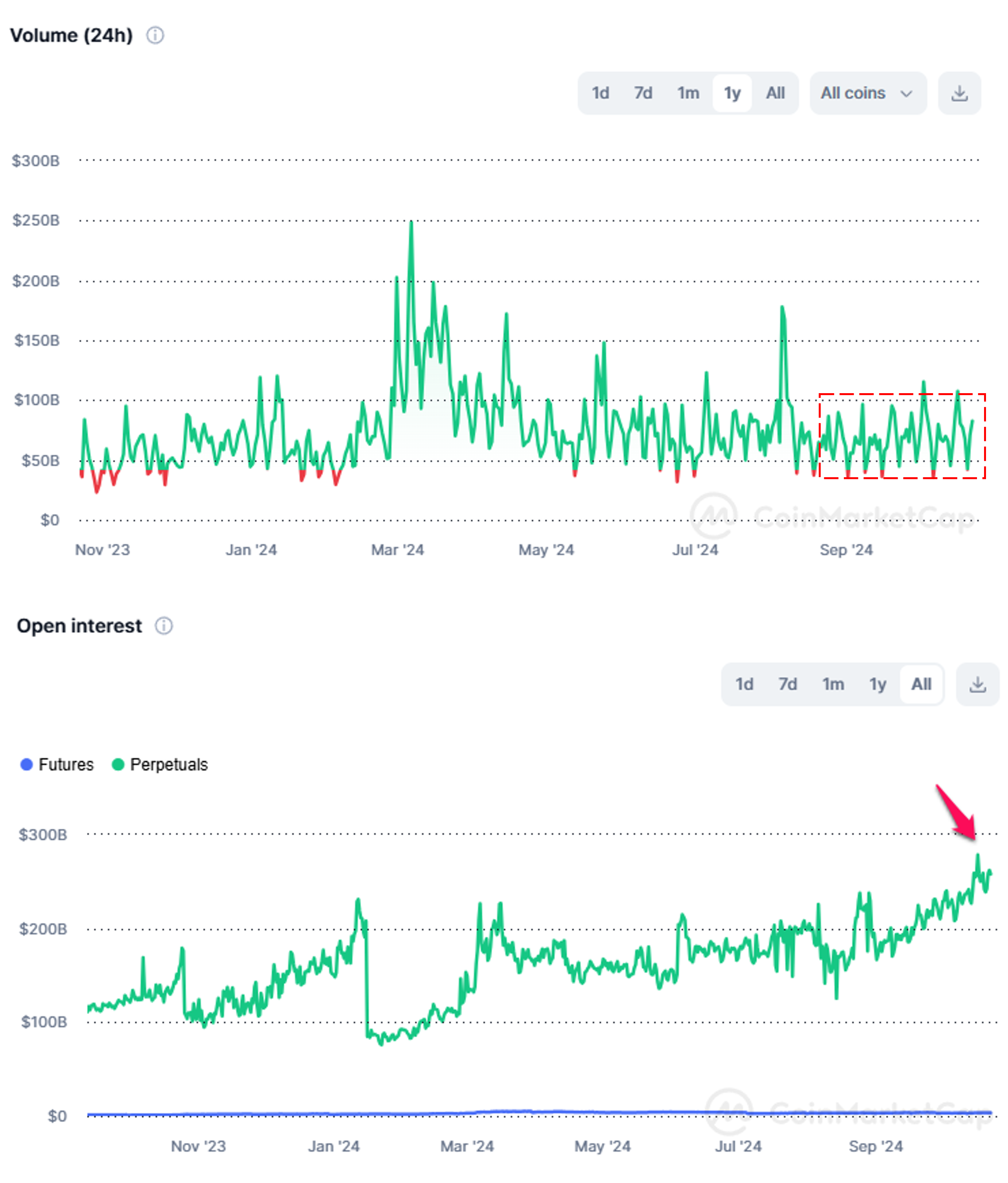

Despite a noticeable rise in retail on-chain activity, spot trading volume on centralized exchanges (CEX) remained stable. CoinMarketCap data shows that daily spot trading volumes on exchanges hovered between $50 billion and $100 billion.

However, derivatives trading volume surged over the past two months. By October, total Open Interest exceeded $260 billion, the highest in a year. This suggests retail investors may be more inclined towards derivatives than spot trading.

Read More: Best Crypto Derivative Exchanges in 2024

On the flip side, investor Lark Davis observed that interest in crypto searches has not seen a significant breakthrough. This indicates that if retail investors have returned, they are mostly focused on derivative trading.

“Current Google trends show minimal retail interest in crypto. Retail is sleeping while institutions are stacking,” Davis remarked.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.