Bitcoin’s daily trading volume is regularly surpassing the total market capitalization of public Bitcoin mining companies, amid concerns public miners are overvalued.

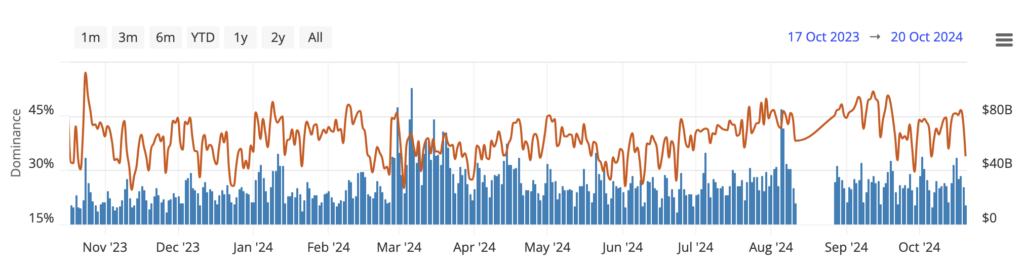

On Oct. 21, Bitcoin recorded $37 billion in spot trading volume, maintaining a trend between $20 billion and $40 billion throughout 2024. Bitcoin derivatives have also reached an all-time high of around $40 billion, with nearly double that in trading volume, according to data from Coinglass.

Despite opinions that mining stocks are overvalued from a fundamentals perspective, market forces suggest these valuations may increase further as FOMO and momentum investing intensify, as noted by D.R. Lewis.

Lewis notes the entire public Bitcoin mining sector holds a market capitalization of approximately $28 billion. These companies collectively produce close to 30% of Bitcoin’s supply at scale.

He observes that prices can become irrational and deviate rapidly from fundamental valuations, especially for those experiencing their first market cycle. The daily transactional volume on Bitcoin exchanges exceeding the total market cap of miners highlights a significant disparity in the Bitcoin miner market.