Ethereum headed for short squeeze? What’s going on with ETH

10/23/2024 21:30

ETH may experience a short-lived pullback courtesy of short liquidations and appetite for leverage grows, forming short squeeze scenario

- ETH pulled back below $2,600 after encountering strong resistance above $2,700.

- The pullback could be a trap that could set ETH up for a potential short squeeze as leverage soars.

Ethereum [ETH] was on the third day of a bearish retracement after encountering resistance above $2700. However, there is speculation that the pullback might be short-lived.

A recent CryptoQuant analysis suggested that the ETH short positions have surged above the $2,700 price level.

This confirmed that many expected a retracement due to previous resistance at this price level. Currently, sell pressure has overtaken demand, pushing the price to $2584, at press time.

The analysis warned that the surge in shorts and appetite for leverage could expose ETH to a short-squeeze scenario.

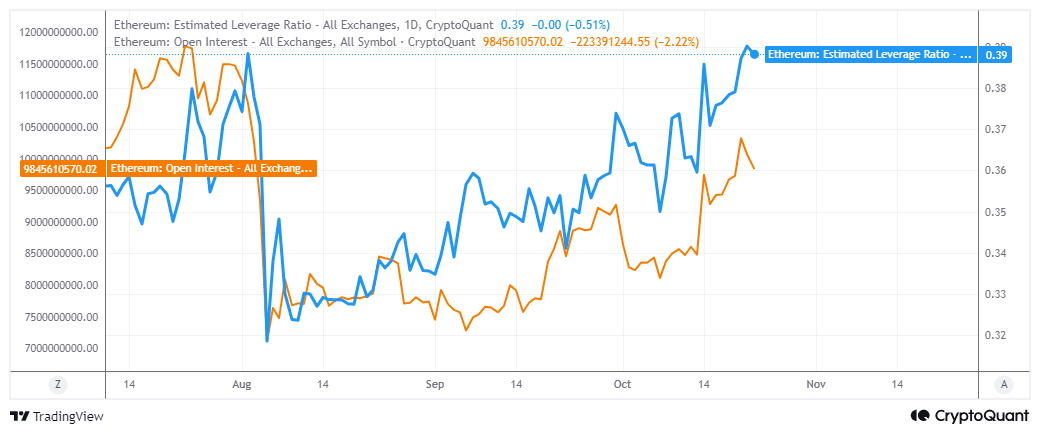

Ethereum’s Open Interest has been rising since the 6th of September. This indicated a renewed interest in the derivatives segment.

More importantly, ETH’s estimated leverage ratio recently soared to levels last seen in early July.

A surge in overleveraged shorts could underscore fertile ground for whales to shake things down by pushing prices up. But what are the odds of this happening?

Assessing ETH demand to establish a short squeeze

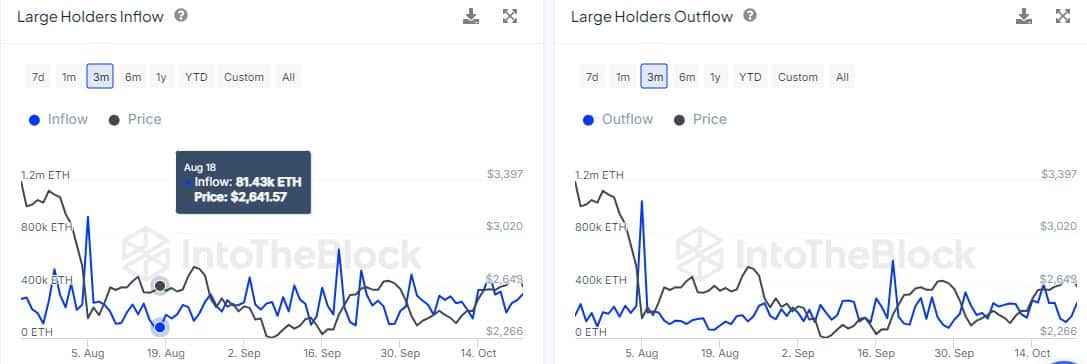

The biggest sign that a short squeeze could be on the way was if the whales started aggressively accumulating.

According to stats on IntoTheBlock, ETH flowing into large holder addresses grew from 194,280 coins on the 19th of October to 335,870 coins, on the 22nd of October.

This confirmed that large holders have been accumulating more ETH as prices dipped.

On the other hand, large holder outflows grew from 122,380 ETH on the 20th of 0ct0ber to 267,180 ETH on the 22nd of October.

This meant the amount of Ethereum sold was slightly higher than the net buys, which is in line with the bearish price action during the same period.

Despite bears dominating, large holders bought more coins than they sold. In the last 24 hours, they purchased 68,690 ETH, worth over $177 million.

The data suggests that an attempt by the whales, to push the price back up, might already be in play.

Read Ethereum’s [ETH] Price Prediction 2024-25

This means that the coin could be set for an interesting second half of the week, potentially characterized by another rally and an attempt to push past the latest resistance zone.

Ethereum was prone to volatile conditions, and the level of Open Interest and appetite for leverage has been rising.