Central, Northern, and Western Europe made up 22% of global crypto volume between July 2023 and June this year, according to Chainalysis.

Central, Northern, and Western Europe has emerged as the second-largest crypto economy globally, receiving $987.25 billion in on-chain value between July 2023 and June, blockchain forensic firm Chainalysis noted in a recent research report.

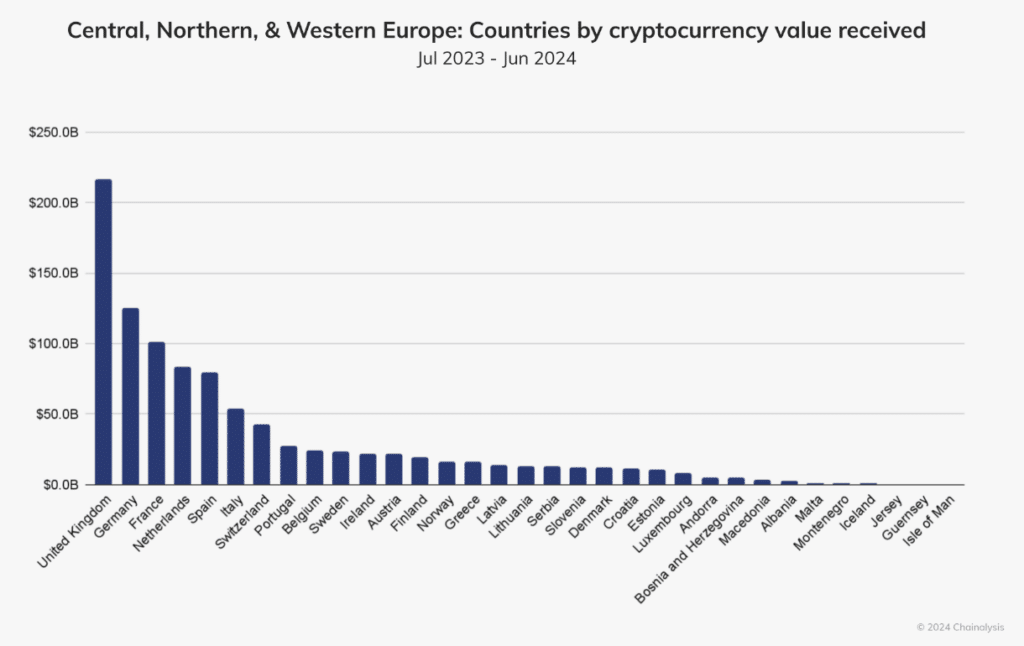

This figure accounts for more than 21.5% of the total global transaction volume, with most CNWE countries witnessing a year-over-year growth rate of 44%. The analysts say the United Kingdom remains at the forefront of this trend, contributing $217 billion to the region’s total and ranking 12th in the global crypto adoption index.

Of the sum, Bitcoin (BTC) recorded nearly 75% growth for transactions below $1 million, marking it as the highest-performing asset type in the region.

“Across all transaction sizes, BTC accounted for $212.3 billion — roughly one-fifth — of CNWE’s total value received on-chain.”

Chainalysis

Bitcoin much less popular than stablecoins for small transactions

However, Bitcoin’s performance in smaller transactions lagged behind that of North America, with stablecoins making up nearly half of CNWE’s total inflows at $422.3 billion. Stablecoin purchases using fiat currency in the region significantly outpaced Bitcoin, with the euro accounting for 24% of stablecoin purchases compared to just 6% for BTC.

In the U.K., which recorded a growth rate of 58.4%, stablecoins dominate the merchant services market, consistently holding a 60-80% market share. The demand for stablecoins continues to rise, particularly as businesses in inflation-affected economies like Argentina seek financial stability through crypto amid challenges posed by traditional currencies, the report noted.