Solana vs Ethereum: Is SOL’s lead a sign of a new crypto pecking order?

10/24/2024 20:00

SOL has a strategic plan to overtake ETH by leveraging its high throughput to enable faster transactions—something ETH struggles with.

- Solana has capitalized on Bitcoin’s pullback, pulling ahead of Ethereum.

- With momentum shifting, can ETH make a comeback?

Loosely dubbed the “Ethereum Killer,” Solana [SOL] has demonstrated impressive resilience in this bull cycle. It has earned this title not just by market cap, but by consistently ranking among the top weekly gainers while Ethereum [ETH] remains flat.

In this cycle, SOL is thriving as BTC hits key psychological levels, attracting investors looking to shift capital to mitigate risk – an edge that ETH once held.

SOL is taking lead over ETH

Despite ETH’s leading market cap of $300 billion, significantly outpacing SOL’s $81 billion, recent shifts show that SOL’s market cap has increased by over 5% while ETH has declined by 3%.

This trend is particularly noteworthy as it coincides with Bitcoin’s recent surge to nearly $70K, marking a 16.67% gain in just ten days.

Typically, an overheated market attracts liquidity into high-cap altcoins, as risk-averse investors seek to redistribute profits.

Subsequently, when BTC reached market tops, ETH would experience significant gains. However, unlike previous cycles, SOL seems to have taken the lead this time around.

Just four days ago, as BTC faced resistance as its price moved above the four-month old slump, SOL posted a daily gain of 4% – the highest in the past week – marking a crucial turning point.

The next day, BTC experienced a 2% pullback, establishing $70K as the new local high. In response, ETH mirrored this behavior, falling nearly 3% and continuing its retracement.

Conversely, SOL bulls have effectively prevented a similar pullback. In fact, SOL has been surging after breaking the $160 resistance, achieving this milestone on its fourth attempt following three previous failures.

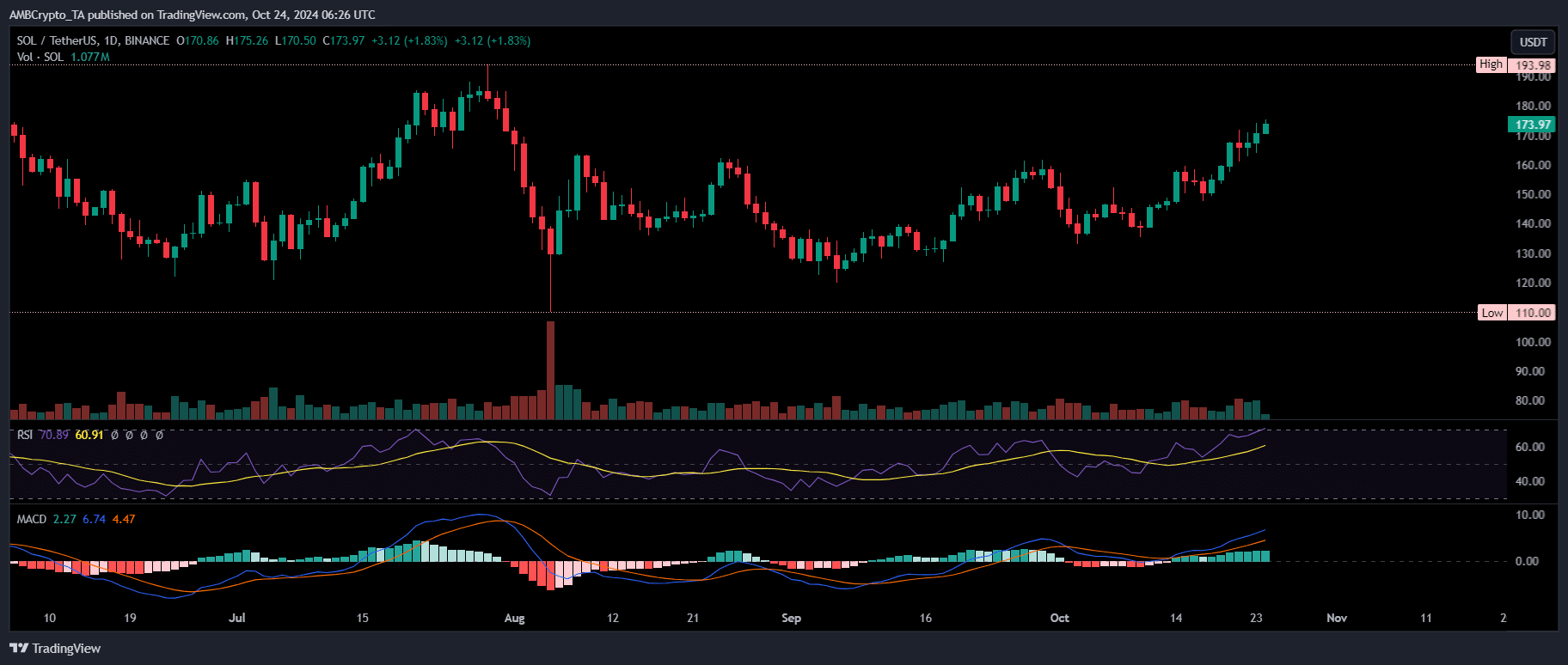

Currently trading at $173, SOL may be due for a correction, as the RSI shows an overbought condition. With 83% of price movement in the last two weeks being upward, a trend reversal could be on the horizon.

Could this shift investor attention back to ETH?

A trend reversal could be near, but watch out for this

Earlier, a report by AMBCrypto highlighted ETH’s current pullback as a strategic move by traders aimed at flushing out weak hands.

This dip could set the stage for an imminent breakout, attracting new buyers and encouraging whales to continue their accumulation – potentially driving ETH above $2,700.

However, ETH’s rebound in this cycle is closely tied to SOL. While ETH could be poised for a short-term reversal as it hits support, achieving a breakout will depend on carefully monitoring SOL across various metrics.

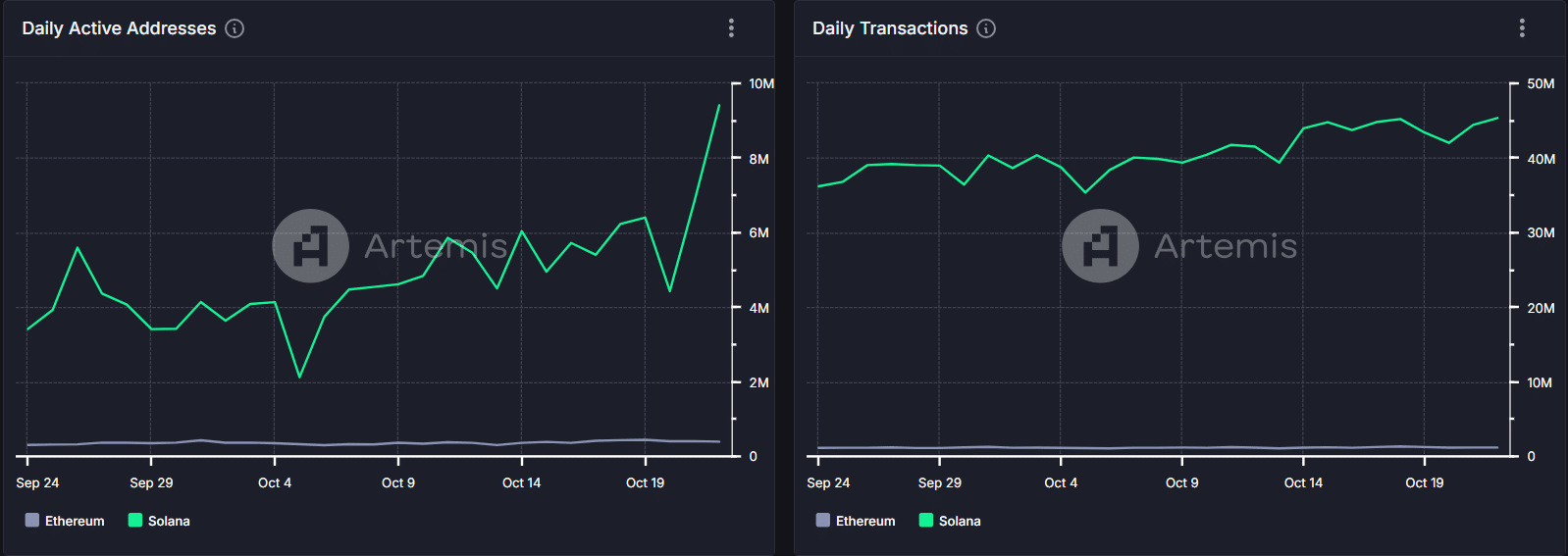

In the past month, daily active addresses on Solana have surged by 175%, while Ethereum has only seen a modest double-digit increase.

This spike in activity is no coincidence. Solana has strategically positioned itself to outpace ETH by leveraging its high throughput, enabling faster and more affordable transactions.

So far, this strategy has paid off. SOL has effectively capitalized on ETH’s rising costs, generating remarkable momentum this cycle and attracting significant interest from BTC investors as well.

Read Solana’s [SOL] Price Prediction 2024–2025

In other words, SOL’s overall outlook appears far brighter than ETH’s, establishing it as the leading altcoin for the long run.

While a correction could bring SOL below $170, it’s still poised to outshine ETH, potentially challenging ETH’s path to easily hitting $2.7K.