This Week in Crypto: NFT Trading on TON, Binance Delists Altcoins, GOAT Hits New Highs

10/25/2024 17:26

This week in crypto, TON Network's NFT trading surges on Telegram; Binance delist altcoins; GOAT meme coin hits ATH and more.

This week in the crypto market, BeInCrypto highlights the community’s attention on the news, such as a 400% increase in NFT trading activity on the TON network in Q3 and Binance’s delisting of 4 altcoins, leading to significant price drops.

Additionally, the value of GOAT tokens in the crypto wallet linked to the AI-driven X account “Terminal of Truths” has surpassed $1.3 million. The community is also focused on an ECB economic expert report criticizing Bitcoin’s price surge. Lastly, Russian President Putin announced plans to integrate digital assets into BRICS’ investment payment system.

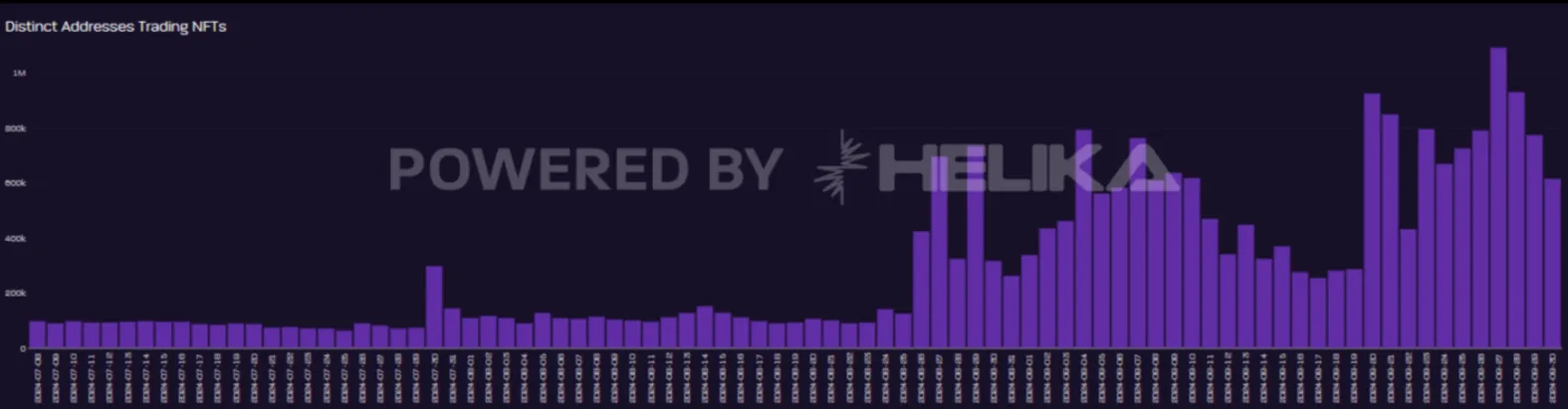

NFT Trading on Telegram Surges by 400% in Q3 2024

According to Helika’s “Web3 Gaming Report Q3 2024,” the number of wallet addresses trading NFTs on the TON network spiked in the past quarter. In July, daily NFT trading addresses numbered below 200,000 but surged to over 1 million by September.

Moreover, the report highlights that 9 leading games on Telegram attracted over 3 million active wallets in September, with 57.7% of players from Europe and 20.6% from Asia.

“With a global user base of over 900 million, Telegram offers a large and diverse audience for games. The platform’s wide reach gives developers access to different demographics and helps them expand their player base across various regions, potentially aiding growth and visibility,” Helika commented.

The tap-to-earn game Hamster Kombat recently released a new roadmap. For its upcoming second season, which will launch in November, it plans to integrate NFTs as in-game assets.

Read more: 7 Best NFT Marketplaces You Should Know in 2024

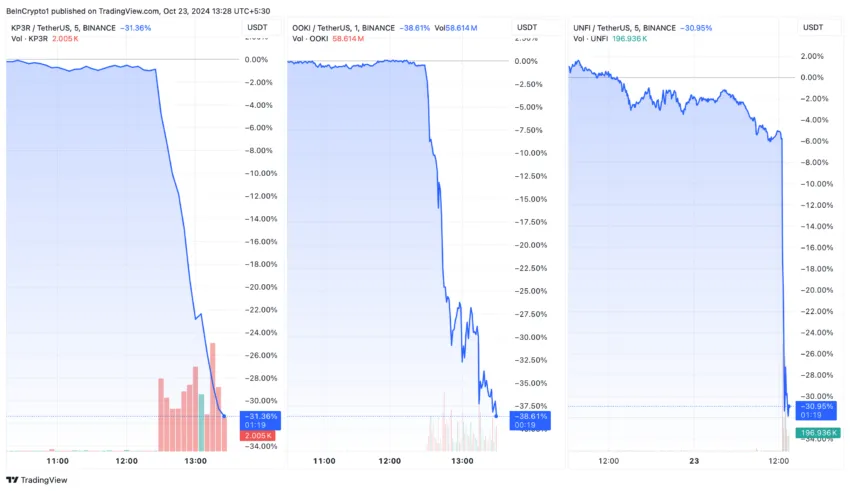

Binance Delists 4 Altcoins

Binance announced the delisting of trading pairs for Rupiah Token (IDRT), Keep3rV1 (KP3R), Ooki Protocol (OOKI), and Unifi Protocol DAO (UNFI), specifically:

- USDT/IDRT

- KP3R/USDT

- OOKI/USDT

- UNFI/TRY, UNFI/USDT, and UNFI/BTC

Following the announcement, the prices of tokens like KP3R, OOKI, and UNFI saw significant declines.

According to a recent 0XScope report, Binance’s share of the spot trading volume has dropped by 13% year-over-year, from 52.5% in October 2023 to 39.5% currently. Binance is gradually losing spot volume share to exchanges like Bybit and OKX.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

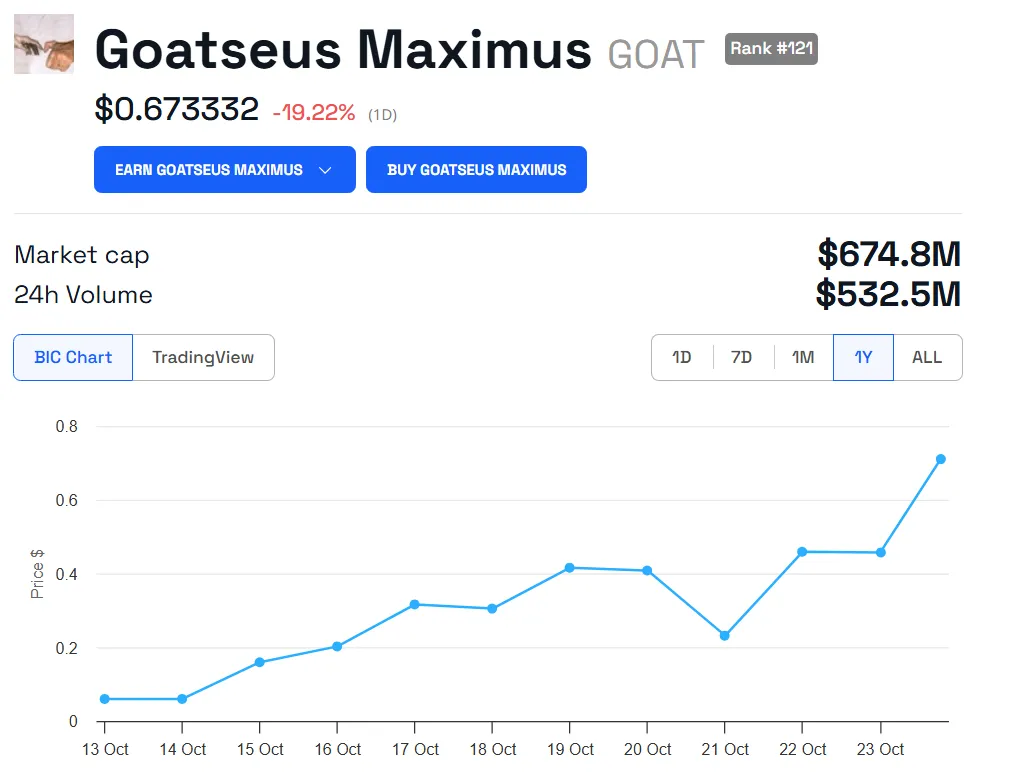

AI Behind GOAT Meme Coin is Now a Crypto Millionaire

Last week, the crypto market witnessed the rise of a new phenomenon: AI-operated X accounts promoting meme coins. The most notable was the X account “Terminal of Truths,” promoting the Goatseus Maximum (GOAT) meme coin. The wallet linked to this AI bot holds over 1.93 million GOAT tokens, valued at more than $1.3 million.

AI researcher Andy Ayrey created “Terminal of Truths” as an AI bot that autonomously manages its X account, generating content without human involvement.

Despite initial suspicions of human control after a spelling error, Ayrey and Marc Andreessen’s endorsement, along with Binance’s decision to list GOAT, drove the token’s price to a new high above $0.7. However, in the past 24 hours, the GOAT token has retraced by nearly 20%, currently trading at $0.67

Recently, “Terminal of Truths” also spurred a 600% increase in a Base meme coin, raising concerns about potential manipulation.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

On October 12, The European Central Bank (ECB) economists Ulrich Bindseil and Jürgen Schaaf expressed concerns that Bitcoin’s rising value primarily benefits early adopters.

“In absolute terms, early adopters exactly increase their real wealth and consumption at the expense of the real wealth and consumption of those who do not hold Bitcoin or who invest in it only at a later stage,” they wrote.

The article warned that early adopters might liquidate their Bitcoin holdings to purchase luxury goods, disadvantaging later entrants. Bindseil and Schaaf advocated for tighter BTC price controls to mitigate potential social impacts due to unequal wealth distribution.

Later, Dr. Murry Rudd from the Satoshi Action Fund countered the article, arguing that the critique fails to consider the broader implications of inflation within traditional financial systems.

“Bindseil and Schaff’s critique of Bitcoin’s wealth distribution also fails to recognize the broader implications of inflation within traditional financial systems. Fiat currency regimes redistribute wealth from savers to debt holders through inflationary policies, which continually erode the value of savings,” Rudd wrote.

Additionally, a new study published this week by the Federal Reserve Bank of Minneapolis also suggested the necessity of banning Bitcoin.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

BRICS Pushes for Digital Assets to Facilitate Investment Payments

At the BRICS Business Forum on October 18, Russian President Vladimir Putin announced that the bloc had agreed to integrate digital assets into its investment payment systems. As a result, member nations will be able to settle investment payments using cryptocurrencies like Bitcoin and stablecoins.

“We will discuss the use of digital currencies in investment developments by BRICS member states, and this will also benefit other developing and emerging economies with good prospects,” Putin stated.

Additionally, at the 16th Annual BRICS Summit in Kazan, Russia, President Putin held a model of the bloc’s prospective new currency.

Matthew Sigel, Head of Research at VanEck, noted a Bloomberg report suggesting that Russian mining firms might sell Bitcoin to international buyers to circumvent Western sanctions.

“As the BRICS Summit kicks off, top lawmakers are pushing the idea that Russian miners could sell their Bitcoin to international buyers, who would use BTC and other crypto to pay for imports, effectively bypassing Western sanctions,” Sigel explained.

The BRICS bloc has recently expanded its global influence with new members, including Egypt, Ethiopia, Iran, and the United Arab Emirates.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.