Bitcoin shake-up: Weak hands exit as inflows hit $21.8B – Breakout next?

10/26/2024 00:00

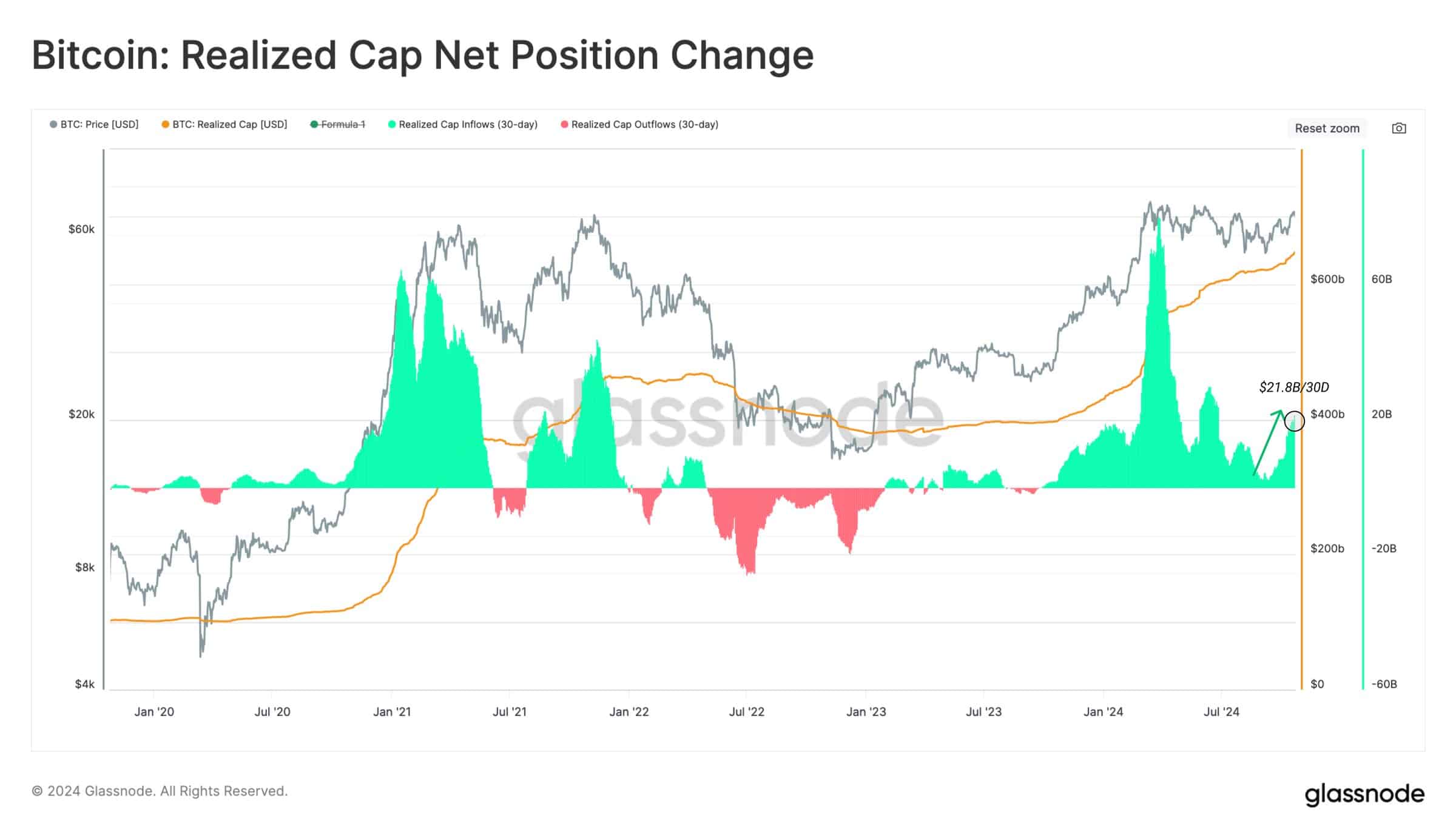

Over the last 30 days, capital inflows into BTC have surged by $21.8B, a 3.3% increase, pushing it's realized cap to an ATH of over $646B.

- Capital inflows into Bitcoin surged to new ATH.

- Exit of weaker hands may have strengthened BTC’s market foundation.

Bitcoin [BTC] price movements are under close watch as recent data reveals a notable rise in net capital inflows, pointing to potentially higher prices ahead.

Over the last 30 days, capital inflows into Bitcoin have surged by $21.8 billion, a 3.3% increase, pushing Bitcoin’s realized cap to an all-time high of over $646 billion.

This growth suggests that liquidity across Bitcoin is rising, and with increased capital backing the asset, Bitcoin could be positioned for a significant price rally.

Weak hands out as BTC retests breakout level

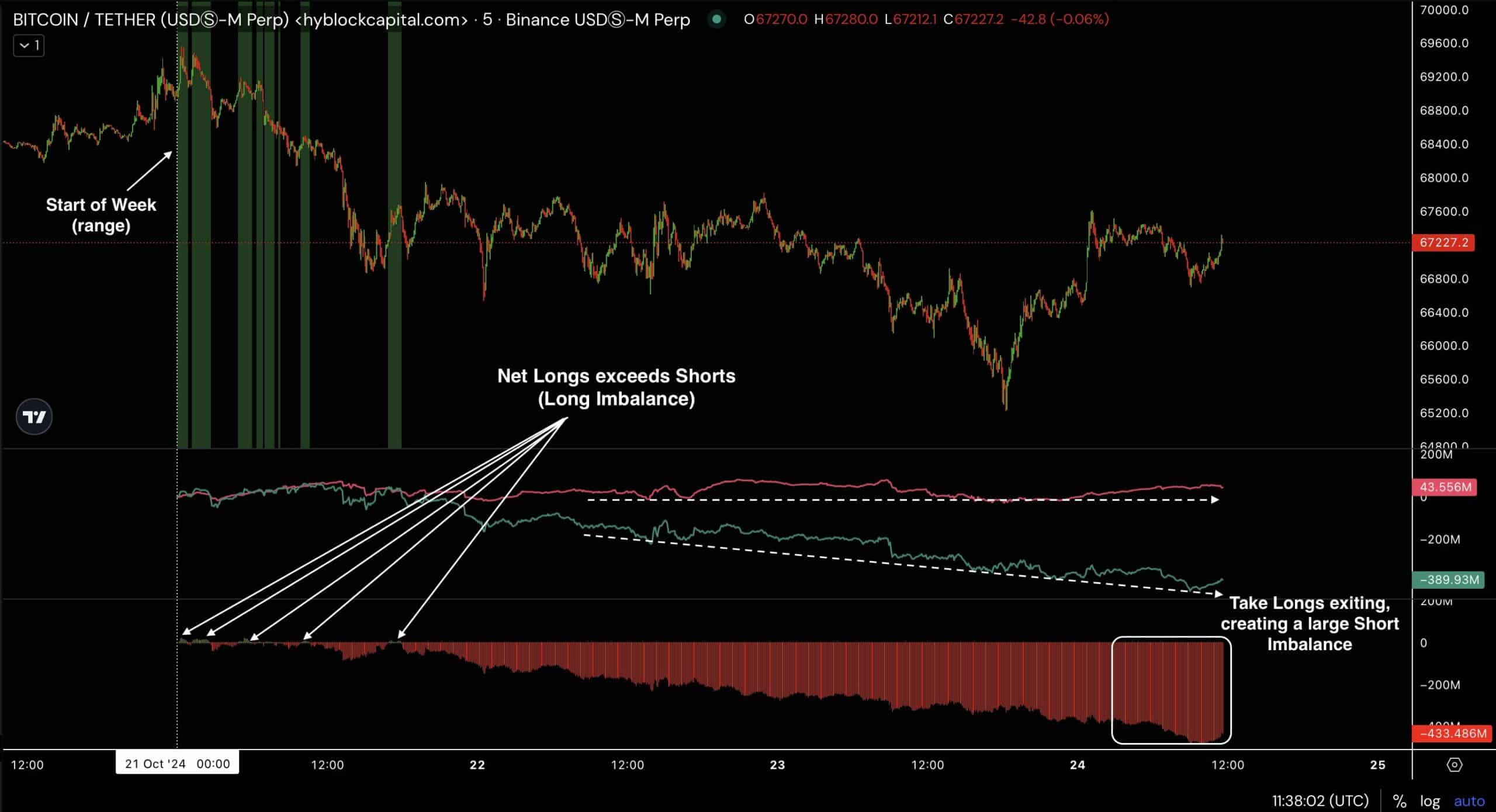

The price dynamics of Bitcoin this week indicate weak hands may have exited the market, creating an environment for new capital to drive the next major move.

At the start of the week, BTC saw a decline, leading some traders to pursue aggressive long positions in hopes of catching a rebound.

This created a scenario where BTC trapped some of these longs, leading to further selling pressure.

However, following this shakeout, Bitcoin’s price quickly recovered, signaling that the exit of weaker hands may have strengthened the market’s foundation.

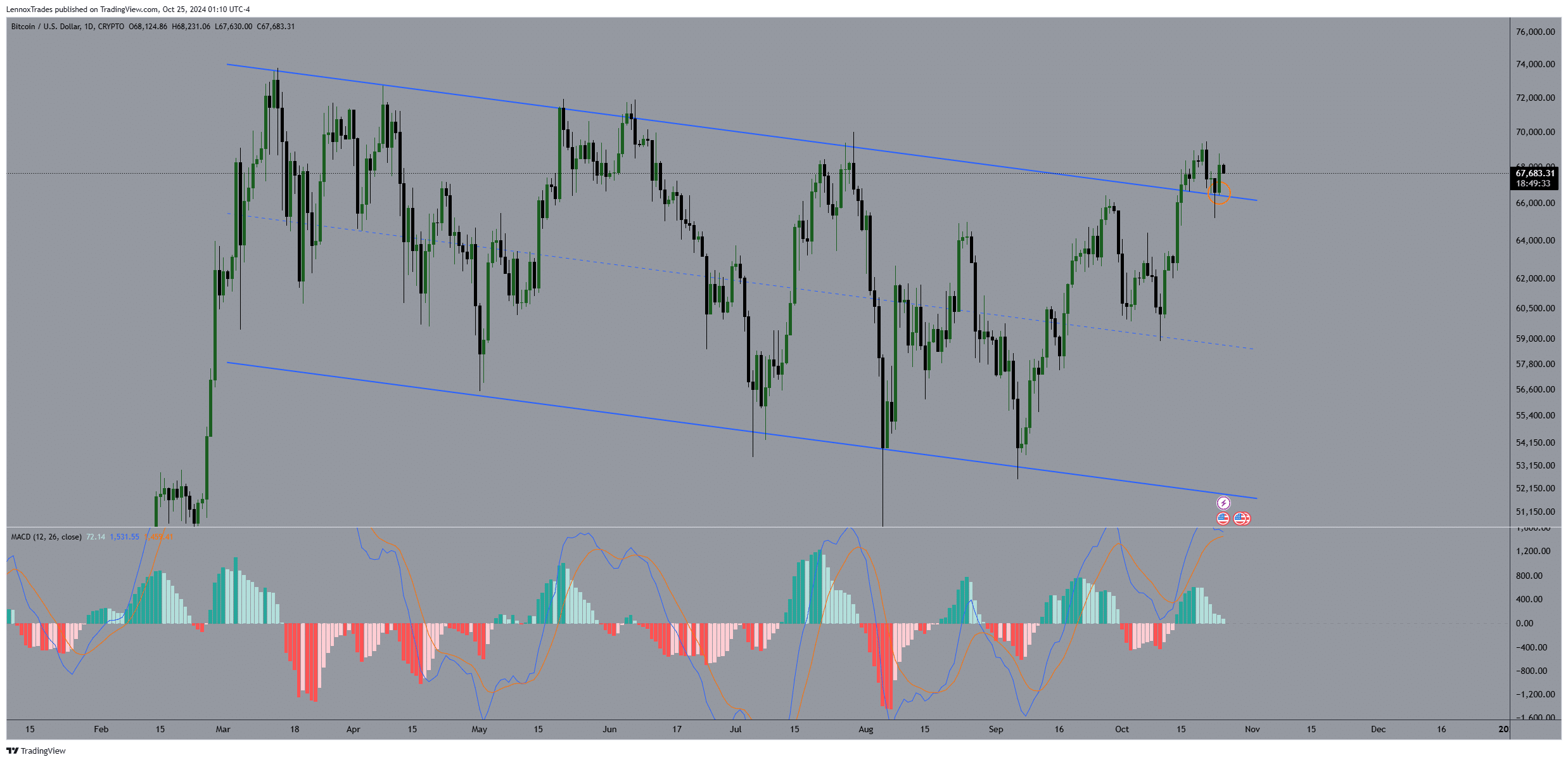

In terms of technical indicators, BTC has recently retested its descending trend channel, which has been a crucial resistance for more than eight months.

A breakout from this channel with a successful retest suggests Bitcoin may continue its upward trajectory.

BTC reached this trend channel’s upper limit earlier, testing the $69.5K zone but ultimately pulled back.

Despite this rejection, Bitcoin has since rebounded strongly off the breakout level, with yesterday’s daily close as at press time, coming in bullish.

This move could be the confirmation traders were looking for, potentially setting the stage for a rally that could challenge previous highs.

New holders to determine next move

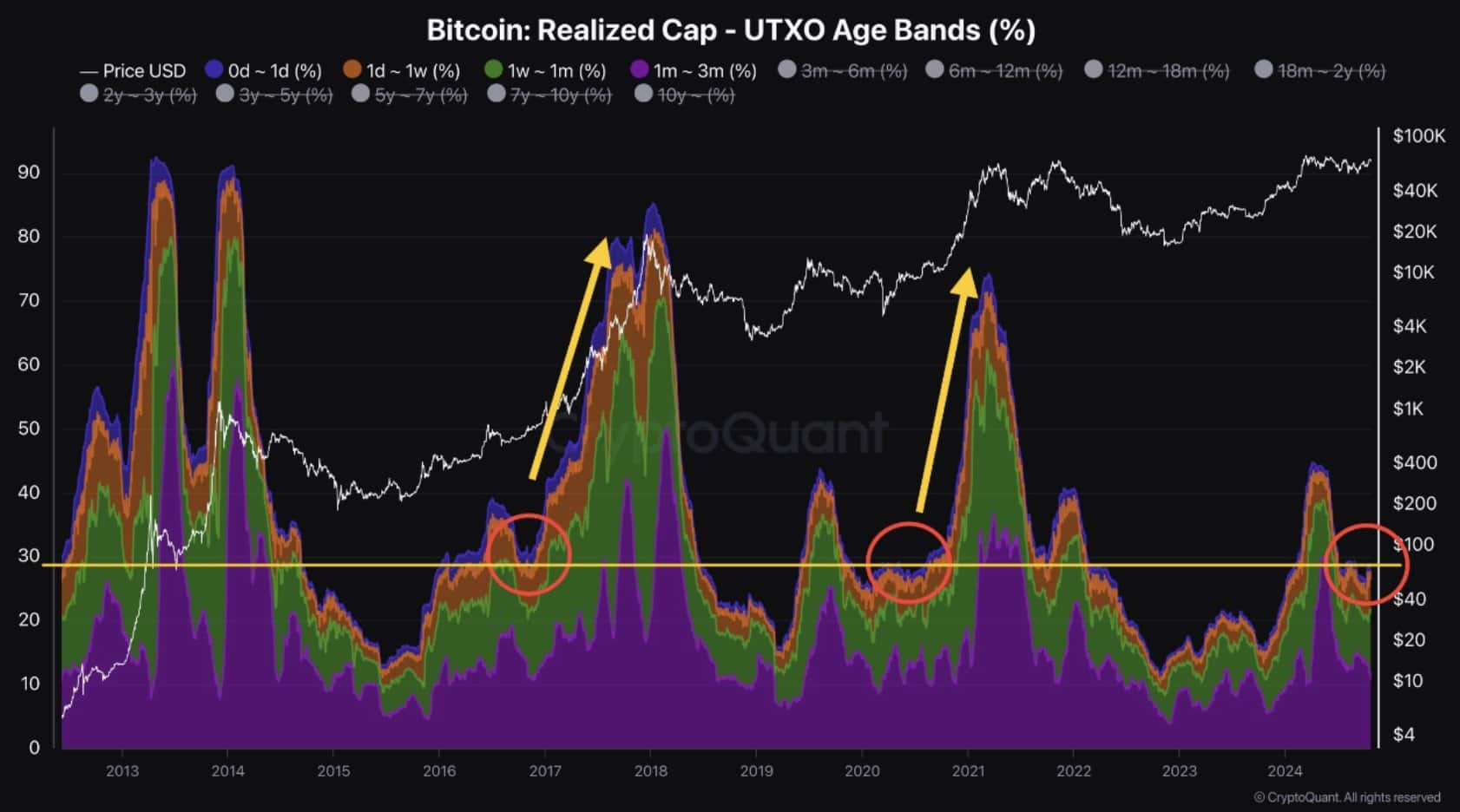

Finally, the actions of new investors appear to be critical in determining Bitcoin’s next major price direction.

Historical data suggests that when unspent transaction outputs (UTXOs) — a measure of Bitcoin held for less than six months — show a sharp increase following a pause, Bitcoin typically sees significant price growth.

Is your portfolio green? Check the Bitcoin Profit Calculator

Recent data highlights a clear trend, indicating BTC’s price may be set for an upward move. Record-level capital inflows and aligned technical indicators make a BTC breakout look increasingly likely.

As Bitcoin’s liquidity and capital levels climb, and with weak hands largely out, BTC may poised for further upward trajectory. The coming weeks will be telling, and traders will be watching for signs that BTC is ready to reach new highs.