Crypto Inflows Surge to $901 Million as US Election Nears, Bitcoin Dominates

10/28/2024 20:40

Crypto investment inflows reached $901 million as US political shifts impact Bitcoin. Strong gains linked to Republican polls.

Crypto investment inflows reached $901 million last week, a significant setback from the previous week’s positive flows. Nevertheless, it adds to the series of inflows as the political climate intensifies in the run-up to the US elections.

Among digital assets, Bitcoin attracted nearly all attention, drawing in $920 million in inflows. Notably, this shift did not extend to short-Bitcoin positions, which experienced minor outflows totaling $1.3 million. This indicates investors’ prevailing confidence in Bitcoin’s upward trajectory.

Political Momentum Boosts Crypto Investment Inflows

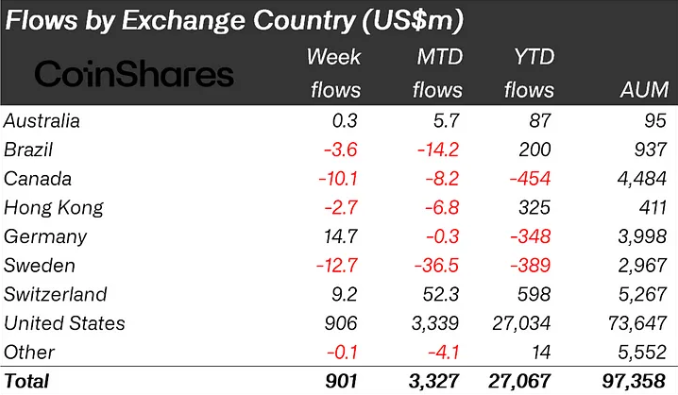

Amid heightened anticipation of potential political shifts in the US, digital asset investment products have continued with positive flows. The latest CoinShares report reveals an influx of $901 million into these assets.

With these numbers, October is effectively the fourth-largest month on record for inflows, bringing this year’s cumulative inflows to $27 billion. Noteworthy, this is nearly triple the previous high of $10.5 billion set in 2021.

The traction highlights the increased enthusiasm around cryptocurrency investments as the election cycle in the US intensifies. Specifically, the bulk of this month’s inflows, amounting to $906 million, originated in the US, setting a stark disparity against other regions.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

CoinShares’ researcher James Butterfill ascribes to the influence of domestic political developments in the US on the crypto market. Specifically, the researcher highlights politics-centric factors driving the current surge, notably the upcoming 2024 presidential election.

“We believe that current Bitcoin prices and flows are heavily influenced by US politics, with the recent surge in inflows likely linked to the Republicans poll gains,” a paragraph in the report reads.

The general sentiment is that the Republican side of the political divide could alter regulatory and tax policies in ways that could benefit the digital asset space. This correlation was evident over the last two weeks, with crypto investment inflows soaring to $2.2 billion in the week ending October 18 and $406 million in the week ending October 11, as reported by BeInCrypto.

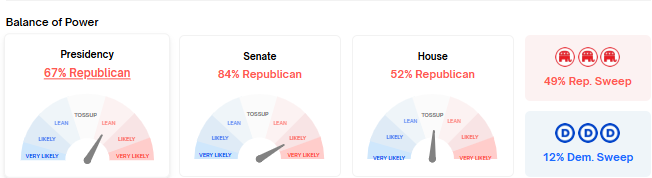

The intensified interest in cryptocurrency correlates with recent polling shifts favoring Republicans. The swing states, historically pivotal in determining election outcomes, have also influenced investor sentiment. According to data from the Polymarket prediction market, Republicans are showing strength in several of these key states on the balance of power metrics, which could further amplify crypto investment inflows if this trend continues.

Similarly, Donald Trump currently leads on the prediction market, standing at 66.2% in head-to-head polls against Democratic Party presidential aspirant Kamala Harris, who trails at 33.7%. Meanwhile, the countdown shows Americans are just over a week away from the US elections.

With a potential political shift on the horizon, the cryptocurrency market is poised to attract continued interest. Investors are keeping a close eye on US election polls.

Read more: How Can Blockchain Be Used for Voting in 2024?

Of note, beyond demonstrating a resurgence in Bitcoin, these sustained series of crypto investment inflows highlight how political developments could shape the cryptocurrency playing field in the days ahead. As political sentiment gains momentum, investors are increasingly viewing Bitcoin as a viable hedge against economic uncertainties.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.