EigenLayer (EIGEN) Open Interest Hits Record Low After 25% Price Drop

10/29/2024 01:30

EIGEN faces price pressures as Open Interest and active addresses decline; recovery might hinge on renewed trader engagement.

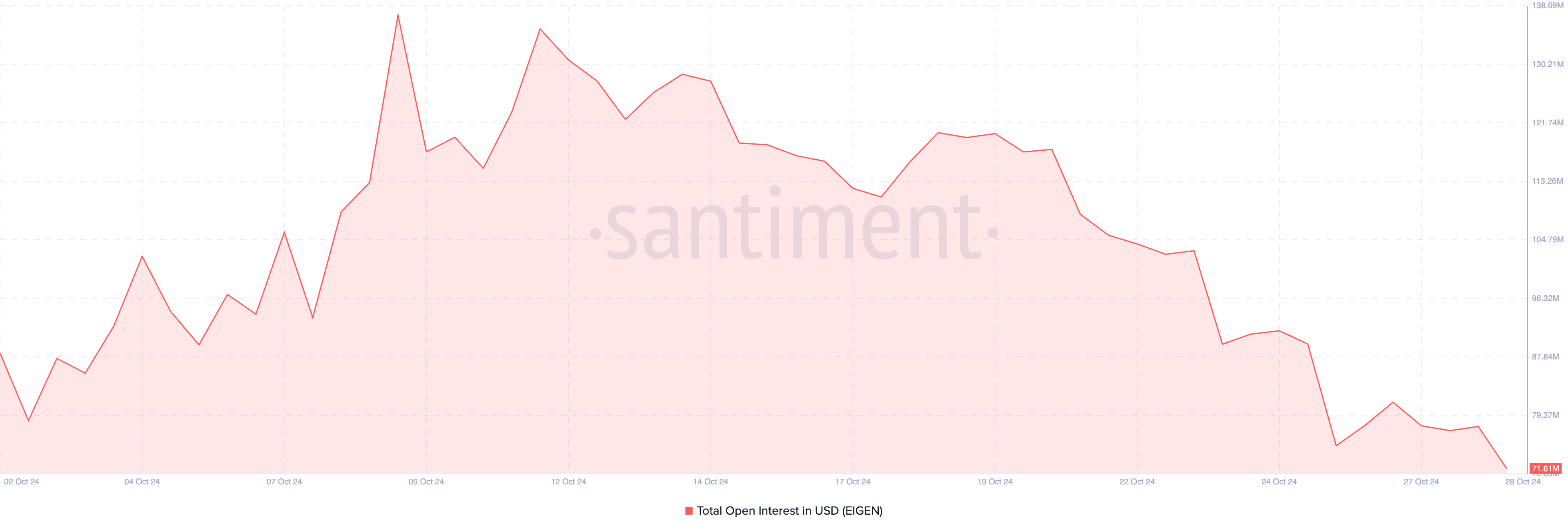

About ten days after EigenLayer listed its native token, EIGEN, on exchanges, its price attempted to revisit the launch price, fueled by a notable rise in Open Interest (OI). This surge suggested strong interest among traders.

However, EIGEN’s OI has plunged to its lowest level since its launch. What does this imply for the altcoin’s value?

EigenLayer Goes From Hype to Decline

EIGEN officially launched on October 1, with its price at $4.53. By October 6, the price dropped to $3, fueled by rising selling pressure from airdrop recipients. But it did not take long for EIGEN’s price to bounce, as it retested $4 again four days later.

BeInCrypto’s findings reveal that EigenLayer’s rebound was fueled by a significant increase in Open Interest (OI), which rose above $137 million during that period.

A high OI typically reflects heightened speculative activity, suggesting that more traders are actively participating and committing capital to the altcoin. This uptick in OI often correlates with increased volatility and, in many cases, upward price momentum.

Conversely, when Open Interest drops significantly, as seen with EigenLayer’s OI currently at an all-time low of $71.81 million, it can indicate waning interest from traders and a lack of fresh capital entering the market.

Read more: What Is EigenLayer?

Low OI often correlates with diminished buying pressure, making it more challenging for the price to sustain upward momentum. Following this development, EIGEN’s price dropped by 25%.

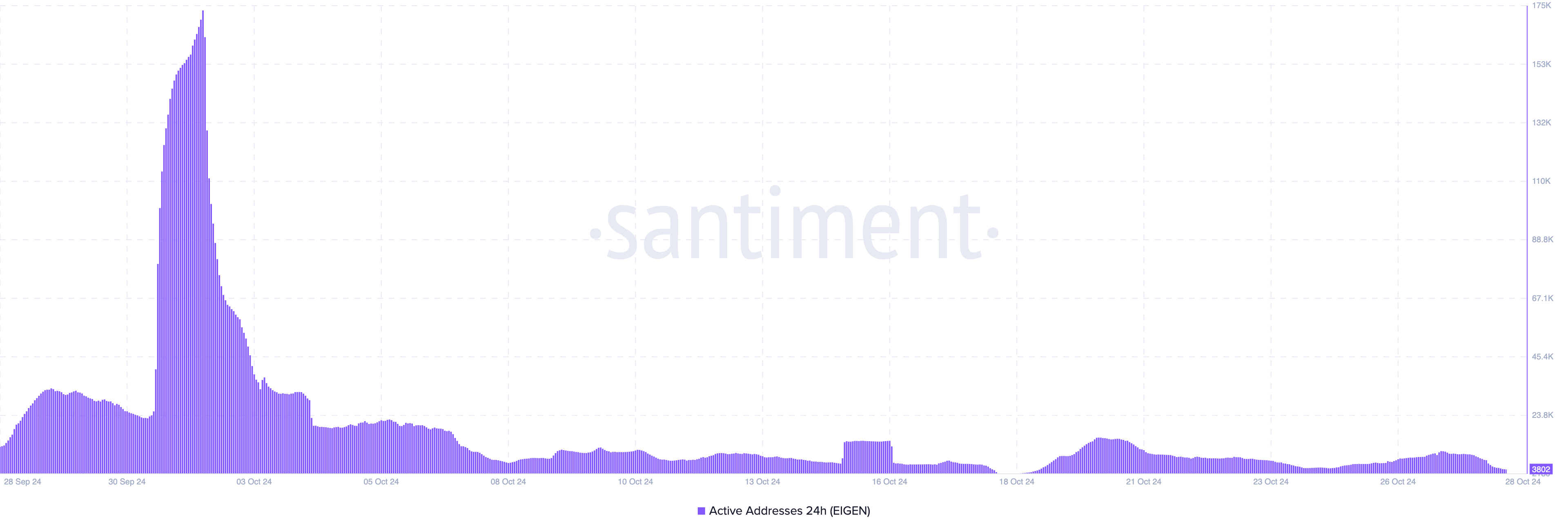

Additionally, active address metrics for EigenLayer reveal a significant drop in engagement, suggesting diminishing demand.

Data from Santiment shows that just a day after EIGEN became tradable, over 173,000 addresses interacted with the token. Yet, as of now, this number has plummeted to fewer than 4,000 active addresses.

Such a sharp decline often implies reduced interest and participation. From a price perspective, this drop in active addresses could lead to lower demand and exert downward pressure on EIGEN’s value.

EIGEN Price Prediction: Buying Pressure Weak

On the 4-hour chart, EIGEN’s price is likely to face resistance at $2.86. This price level is where the 78.6% Fibonacci retracement level lies. Historically, when crypto prices reach this point, they require a lot of buying pressure to surpass it.

However, the altcoin does not seem to be in such a situation, as indicated by the Chaikin Money Flow (CMF). Due to this situation, EIGEN’s price might slide to $2.59 in the short term.

Read more: Ethereum Restaking: What Is it and How Does it Work?

If sentiment doesn’t improve, EIGEN may face additional downward pressure. Yet, if EigenLayer Open Interest jumps, the price might stabilize or even bounce toward $3.36

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.