Bitcoin’s pivotal ‘decision week’ – What’s next as Uptober ends?

10/29/2024 04:00

Bitcoin enters a decision week post-Uptober. With a potential supply shock and labor data in focus, will BTC surge or see a pullback?

- Into The Cryptoverse CEO forecasts Bitcoin’s future price movements.

- Increasing greed warrants caution.

As the much anticipated month of ‘Uptober’ comes to a close, everybody only has one question on their mind: What’s next for Bitcoin [BTC]?

Well, Benjamin Cowen, CEO and founder of Into The Cryptoverse, seems to have the answer. In his latest video, the exec emphasized the importance of the month’s last week, stating,

“This week that we are going into, I believe, will be the decision week for the path of Bitcoin for the rest of the fourth quarter.”

Down or up: Where will Bitcoin go?

Cowen elaborated that the king coin is at a crossroads between the cyclical view and the monetary policy view.

Historically, BTC has performed strongly in the fourth quarter of its halving years.

Barring unfavorable macroeconomic factors, the former trend might push prices upward in Q4 2024. Therefore, if the coin can break through the $70,000 mark with sustained momentum, the cyclical outlook strengthens.

Conversely, if Bitcoin falters near the $70,000 mark, dropping back to $64,000, the monetary policy outlook could prevail.

This perspective aligns with previous patterns where BTC declined after reaching peaks in April and August. Thus, this scenario suggests a temporary pullback, with the next significant rally likely delayed until early 2025.

Upcoming labor market report: A decisive factor?

But what will decide the king coin’s fate? The answer is quite simple. The CEO underlined that the labor market data can likely dictate the short-term direction.

Interestingly, AMBCrypto noted that in the past, weaker job reports—signaling fewer jobs added—have often led to Bitcoin rallies.

For example, after the April jobs report in early May, it saw a 6% boost as the labor market softened. Conversely, stronger job reports in June and July correlated with BTC price declines. So, if the pattern holds true the upcoming report would prove pivotal for BTC’s prospects.

Beyond price action, Cowen highlighted that Bitcoin’s market dominance was nearing a critical 60% threshold. This dominance milestone signaled its growing influence and could lead to market-wide adjustments.

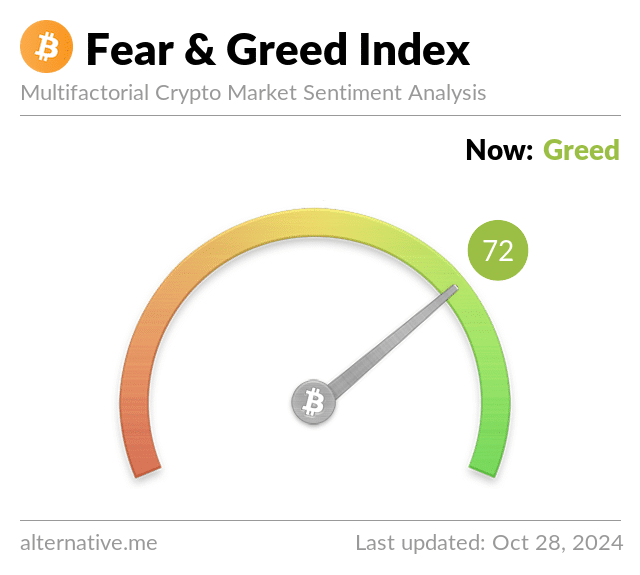

BTC’s greed rises

Adding to the heightened anticipation, Bitcoin’s Fear and Greed Index was recorded at 72, at press time.

Worth noting that elevated greed levels often indicate that many investors expect continued price gains, reinforcing a bullish sentiment.

Yet, this also raises concerns about potential market overheating, especially if external factors, such as regulatory developments or economic data, trigger a shift in sentiment and spark sell-offs.

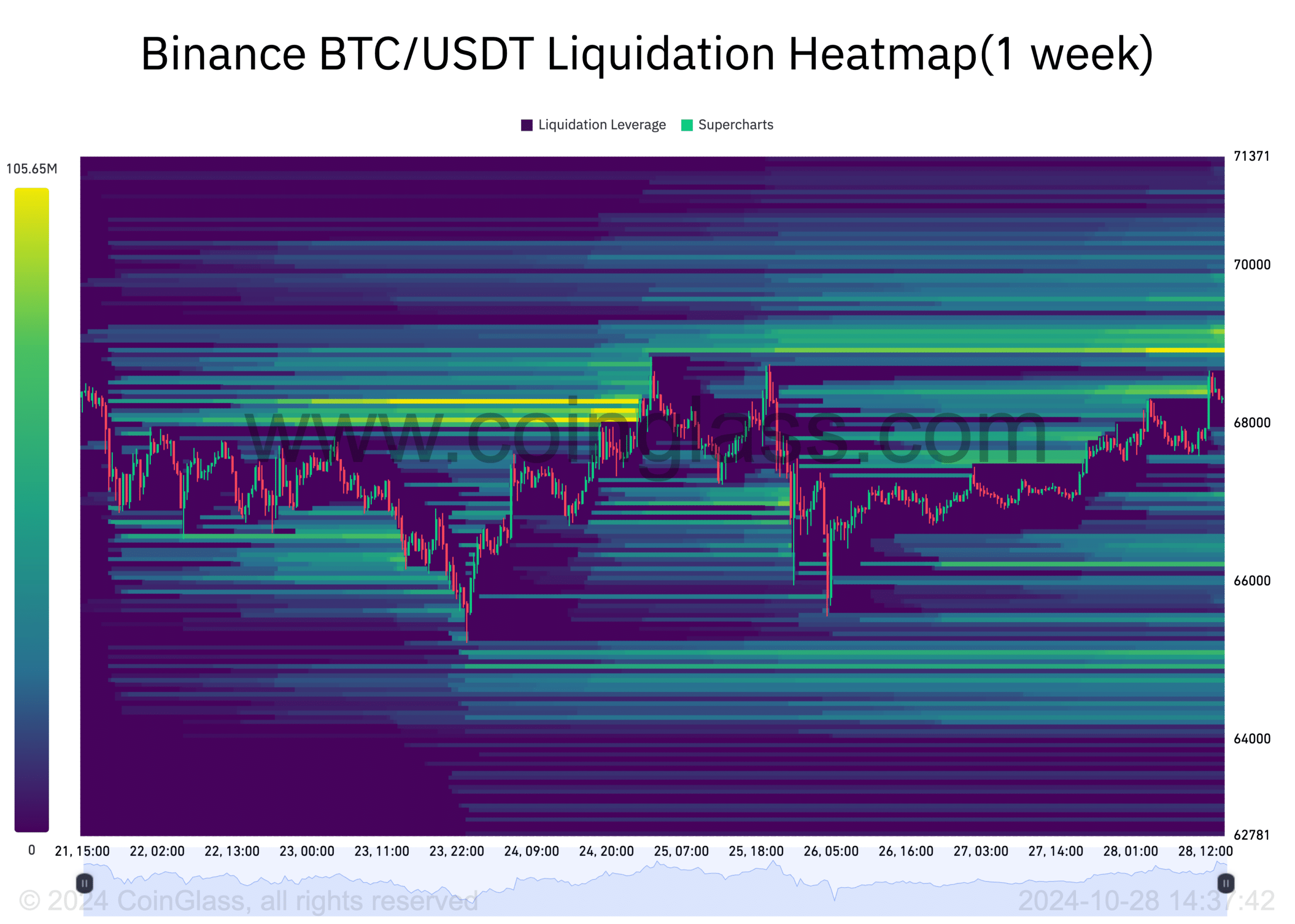

What does the liquidation heatmap say?

To explore BTC’s potential short-term path further, AMBCrypto analyzed the one-week liquidation heatmap from Coinglass.

The heatmap revealed a strong liquidity cluster at around $68,900. So, in the short term, a move toward this magnetic zone can likely materialize.

At this level, the coin faces the possibility of either a rejection or a breakthrough, each carrying implications for the broader market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In addition, AMBCrypto’s observations indicated an impending supply shock. This could set the stage for significant upward price movement, thereby favoring the latter possibility.