Here’s what AVAX buyers should know before they go long

10/29/2024 18:00

As predicted in our previous article, Avalanche (AVAX) has moved sideways lately after breaking out of its previous rising channel...

- Buyers are trying to gain some ground, but face issues near the important EMAs

- If AVAX fails to stay above the $24 support, AVAX might face more downside risks

As predicted in our previous article, Avalanche (AVAX) has moved sideways lately after breaking out of its previous rising channel. Recent price activity showed mixed signals, with buyers working hard to push it above key resistance levels.

Should AVAX holders be worried, or is there still a chance for a breakout?

Can AVAX bulls gain back their ground?

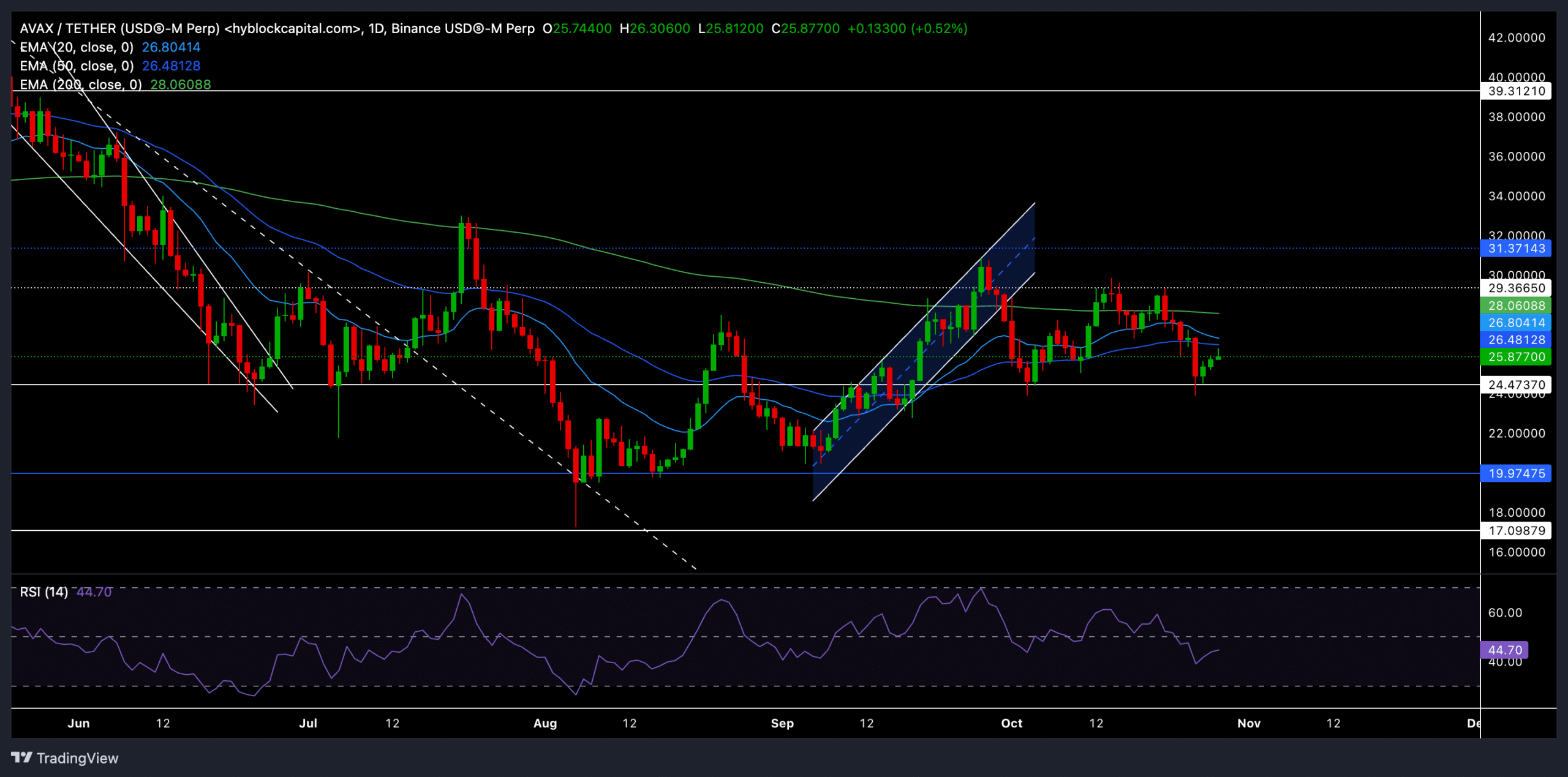

After a steady hike earlier in September, AVAX recently broke down from its upward trend. Since then, the price has fluctuated between the $24 and $30 range. AVAX was trading at $25.87 at press time, just above the support.

The 20-day EMA was $26.80, and the 50-day EMA was $26.48. The 20 EMA looked south, suggesting a possible bearish crossover. If AVAX cannot break and stay above these levels, this crossover could lead to more selling pressure. Additionally, the 200-day EMA at $28.06 seemed to be an important resistance level that buyers must overcome to gain momentum upwards.

Key levels to monitor

Support: The $24.47 level is crucial. If the price goes below this, losses could head towards the $20-mark.

Resistance: Immediate resistance was at the 20-day EMA ($26.80) and the 50-day EMA ($26.48). If the price breaks above these, it may test the $28 resistance (200-day EMA) and then the $31.37-level.

The Relative Strength Index (RSI), at press time, was at 44.7, showing slight bearish momentum as it stayed below 50. If it moves above 50, it could boost buyers’ confidence, while a dip below 40 may add to the bearish pressure.

Derivatives data for AVAX revealed THIS

Derivatives data highlighted mixed signals for AVAX traders. Volume increased by 62.73% to $298.27 million, indicating more trading activity. However, Open Interest dropped by 5.20% to $248.31 million – A sign of decreased trader confidence as many seemed to be closing their positions.

Interestingly, the long/short ratio on major exchanges was 0.941, slightly favoring sellers. However, on Binance, the long/short ratio for AVAX/USDT was 2.3367, showing that many traders there are still optimistic about the coin’s potential gains.

Traders should stay cautious, paying attention to the overall market sentiment and the movement of top cryptos like Bitcoin. These factors can significantly influence AVAX’s trajectory in the near term. Traders should keep an eye on the 20-day and 50-day EMAs. Any bearish crossover could mean a return to the $20-zone.