US Bitcoin ETFs Could Face Potential Impact from China-Saudi Liquidity Partnership

10/29/2024 23:42

China and Saudi Arabia’s $1 billion ETF deal aims to shift market power, attracting regional investors and challenging US Bitcoin ETFs.

New ETF partnerships between China and Saudi Arabia raise concerns over the potential impact on US Bitcoin ETF market liquidity.

According to recent reports, China and Saudi Arabia have struck an ETF “quid pro quo” arrangement following Chinese President Xi Jinping’s visit to Riyadh.

Bitcoin ETFs Have Fueled the US Market, China and Saudi Wants to Flip It

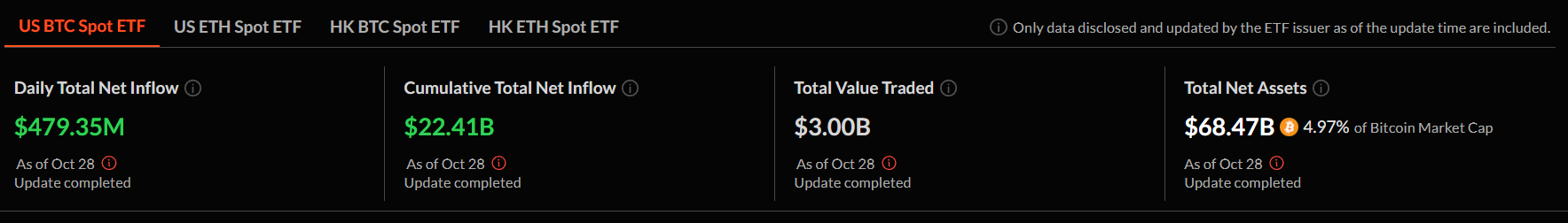

Bitcoin ETFs currently hold $68.47 billion in net assets in the US alone, a significant figure within the country’s broader $9 trillion ETF market. This has allowed the US to dominate global ETF activity.

In fact, iShares Bitcoin Trust ETF (IBIT) is currently among the top 100 ETFs by asset.

Read More: What Is a Bitcoin ETF?

However, the new financial pact between China and Saudi Arabia could change the scenario. Bloomberg analyst Eric Balchunas reported that each country has pledged to invest $1 billion in the other’s ETF market.

Saudi Arabia, for instance, will invest in Hong Kong ETFs that include Saudi-listed companies. China will similarly direct funds toward Saudi ETFs tracking Chinese stocks.

The strategy, described by Balchunas as a “liquidity-sharing” initiative, aims to attract local investors by making ETFs in each country more appealing. The move could lure back local investors who might otherwise have chosen more liquid, US-based ETFs.

Saudi Arabia’s New Middle East ETF Initiative

After President Xi’s visit, Saudi Arabia announced its inaugural ETF targeting Chinese stocks, the Albilad CSOP MSCI Hong Kong China Equity ETF. The asset will be launched with over $1.2 billion in initial funding, marking the largest ETF of its kind in the Middle East.

Listed on the Saudi Stock Exchange, this ETF will provide Saudi investors with streamlined access to Hong Kong-listed shares. The Saudi ETF’s considerable scale has allowed it to surpass even the largest Islamic ETFs currently listed on the Qatar Exchange.

This initiative raises concerns about whether both countries are seeking a coordinated push to weaken the appeal of Bitcoin ETFs in the US.

Read More: How To Trade a Bitcoin ETF – A Step-by-Step Approach

“Even tho this is a bit inauthentic I can’t knock it as all of these countries constantly seeing the US steal away local investors like a liquidity vampire. The US has a quarter of all the ETFs in the world but has 70% of the global aum and 84% of all the volume. You gotta fight for your liquidity,” Eric Balchunas wrote in a recent X (formerly Twitter) post.

Many non-US markets feel they are losing out as American ETFs attract a growing share of global investors. China and Saudi Arabia’s new ETF alliance appears to counter this trend.

Bitcoin ETFs saw over $3 billion in net inflow in October. This has largely contributed to Bitcoin’s ongoing bull run, as the largest cryptocurrency is currently trading at around $72,500.

There’s a growing optimism across the community that BTC could record a new all-time high in the current bull run.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.