Bitcoin doesn’t require a U.S. dollar crash to become a six-figure asset class, Bitwise CIO Matt Hougan opined on X.

Bitcoin (BTC) has often been hailed as a hedge against the dollar’s declining purchasing power and as a potential beneficiary of a massive fiat implosion.

Some proponents have suggested that Bitcoin needs a dollar collapse to reach $200,000 per BTC and beyond. However, Hougan argued that this assumption is incorrect for two main reasons: growing demand for store-of-value assets and persistent government spending.

According to the Bitwise executive, these factors reinforce investor conviction when they invest in Bitcoin. Hougan further argued that store-of-value markets have gained momentum due to “governments abusing their currencies.”

— Matt Hougan (@Matt_Hougan) October 29, 20241/ A financial advisor asked me a great question over dinner last week:

Does the U.S. dollar need to collapse for bitcoin to hit $200,000?

The answer is "no." Here's why…

For instance, U.S. spending has accelerated in recent years, and the country’s debt has surpassed $35 trillion. Analysts estimate the national debt grows by about $1 trillion every 100 days at its current pace.

Additionally, Unlimited Funds CIO Bob Elliott cited data indicating that “developed world sovereign debt,” such as U.S. Treasuries, may no longer effectively serve as bailout mechanisms, potentially supporting a pro-Bitcoin outlook.

— Bob Elliott (@BobEUnlimited) October 29, 2024The selloff in US bonds has sparked a global dump of developed world sovereign debt.

Since US yields started rising after the Fed meeting in Sept, global bond yields are higher, while the dollar and gold are surging, reflecting an increasingly global debt contagion.

Thread.

Hougan expects this pattern to continue, leading to more mature BTC markets, increased adoption, and higher prices for the leading cryptocurrency.

So, no, the dollar doesn’t need to collapse for bitcoin to hit $200k. All you need is Bitcoin to continue on its current path of maturing as an institutional asset. But it’s increasingly looking like both parts of the argument will come true. That’s why Bitcoin is surging toward all-time highs.

Matt Hougan, Bitwise CIO

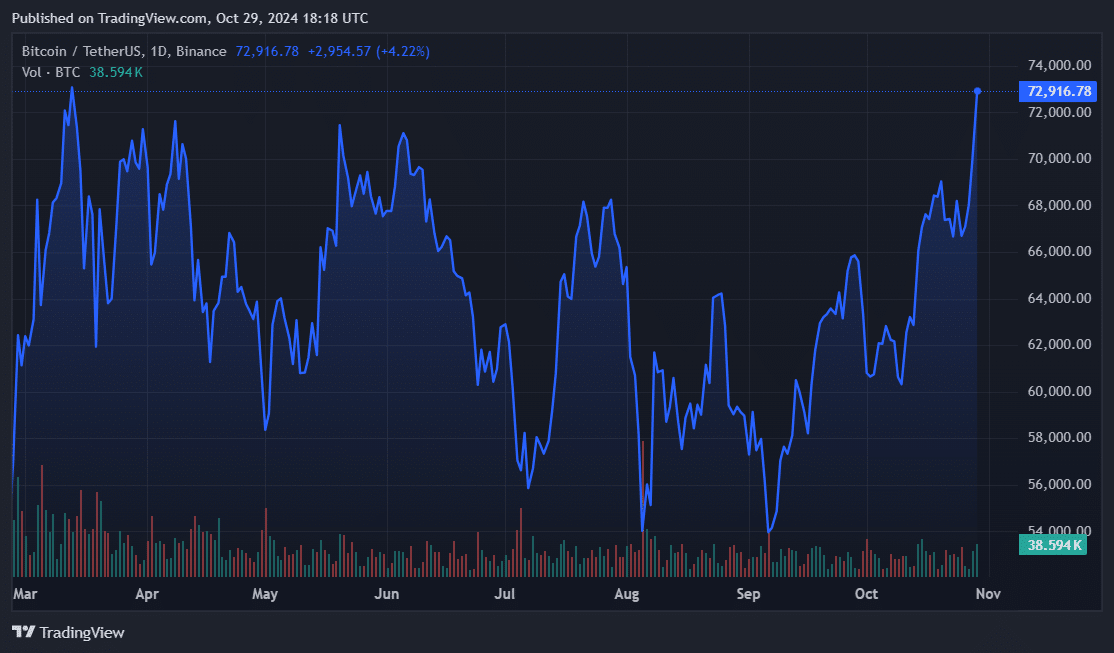

Hougan’s remarks came on Oct. 29, as BTC rallied closer to its all-time high set in March. BTC rose 5% in the last 24 hours, reaching $72,756. While technical indicators pointed to a potential Bitcoin breakout, historical patterns warn of volatility as U.S. citizens prepare to vote in the upcoming presidential election.